How Much Auto Liability Insurance Do I Need

How Much Auto Liability Insurance Do I Need?

What is Auto Liability Insurance?

Auto liability insurance is a type of coverage that protects you financially if you are held legally responsible for an accident or damage to another person or their property. It is typically required by law in most states. It is also known as “third-party” insurance because it pays out to third parties who may have been injured or had their property damaged as a result of your negligence. It is typically the most important type of insurance that you need to carry on your vehicle.

How Much Auto Liability Insurance Do I Need?

The amount of auto liability insurance you need depends on the type of vehicle you have and the extent of the damage it may cause in an accident. Generally speaking, the more expensive and powerful the vehicle, the more liability coverage you should have. You should also consider the financial consequences of being held liable for an accident, including medical bills, lost wages and other damages.

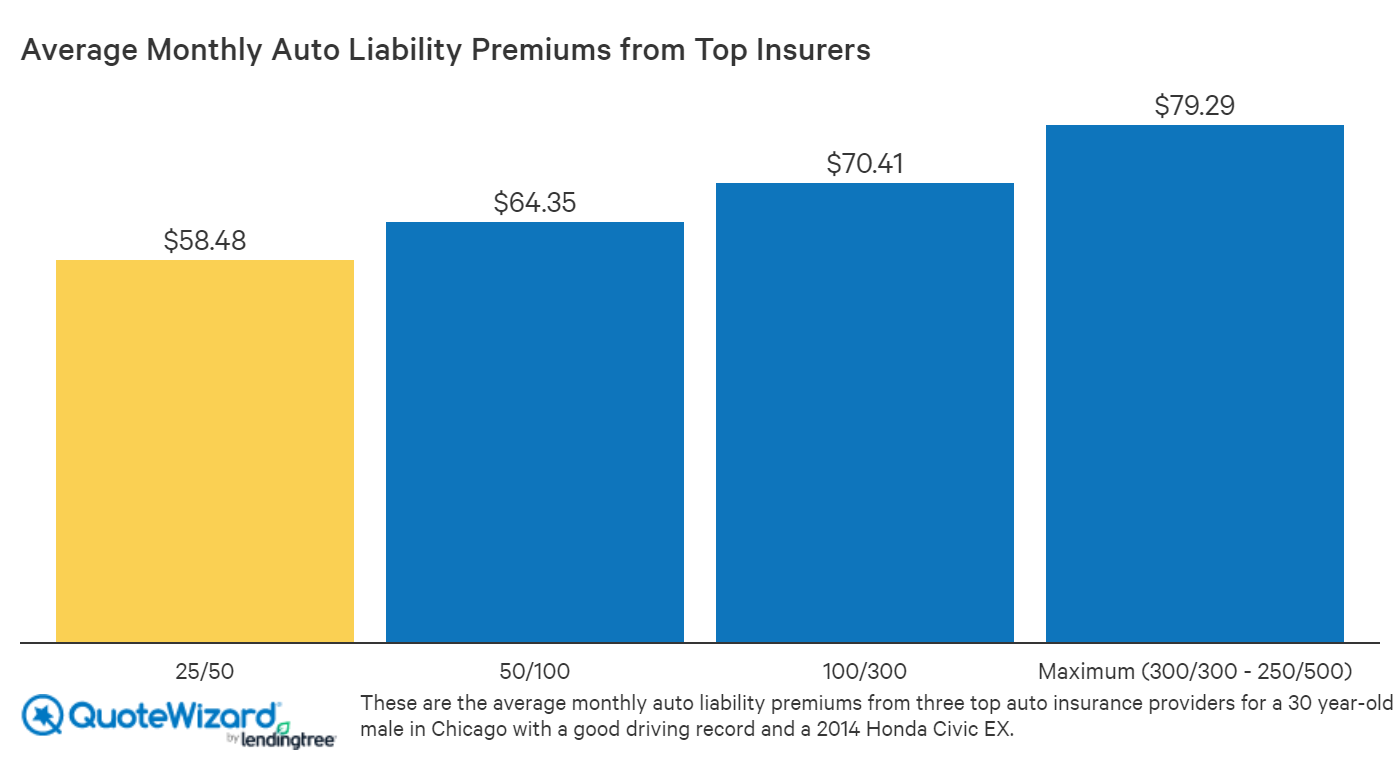

Most states have minimum liability requirements for all drivers, so it’s important to know what your state requires. In some states, these limits are lower than what experts recommend. Higher limits can provide more protection and peace of mind, but they also come with higher premiums. It’s important to take all of these factors into consideration when deciding how much auto liability insurance you need.

Should I Carry Uninsured and Underinsured Motorist Coverage?

Uninsured and underinsured motorist coverage is additional coverage that can help protect you if you’re involved in an accident with an uninsured or underinsured driver. In some states, it is required by law. It is important to understand the coverage limits and what is and isn’t covered. This type of coverage can provide additional protection if you’re involved in an accident with an uninsured or underinsured driver, but it can also come with higher premiums.

Should I Get Additional Coverage?

It’s important to consider additional coverage options such as comprehensive and collision coverage, which can help pay for repairs to your own vehicle if you’re involved in an accident. This type of coverage can be beneficial if you own a newer or more expensive vehicle, but it can also come with higher premiums. It’s important to weigh the cost of the coverage against the potential financial losses if you’re involved in an accident.

Conclusion

Auto liability insurance is an important type of coverage that protects you financially if you are held legally responsible for an accident or damage to another person or their property. The amount of coverage you need depends on the type of vehicle you have and the extent of the damage it may cause in an accident. Most states have minimum liability requirements, but you may want to consider higher limits to provide more protection. You should also consider uninsured and underinsured motorist coverage and additional coverage options such as comprehensive and collision coverage.

The Death of Best Car Insurance - Puriwulandari

How much auto insurance do you need? - Johnson Jensen

What Is Car Insurance Liability? | Visual.ly

Auto Insurance Liability Coverage / Prepare Yourself For a Next Auto

Basic Liability Auto Insurance | 844-495-6293 call today!