How Much Is Basic Liability Car Insurance

How Much Is Basic Liability Car Insurance?

When it comes to buying car insurance, many people consider basic liability car insurance. This is because it is often the most affordable option, and it covers the legal minimum for car insurance requirements. However, many people are unsure of exactly how much basic liability car insurance can cost.

The cost of basic liability car insurance can vary significantly depending on a few factors such as the state that you live in, the type of car that you drive, and the amount of coverage that you want. For instance, some states may require drivers to carry a certain amount of coverage while other states may not. Additionally, cars with higher value will usually cost more to insure than less expensive cars.

What Is Included in a Basic Liability Car Insurance Policy?

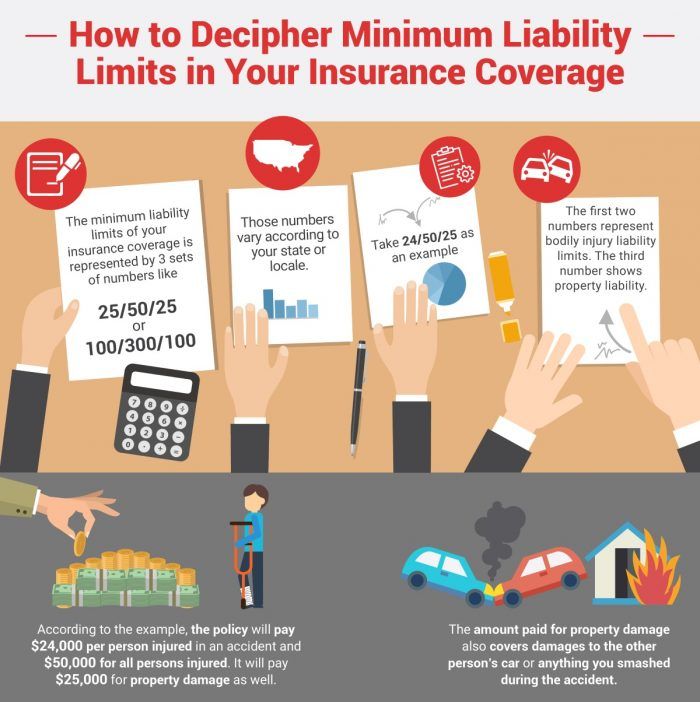

Basic liability car insurance covers the legal minimum for car insurance requirements in most states. It typically includes coverage for property damage and bodily injury that you may cause to another person or property during an accident. It does not cover damages to your own car if you are at fault for the accident.

How Much Does Basic Liability Car Insurance Cost?

The average cost of basic liability car insurance in the United States is around $500 per year. However, this cost can vary significantly depending on the factors mentioned above. For instance, if you live in a state with higher car insurance requirements or if you drive a more expensive car, you may end up paying more for basic liability car insurance.

What Factors Impact The Cost Of Basic Liability Car Insurance?

The cost of basic liability car insurance will vary depending on a few factors. As mentioned above, the state that you live in and the type of car that you drive can have a significant impact on the cost of your insurance. Additionally, your age and driving record can also affect the cost of your insurance. Younger and less experienced drivers, for instance, may end up paying more for their insurance.

How Can I Get The Best Rates For Basic Liability Car Insurance?

There are a few ways that you can get the best rates for basic liability car insurance. The first is to shop around and compare quotes from different insurance companies. This will allow you to find the best rates for the coverage that you need. Additionally, you can also look for discounts that may be available such as good driver discounts or multi-policy discounts.

In conclusion, basic liability car insurance is often the most affordable option for car insurance coverage. The cost of this type of insurance can vary significantly depending on a few factors such as the state that you live in, the type of car that you drive, and the amount of coverage that you want. If you are looking for the best rates for basic liability car insurance, it is important to shop around and compare quotes from different insurance companies. Additionally, you can also look for discounts that may be available to help lower the cost of your insurance.

41+ Types Of Allstate Insurance - Hutomo Sungkar

Auto Insurance Liability Limits: What Do The Numbers Mean? | Visual.ly

What Is Car Insurance Liability? | Visual.ly

PPT - Cheapest Liability Car Insurance Texas PowerPoint Presentation

All the Different Types of Car Insurance Coverage & Policies Explained