How Much Does Long Term Care Insurance Typically Cost

How Much Does Long Term Care Insurance Typically Cost?

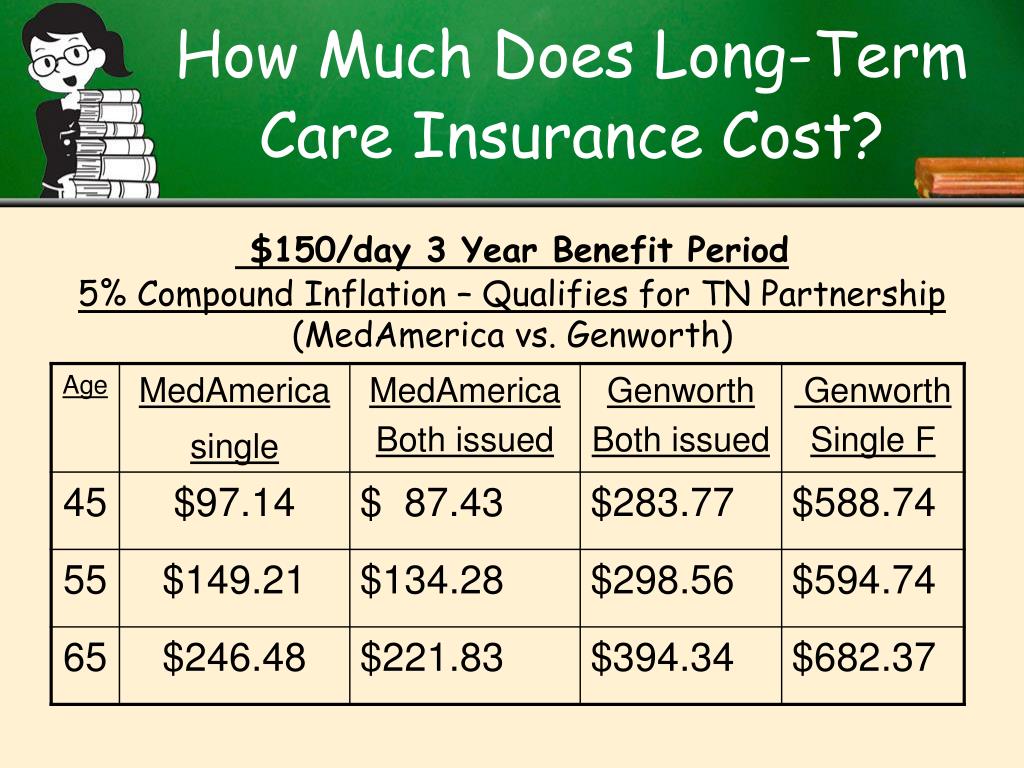

The cost of long-term care insurance can vary greatly depending on the level of coverage you desire and the company from which you purchase the policy. The prices and coverage can vary from one policy to another, so it’s important to research your options carefully. In general, the cost of long-term care insurance can range from a few hundred to several thousand dollars per year.

What Factors Impact the Cost of Long Term Care Insurance?

There are a few factors that can affect the cost of long-term care insurance. The most important factor is the age of the policyholder. Generally, the younger you are when you purchase a policy, the lower the premiums will be. Additionally, the amount of coverage you purchase will also affect the cost, with higher levels of coverage costing more. Your health can also influence the cost of the policy, as individuals with pre-existing conditions may be charged higher rates.

What Types of Coverage Are Available?

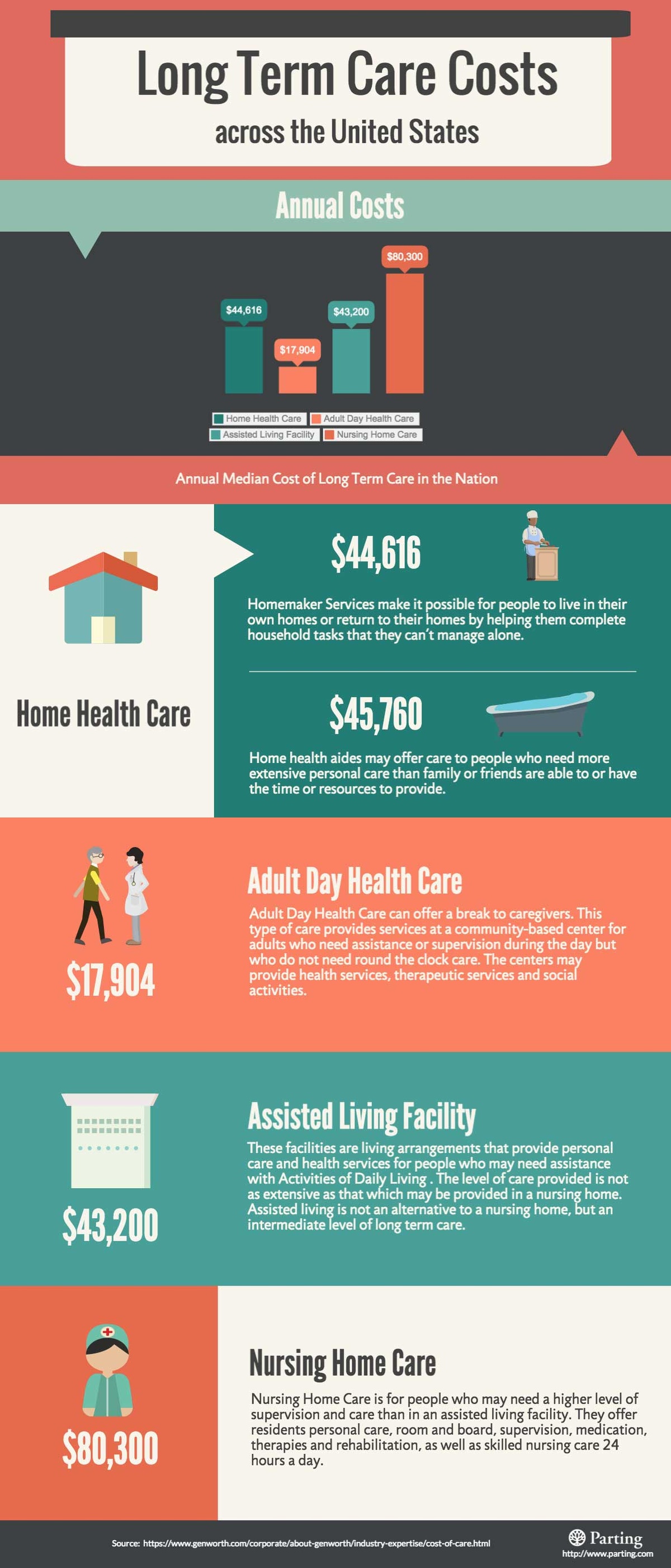

When it comes to long-term care insurance, there are a few different types of coverage available. The most basic type of policy is a traditional long-term care policy, which typically covers nursing home care, home health care, assisted living, and other long-term care services. A second type of policy is a combination policy, which combines life insurance and long-term care insurance into one policy. Finally, there are hybrid policies, which combine features of both traditional long-term care insurance and life insurance policies.

How Much Does Long Term Care Insurance Typically Cost?

The cost of long-term care insurance can vary significantly depending on the type and amount of coverage you purchase. Generally speaking, traditional long-term care insurance policies can cost anywhere from a few hundred to several thousand dollars per year. Combination policies and hybrid policies can be more costly, since they are a combination of two policies. It’s important to look at the details of each policy before making a decision to ensure you’re getting the coverage you need at a price you can afford.

How Can I Find the Best Policy for My Needs?

When it comes to finding the best policy for your needs, it’s important to do your research and shop around. Compare different policies from different companies to make sure you’re getting the coverage you need at a price that fits your budget. Additionally, make sure to read the fine print of any policy you’re considering to make sure you understand what’s covered and what’s not.

Conclusion

Long-term care insurance can be a great way to protect yourself and your family should you ever need long-term care services. It’s important to consider the cost of a policy and shop around to make sure you’re getting the coverage you need at a price you can afford. By doing your research and comparing different policies, you can find the right policy for you.

6 Useful Tips to Avoid Paying $280,000 Health Care Costs in Retirement

Nursing Home Insurance Policy Cost - Insurance Reference

PPT - Offering Long Term Care Insurance to Your Employees is as easy as

Long-Term Care Insurance: The Ultimate Guide

Long Term Care Insurance Cost - Insurance Reference