How Much Is Full Coverage Car Insurance

How Much Is Full Coverage Car Insurance?

Understanding Full Coverage Car Insurance

Full coverage car insurance is a term often used by drivers when they are shopping for auto insurance. It is an insurance policy that provides protection against both physical damage to your car and financial liability due to an accident or other incident. It is important to note that full coverage car insurance does not actually exist, as there is no single policy that provides comprehensive coverage for all eventualities. Instead, you will purchase separate policies for different types of coverage, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

What Does Full Coverage Car Insurance Include?

Full coverage car insurance usually includes liability, collision, and comprehensive coverage. Liability insurance is the most basic form of coverage and provides protection against other drivers’ property damage and bodily injury in the event of an accident. Collision coverage provides protection against damage to your car in the event of an accident, while comprehensive coverage protects your car from theft, vandalism, fire, and other non-accident related damages. Uninsured/underinsured motorist coverage provides protection in the event that you are involved in an accident with a driver who does not have enough insurance coverage to pay for your damages.

How Much Does Full Coverage Car Insurance Cost?

The cost of full coverage car insurance will vary depending on the amount of coverage you purchase, the type of car you drive, your driving record, and other factors. Generally, you can expect to pay anywhere from $500 to $1,500 per year for full coverage car insurance. The best way to get an accurate estimate is to get quotes from several different insurance companies.

Tips For Lowering The Cost Of Full Coverage Car Insurance

There are several ways to save on full coverage car insurance. For example, you may be able to get discounts for having multiple vehicles insured with the same company, or for having a good driving record. You can also shop around and compare rates from different insurance companies to get the best deal. Additionally, you may be able to get lower rates by raising your deductible or opting for a higher deductible.

Do I Need Full Coverage Car Insurance?

Whether or not you need full coverage car insurance will depend on your individual circumstances. If you have a newer car or are financing your car, you may be required to have full coverage. Additionally, if you live in an area with high rates of theft or vandalism, you may want to consider purchasing comprehensive coverage. Ultimately, the decision is up to you and you should weigh the pros and cons before deciding which type of coverage is best for you.

Conclusion

Full coverage car insurance is an important form of protection for drivers. It provides protection against both physical damage to your car and financial liability due to an accident or other incident. The cost of full coverage car insurance will vary depending on the amount of coverage you purchase, the type of car you drive, and other factors. There are several ways to save on full coverage car insurance, such as shopping around and comparing rates, raising your deductible, and taking advantage of discounts. Ultimately, whether or not you need full coverage car insurance will depend on your individual circumstances.

Cheap Car Insurance in North Carolina | QuoteWizard

18+ Full Coverage Car Insurance Quotes - Best Day Quotes

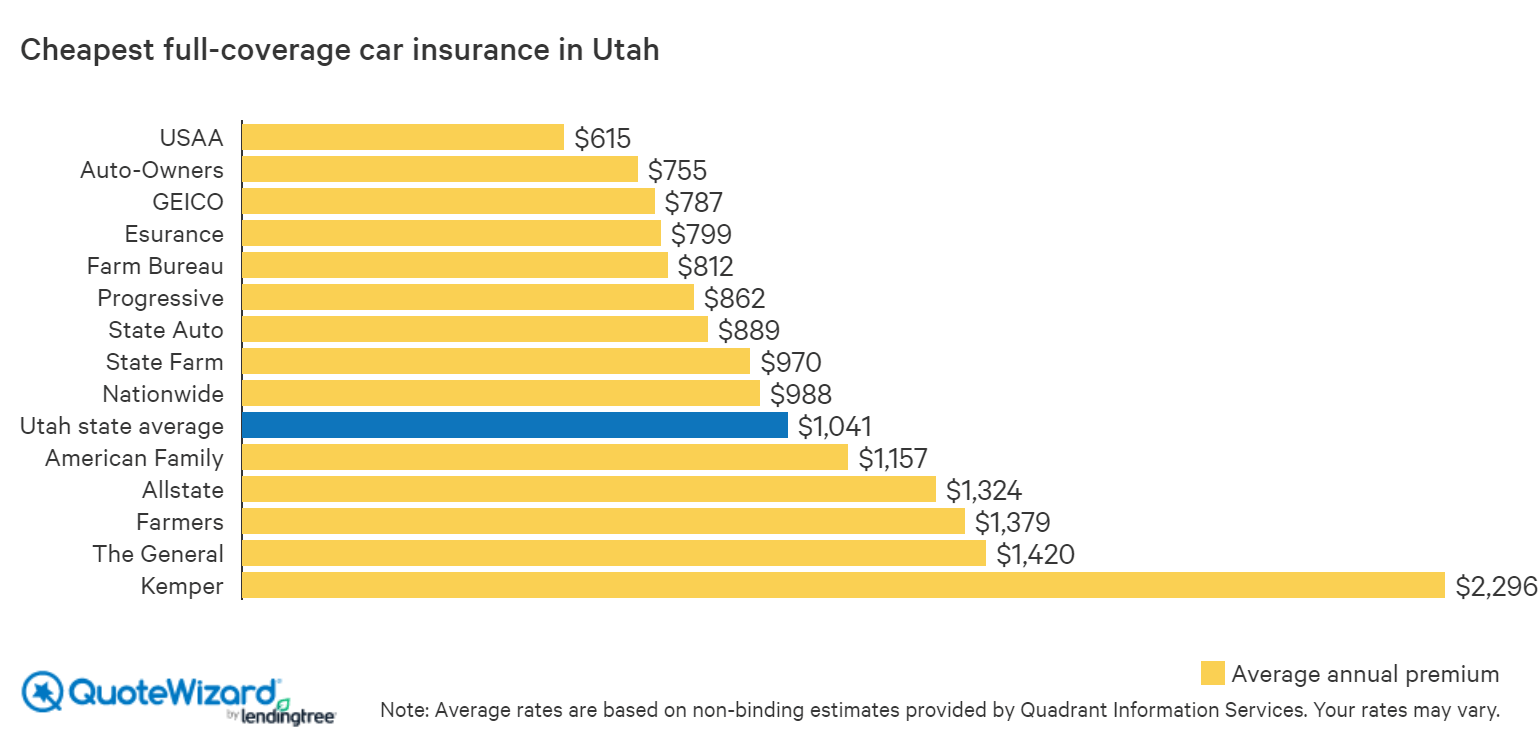

Where to Find Cheap Car Insurance in Utah | QuoteWizard

Average Full Coverage Car Insurance For 20 Year Old

Car Insurance And the Important of Higher Coverage Amounts #infographic