Low Annual Mileage Car Insurance

What Is Low Annual Mileage Car Insurance?

Car insurance is a necessity for all drivers, but the cost can be prohibitively expensive for some. Low annual mileage car insurance can help cut down on the cost of your car insurance by reducing the amount of time you spend on the road driving. This type of car insurance is designed for drivers who don't need to drive very often and who don't put a lot of miles on their vehicles each year.

How Does Low Annual Mileage Car Insurance Work?

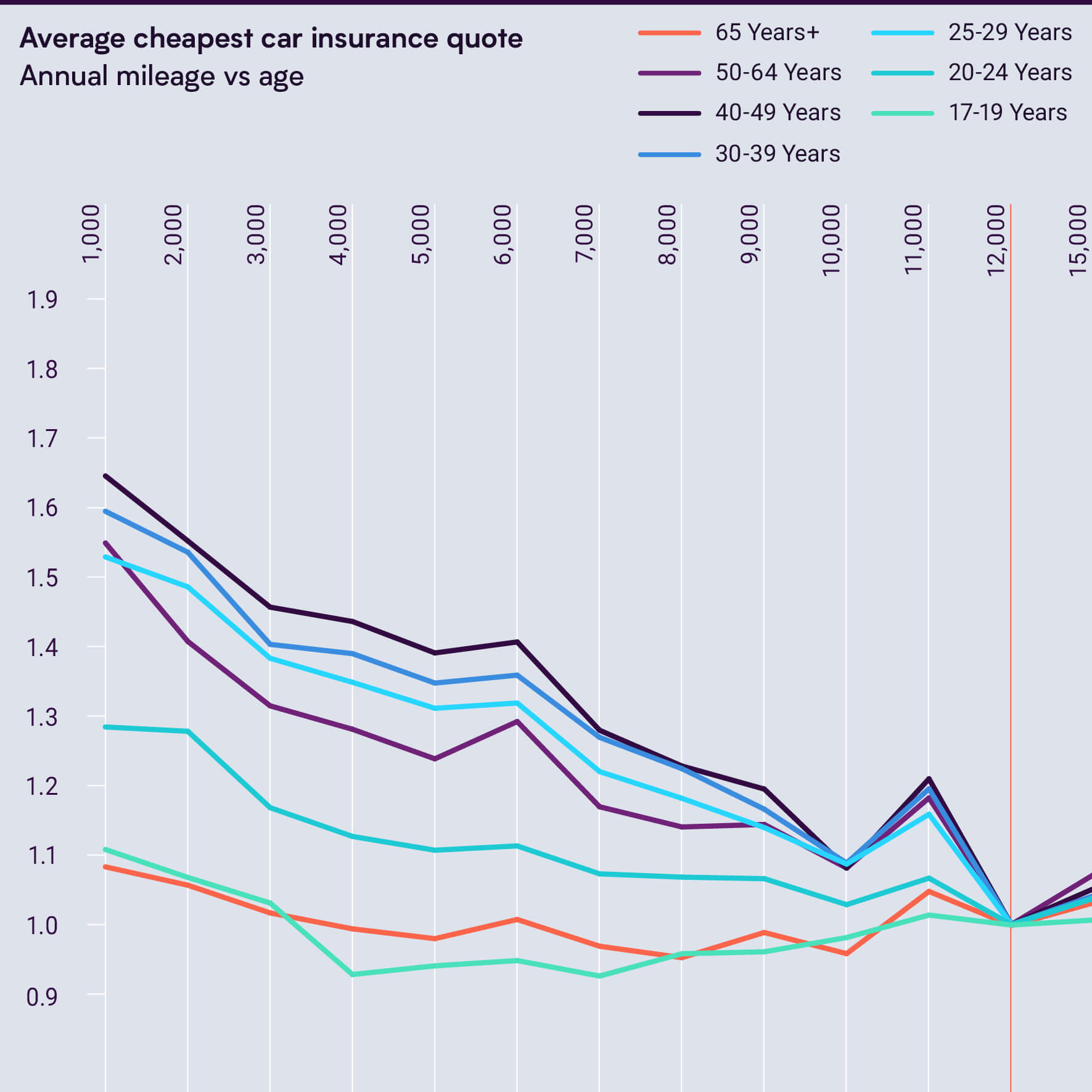

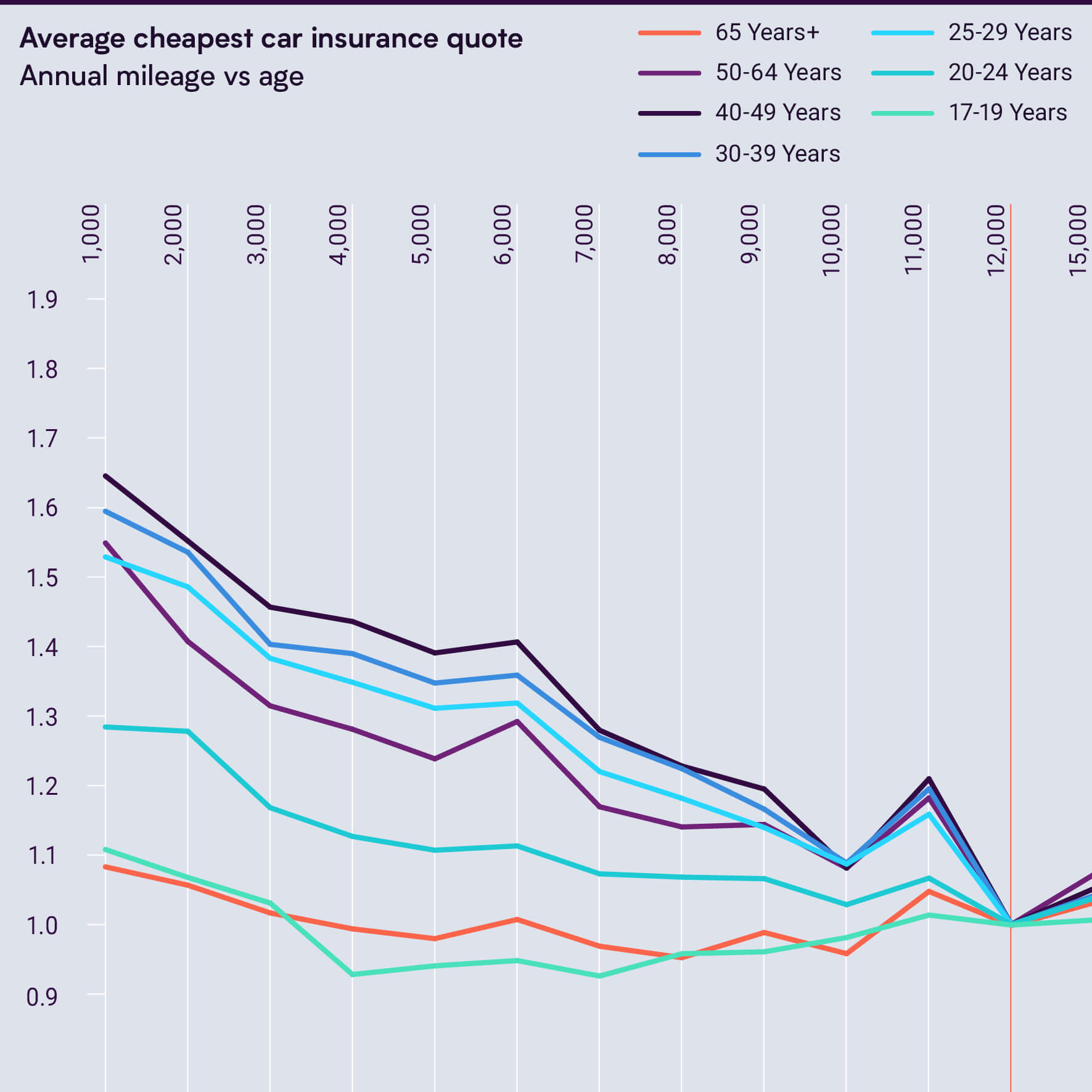

Low annual mileage car insurance works by reducing the amount of time you spend on the road, which in turn reduces the amount of risk you expose yourself and your car to. Insurance companies calculate your car insurance premiums based on the likelihood of you being involved in an accident. The less time you spend on the road, the lower the risk and the lower your premiums will be.

Who Should Consider Low Annual Mileage Car Insurance?

Low annual mileage car insurance is perfect for those who drive infrequently or don't need to drive a lot. This includes people who work from home, who use public transportation to get around, or who have access to a carpool. It is also ideal for those who have multiple vehicles in their household and are only using one of them for most of their trips.

What Should I Look for in a Low Annual Mileage Car Insurance Policy?

When shopping for low annual mileage car insurance, it is important to look for policies that are tailored to your needs. Make sure you understand the terms and conditions of the policy and that you are comfortable with the coverage levels. Also, remember to look for discounts or special offers that may be available. Some insurance companies offer discounts for low annual mileage drivers, so be sure to ask about these.

How Can I Save Money on Low Annual Mileage Car Insurance?

There are several ways you can save money on low annual mileage car insurance. First, make sure you shop around and compare quotes from multiple insurance companies to find the best deal. Second, ask about discounts for low annual mileage drivers. Third, consider raising your deductible if it is possible. Finally, make sure you are taking advantage of other discounts that may be available.

The Bottom Line

Low annual mileage car insurance is a great option for those who don't need to drive very often or who don't put a lot of miles on their vehicle each year. It is important to shop around and compare quotes in order to find the best deal. Make sure you understand the terms and conditions of the policy, and consider raising your deductible if it is possible. Additionally, ask about any discounts or special offers that may be available. With some research and planning, you can find an affordable low annual mileage car insurance policy that meets your needs.

Why are low mileage drivers charged more?

Best Car Insurance For Low Mileage Drivers : How To Buy Cheap Car

What is Low Mileage Car Insurance? | Car insurance, Mileage, Auto

Low Price Car Insurance / The Cheapest Car Insurance Companies August

Safety and Car Insurance for teen drivers: A Complete Guide - Life360