State Farm Gap Insurance Policy

State Farm Gap Insurance Policy: An Overview

Gap insurance is an additional auto insurance coverage that drivers can purchase to cover the “gap” between what they owe on a vehicle and what their insurance company pays out in the event of a total loss. State Farm offers gap insurance coverage to its customers, but not all drivers will need it.

What Does Gap Insurance Cover?

Gap insurance is designed to cover the difference between the actual cash value (ACV) of a vehicle and the total amount that a driver owes on the vehicle. This “gap” is often caused by depreciation and other factors like taxes, fees, and interest. To put it simply, gap insurance ensures that a driver is not left paying for a vehicle if it is totaled and their insurance company pays out the ACV.

Do I Need Gap Insurance?

Whether or not a driver needs gap insurance depends on the specifics of their situation. Generally, drivers who have recently purchased a new or used vehicle, or those with a long-term loan or lease, may want to consider gap insurance. This is especially true if a driver owes more on their vehicle than the ACV. For example, if a driver has a loan balance of $20,000 but the ACV of their car is only $18,000, they may want to consider gap insurance.

What Does State Farm Offer?

State Farm offers gap insurance coverage to its customers for an additional cost. This coverage is only available for vehicles that are 8 years old or newer and it does not cover depreciation. It is important to note that State Farm’s gap insurance coverage is only available for vehicles in which the driver is the primary insured. This means that if a vehicle is jointly owned, both drivers must be insured under State Farm in order to receive gap insurance coverage.

How Much Does State Farm Gap Insurance Cost?

The cost of State Farm gap insurance varies. Generally, the cost is based on factors like the type of vehicle, the amount covered, and the length of coverage. Additionally, State Farm offers discounts for certain drivers and vehicles. To get a more accurate estimate of the cost of gap insurance coverage, drivers should contact their local State Farm agent.

Conclusion

Gap insurance is a great way to protect drivers in the event of a total loss. State Farm offers gap insurance coverage to its customers, but not all drivers will need it. To find out if gap insurance is right for you, contact your local State Farm agent.

Does state farm offer gap insurance - insurance

State farm gap insurance - insurance

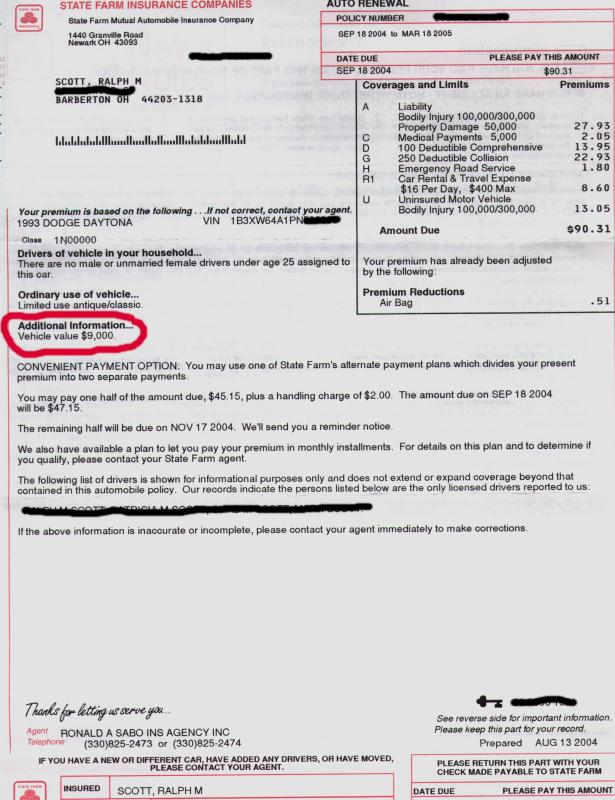

State Farm Ins Policy.jpg photo - Ralph Scott photos at pbase.com

Review Of Car Insurance Quote For State Farm 2022 - Auto Insurance Claims

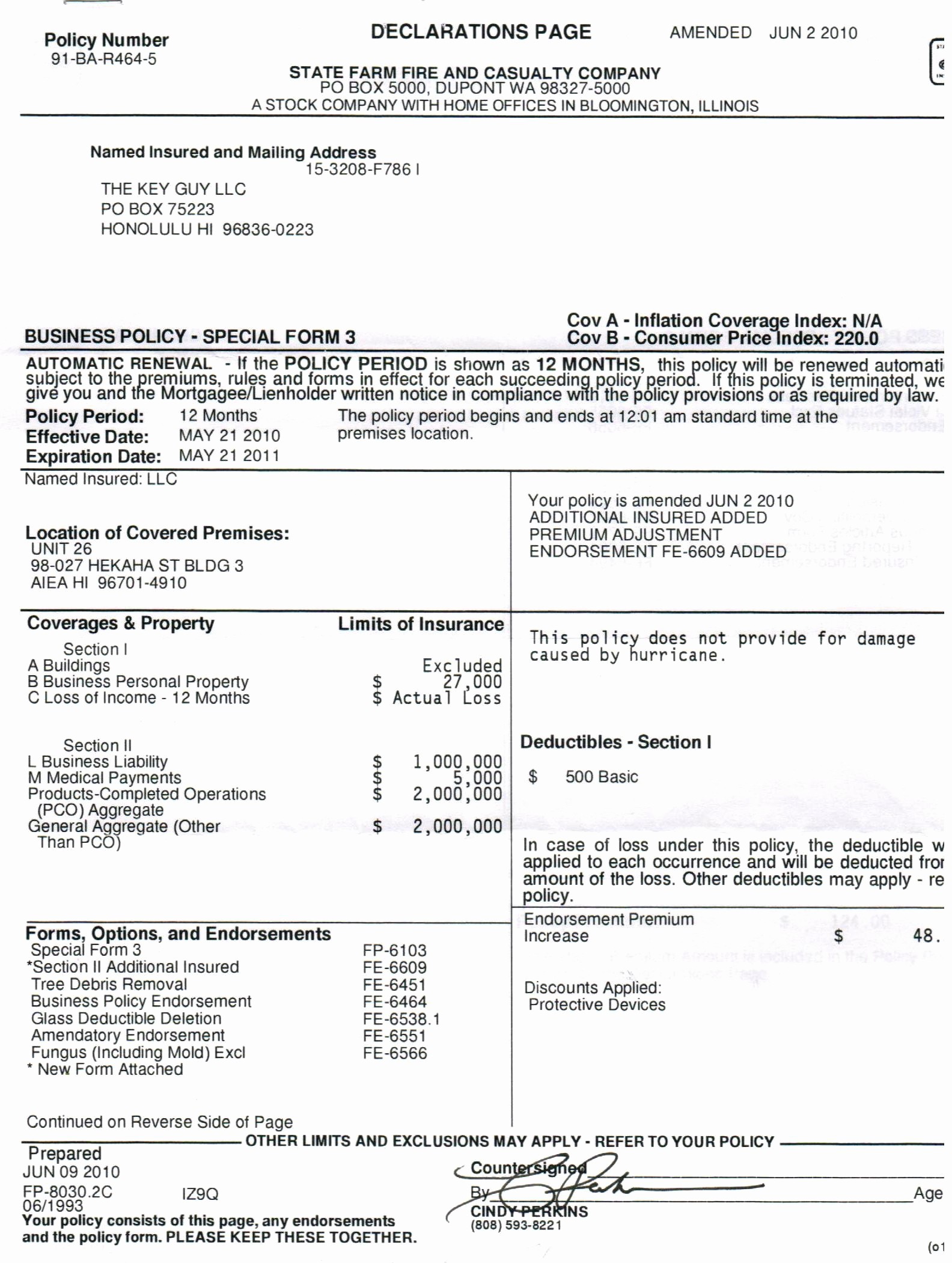

Statefarm Online Bill Pay Beautiful Insurance Declaration Page State