Reliance General Insurance Car Insurance Review

Reliance General Insurance - A Comprehensive Car Insurance Review

Introduction

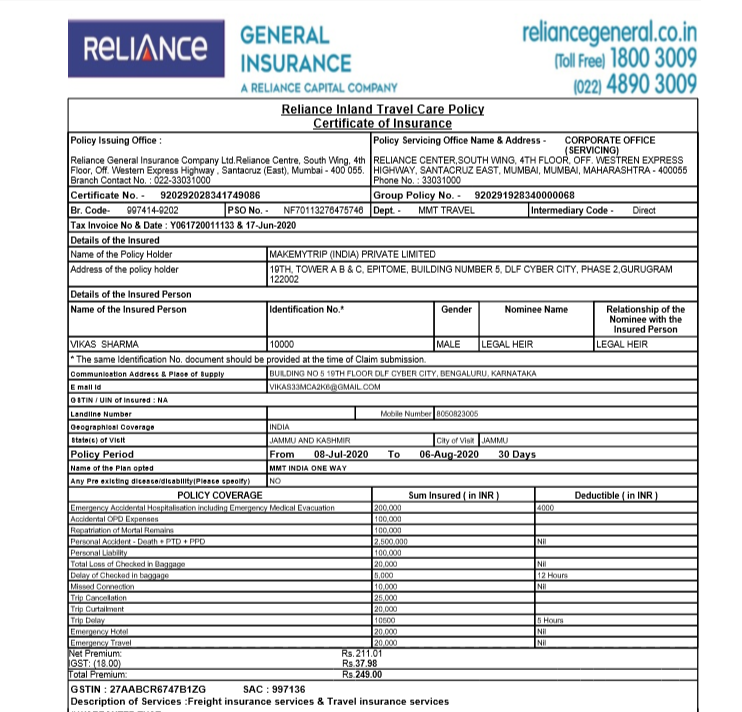

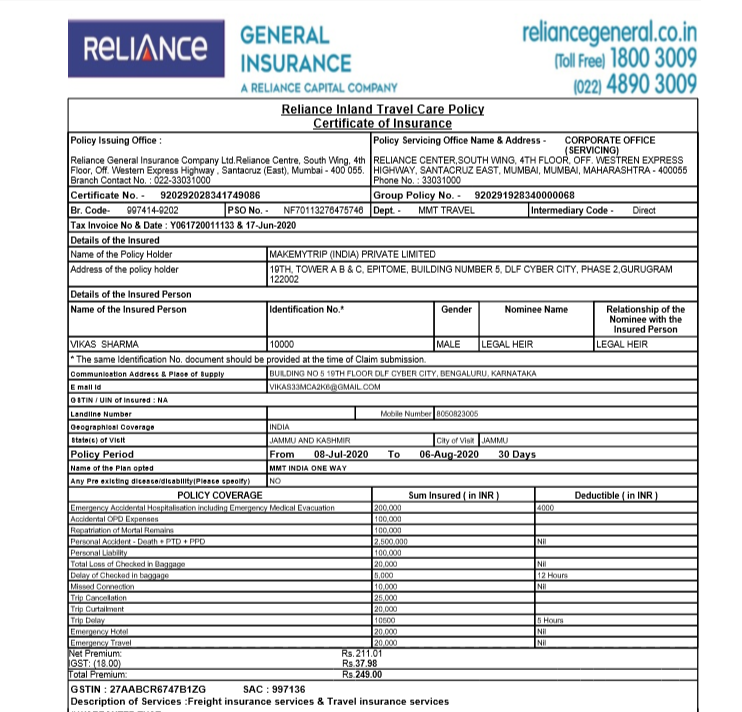

Reliance General Insurance is one of India’s leading general insurance companies. It is well established and has a wide range of products including motor insurance, health insurance, travel insurance, home insurance and more. Reliance General Insurance car insurance is one of the most comprehensive car insurance plans available in the market. This comprehensive plan offers comprehensive coverage for your car and its accessories, liabilities, and third party damages. It also provides coverage for personal accident and fire and theft.

What Does Reliance General Insurance Car Insurance Cover?

Reliance General Insurance car insurance provides comprehensive coverage for any damage to your car and its accessories in the event of an accident, theft, fire or natural calamities. It also covers any personal liability arising out of an accident caused by you. The coverage also includes any third party damages, which means it covers any bodily injury or property damage caused to a third party. It also provides personal accident cover for the owner-driver of the car.

Discounts Offered by Reliance General Insurance Car Insurance

Reliance General Insurance car insurance provides various discounts to its customers. Some of the discounts are based on the age of the car, the engine capacity, the type of fuel used, the geographical area, the type of car, the type of coverage opted for and the no-claim bonus. The no-claim bonus is a reward given to customers who have not made a claim in the past year. This discount can be as much as 50% of the premium.

Add-on Covers Offered by Reliance General Insurance Car Insurance

Reliance General Insurance car insurance provides a number of add-on covers that provide additional protection to your car. These add-on covers include zero depreciation cover, roadside assistance cover, engine protector cover, and more. The zero depreciation cover allows for full coverage of the car parts without any deductions for depreciation. The roadside assistance cover offers assistance in case of a breakdown, flat tire, and other emergencies.

Claim Process of Reliance General Insurance Car Insurance

The claim process of Reliance General Insurance car insurance is simple and straightforward. Customers can either file the claim online or physically visit the nearest branch. The documents required to file the claim are the vehicle’s registration copy, proof of ownership, original bill of purchase, repair bills, police report (if applicable), and the claim form. Once the documents are submitted, the claim is processed and the claim amount is disbursed within a few days.

Conclusion

Reliance General Insurance car insurance is one of the most comprehensive car insurance plans available in the market. It provides comprehensive coverage for any damage to your car and its accessories in the event of an accident, theft, fire or natural calamities. It also provides a number of discounts and add-on covers to provide additional protection to your car. The claim process is simple and straightforward, and the claim amount is disbursed within a few days. All in all, Reliance General Insurance car insurance is an ideal choice for those looking for comprehensive coverage at an affordable price.

Reliance General Insurance — Insurance not paid.

Essential car insurance facts you are unaware of

Car Insurance Policy by Reliance General Insurance

[Resolved] Reliance General Insurance — policy not received

![Reliance General Insurance Car Insurance Review [Resolved] Reliance General Insurance — policy not received](https://www.consumercomplaints.in/thumb.php?complaints=308268&src=reliance cover note0001.jpg&wmax=900&hmax=900&quality=85&nocrop=1)

Reliance General Insurance logs Rs 4,007 cr premium in FY17