Nrma Ctp Personal Injury Insurance

NRMA CTP Personal Injury Insurance: The Benefits of Having Coverage

If you’re in the market for car insurance, then you know there are a lot of options out there. You’ve likely heard of NRMA CTP personal injury insurance, but you may not be sure if it’s the right choice for you. Here, we’ll explore the benefits of this type of coverage and what it can offer you.

What is CTP Personal Injury Insurance?

CTP personal injury insurance – or Compulsory Third Party – is a type of insurance policy that covers any liability you may have if you cause an accident that results in injury to someone else. It is a legal requirement in most Australian states and territories, and is usually included as part of your car insurance package.

What Does NRMA CTP Personal Injury Insurance Cover?

NRMA CTP personal injury insurance provides coverage for any medical or rehabilitation costs that may arise from an accident you cause. It also covers any legal costs you may incur if the injured party decides to sue you for damages. This type of insurance also covers any compensation that may be awarded to the injured party, up to the limit of your policy.

How Does NRMA CTP Personal Injury Insurance Work?

If you are involved in an accident and are found to be at fault, then your NRMA CTP personal injury insurance will cover the liability. Your policy will pay out any compensation that is awarded to the injured party, as well as any legal costs associated with the claim. NRMA CTP personal injury insurance also covers the cost of any medical or rehabilitation expenses incurred by the injured party.

What Are the Benefits of NRMA CTP Personal Injury Insurance?

The main benefit of NRMA CTP personal injury insurance is that it provides you with financial protection in the event of an accident. Without this type of coverage, you may be liable for any medical costs or compensation that is awarded to the injured party. This type of coverage also offers peace of mind, knowing that you are covered if the worst should happen.

What is the Cost of NRMA CTP Personal Injury Insurance?

The cost of NRMA CTP personal injury insurance varies depending on the type of coverage you choose and the limits of your policy. Most insurance companies offer competitive rates and discounts, so it’s worth shopping around to find the best deal. The cost of this type of coverage is usually included in the premium you pay for your car insurance policy, so it’s worth checking to make sure you’re getting the best deal.

NRMA CTP personal injury insurance is an important type of coverage to have. It provides you with financial protection in the event of an accident, and can help to cover any medical costs or compensation that may be awarded. With the right policy, you can rest easy knowing that you’re covered if the worst should happen.

nrma-blue | Blank-it - Safety in Motion

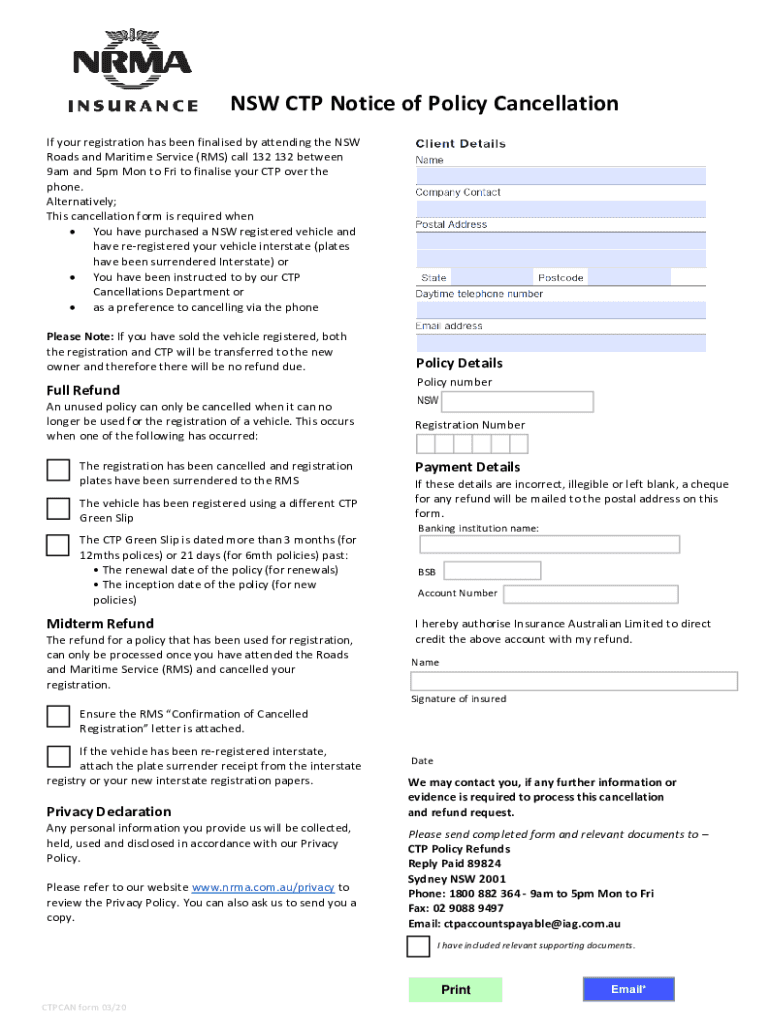

2020-2022 Form NRMA Insurance NSW CTP Notice of Policy Cancellation

How to Build Nrma Insurance PDF Plans

Home And Contents Insurance Nrma

What is CTP Insurance, What Does it Cover, and Who Does It Cover? - MCW