Is New York A No Fault State For Auto Insurance

Is New York A No Fault State For Auto Insurance?

New York is known for its unique insurance laws. One of the most important of these laws is the no-fault insurance system that applies to auto insurance policies. This law has a number of important implications for drivers and policyholders in the state. Understanding the basics of this system can help drivers make informed decisions about their auto insurance policies.

What Is No-Fault Insurance?

No-fault insurance is a type of insurance coverage that is designed to provide compensation to policyholders regardless of who is at fault in an accident. In a no-fault state, drivers are required to purchase a minimum amount of auto insurance coverage that will provide a set amount of compensation for injury and other damages in the event of an accident. This coverage is typically set by state law and is designed to provide a basic level of protection for drivers.

What Does No-Fault Insurance Mean In New York?

The no-fault insurance law in New York is designed to provide drivers with a basic level of protection in the event of an accident. If a driver is injured in an accident, their insurance company will provide a set level of compensation regardless of who is at fault in the accident. This coverage is designed to provide financial protection for drivers and help them avoid costly legal battles in the event of an accident. In addition to this coverage, drivers in New York are also required to purchase a minimum amount of liability insurance.

What Are The Benefits Of No-Fault Insurance?

The no-fault insurance system in New York provides a number of benefits for drivers. First, it helps protect drivers from costly legal battles in the event of an accident. In addition, no-fault insurance can help drivers get the financial compensation they need in the event of a serious injury. Finally, no-fault insurance can help reduce the cost of auto insurance for drivers. By spreading the cost of an accident across all policyholders, no-fault insurance can help reduce the cost of auto insurance for individual policyholders.

What Are The Drawbacks Of No-Fault Insurance?

While no-fault insurance provides a number of benefits for drivers, it can also have some drawbacks. For example, in some cases, the amount of compensation provided by no-fault insurance may not be enough to cover the costs of a serious injury. In addition, some drivers may find that the cost of their auto insurance is higher in a no-fault state. Finally, some drivers may feel that the system discourages drivers from taking responsibility for their own actions.

What Should Drivers Do In New York?

Drivers in New York should understand the basics of the no-fault insurance system and make sure they are carrying the minimum amount of coverage required by law. It is also important to understand the benefits and drawbacks of no-fault insurance so that drivers can make informed decisions about their auto insurance policies. Finally, drivers should always be aware of the laws and regulations that apply to auto insurance in their state.

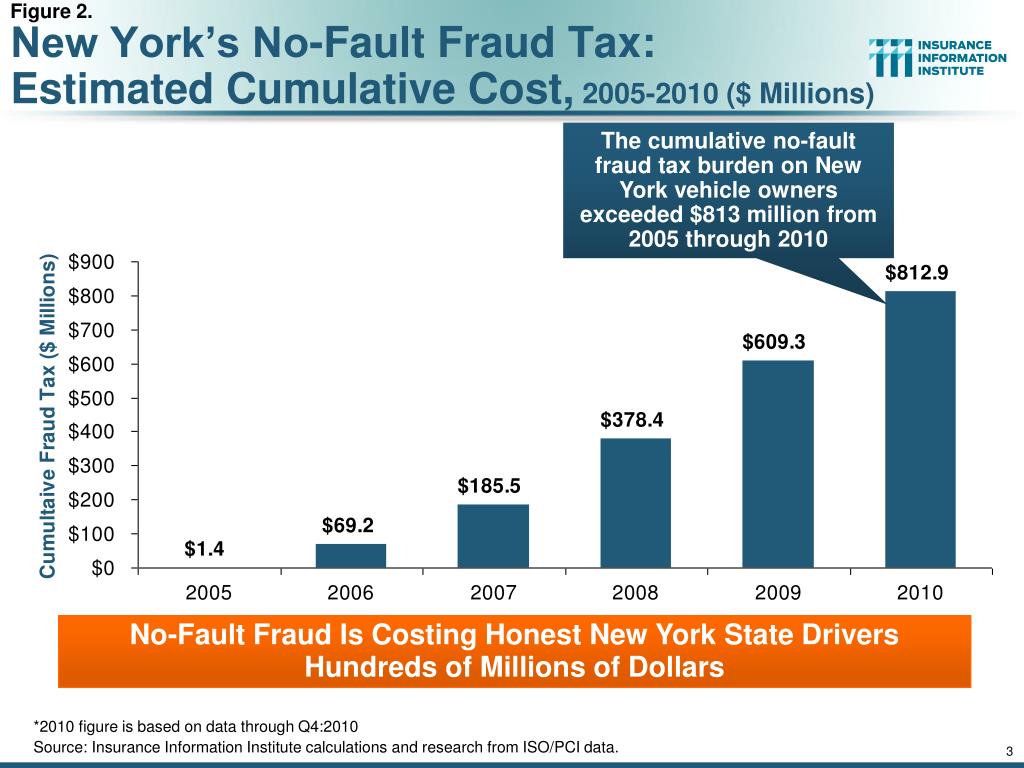

PPT - No-Fault Auto Insurance Fraud in New York State Trends

PPT - No-Fault Auto Insurance Fraud in New York State Trends

Ultimate Guide to No-Fault Auto Insurance

PPT - No-Fault Auto Insurance Fraud in New York State Trends

Coverage Counsel: Fillable New York No-Fault Forms -- NF-2 New York

_Page_1.jpg)