Insurance For Car Under 25

Insurance for Car Under 25 – Is It Possible?

Introduction

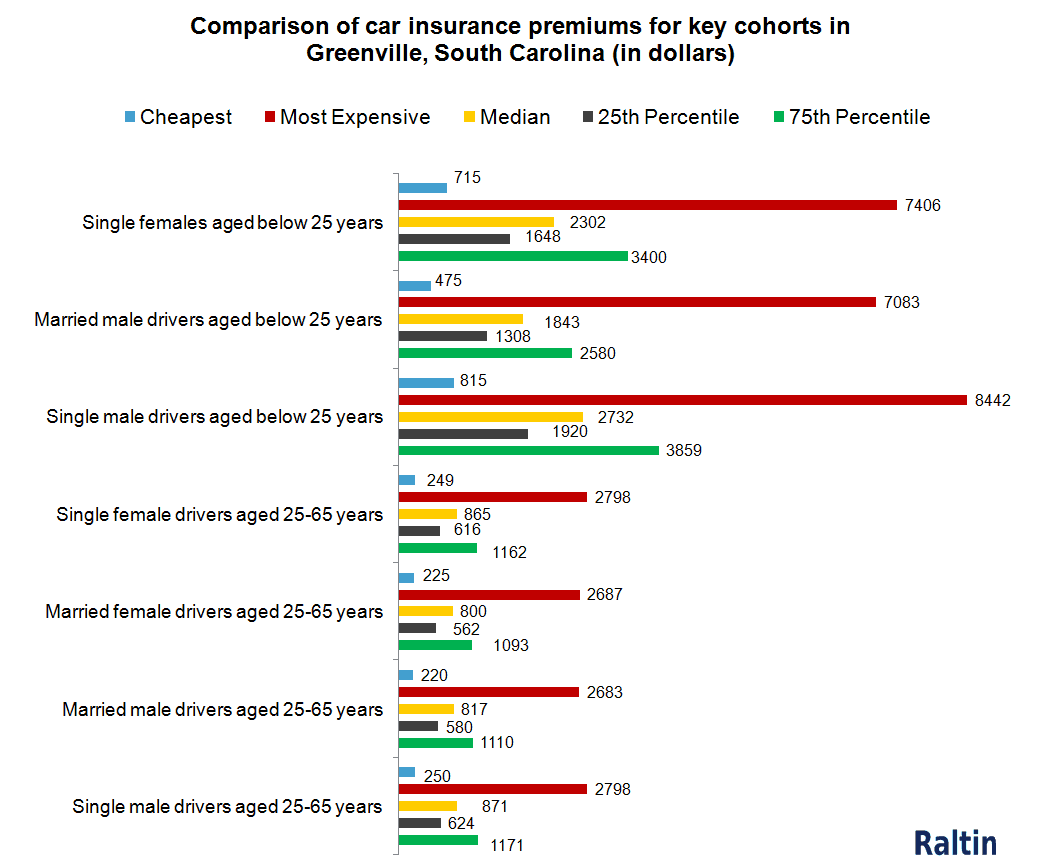

Are you a young car driver under 25 looking for car insurance? If so, you are likely to be facing a bit of a challenge. Car insurance premiums are determined by a variety of factors such as your age, experience, and the type of car you drive. As a rule, younger drivers are considered to be high-risk, so the premiums they are offered tend to be quite high. But don’t give up hope. There are still ways to get affordable insurance for car under 25, if you know what to look for.

Shop Around

The first step towards finding affordable insurance for car under 25 is to shop around. Don’t just settle for the first quote you get. Instead, compare several different insurance companies, and look for any deals or discounts they offer. Many companies will offer discounts for young drivers who have a good driving record, so make sure you ask about these. You should also look for any special deals the company may be running. For example, some companies may offer a discount if you sign up for a multi-year policy, or if you bundle your car insurance with other types of insurance.

Choose Your Car Wisely

The type of car you drive can also have a big impact on your car insurance premiums. Generally, cars that are considered to be high-performance, or that have a lot of added features, will be more expensive to insure. So if you’re looking for affordable insurance for car under 25, it’s best to stick with a basic model. You should also pay attention to the safety features of the car, as this can make a difference in the premiums you are offered.

Choose a Higher Deductible

Another way to get affordable insurance for car under 25 is to choose a higher deductible. The deductible is the amount you pay out-of-pocket before the insurance company pays for the rest of the claim. Choosing a higher deductible can help lower your monthly premiums, but it also means you will have to pay more out of pocket if you ever need to make a claim. So make sure you can afford the higher deductible before you choose it.

Ask About Other Discounts

Finally, don’t forget to ask about any other discounts you may be eligible for. For example, some companies may offer discounts for young drivers who take defensive driving courses or who maintain good grades. So make sure you ask about these before you commit to any policy.

Conclusion

Finding affordable insurance for car under 25 isn’t always easy, but it’s definitely possible. By shopping around, choosing the right car, choosing a higher deductible, and asking about discounts, you should be able to find a policy that fits your needs and your budget. So don’t give up – you can get the coverage you need at a price you can afford.

Car Insurance Under 25: Can I Get Cheap Car Insurance? - Cover

Under 25 Car Insurance - car insurance for females under 25 - YouTube

Under 25 Car Insurance – The Housing Forum

Understanding Auto Insurance - Understanding Car Insurance | Don't

Factors That Affect Your Car Insurance Premium | CoverLink Insurance