Home Insurance Giving More Than

Benefits of Home Insurance Giving More Than You Think

What is Home Insurance?

Home insurance is a type of insurance policy that provides financial protection against losses and damages caused to a home, its contents, and other structures on the property. Generally, it covers the cost of repairing or replacing the home and its contents if they are damaged or destroyed. Home insurance also covers personal liability, which can help protect you if you are sued for causing an accident on your property. Home insurance is an important form of protection for homeowners, as it provides financial security in the event of a disaster or other unexpected event.

What are the Benefits of Home Insurance?

The most important benefit of having home insurance is that it can help cover the costs of repairs or replacement if your home is damaged or destroyed by a covered event, such as fire, theft, or vandalism. Home insurance can also help protect you from personal liability if you are sued for causing an accident on your property. In addition, home insurance can provide coverage for additional living expenses if your home is temporarily uninhabitable due to a covered event. Finally, home insurance can provide peace of mind knowing that you and your belongings are protected in case of an unexpected event.

What Does Home Insurance Cover?

Home insurance policies typically provide coverage for the structure of the home, personal belongings, other structures on the property, and personal liability. Coverage for the home itself includes protection against losses caused by fire, wind, hail, lightning, theft, vandalism, and other covered disasters. Coverage for personal belongings typically includes protection against losses from theft, fire, and other covered disasters. Coverage for other structures on the property typically includes protection for detached garages, sheds, and other structures. Finally, personal liability coverage typically provides protection if you are sued for causing an accident on your property.

Does Home Insurance Cover Floods?

No, home insurance does not typically cover losses caused by floods. If you live in an area that is prone to flooding, you may want to consider purchasing a separate flood insurance policy. Flood insurance provides coverage for losses caused by flooding, including structural damage, personal belongings, and other structures on the property. Flood insurance can help protect you from financial losses in the event of a flood.

Does Home Insurance Cover Earthquake Damage?

No, home insurance does not typically cover losses caused by earthquakes. If you live in an area that is prone to earthquakes, you may want to consider purchasing a separate earthquake insurance policy. Earthquake insurance provides coverage for losses caused by earthquakes, including structural damage, personal belongings, and other structures on the property. Earthquake insurance can help protect you from financial losses in the event of an earthquake.

Conclusion

Home insurance is an important form of protection for homeowners, as it provides financial security in the event of a disaster or other unexpected event. Home insurance can help cover the cost of repairs or replacement if your home is damaged or destroyed by a covered event, and it can also provide coverage for additional living expenses if your home is temporarily uninhabitable due to a covered event. Home insurance typically provides coverage for the structure of the home, personal belongings, other structures on the property, and personal liability. However, it typically does not cover losses caused by floods or earthquakes, so you may want to consider purchasing a separate flood or earthquake insurance policy if you live in an area that is prone to these types of events.

More Than home insurance | Bankrate

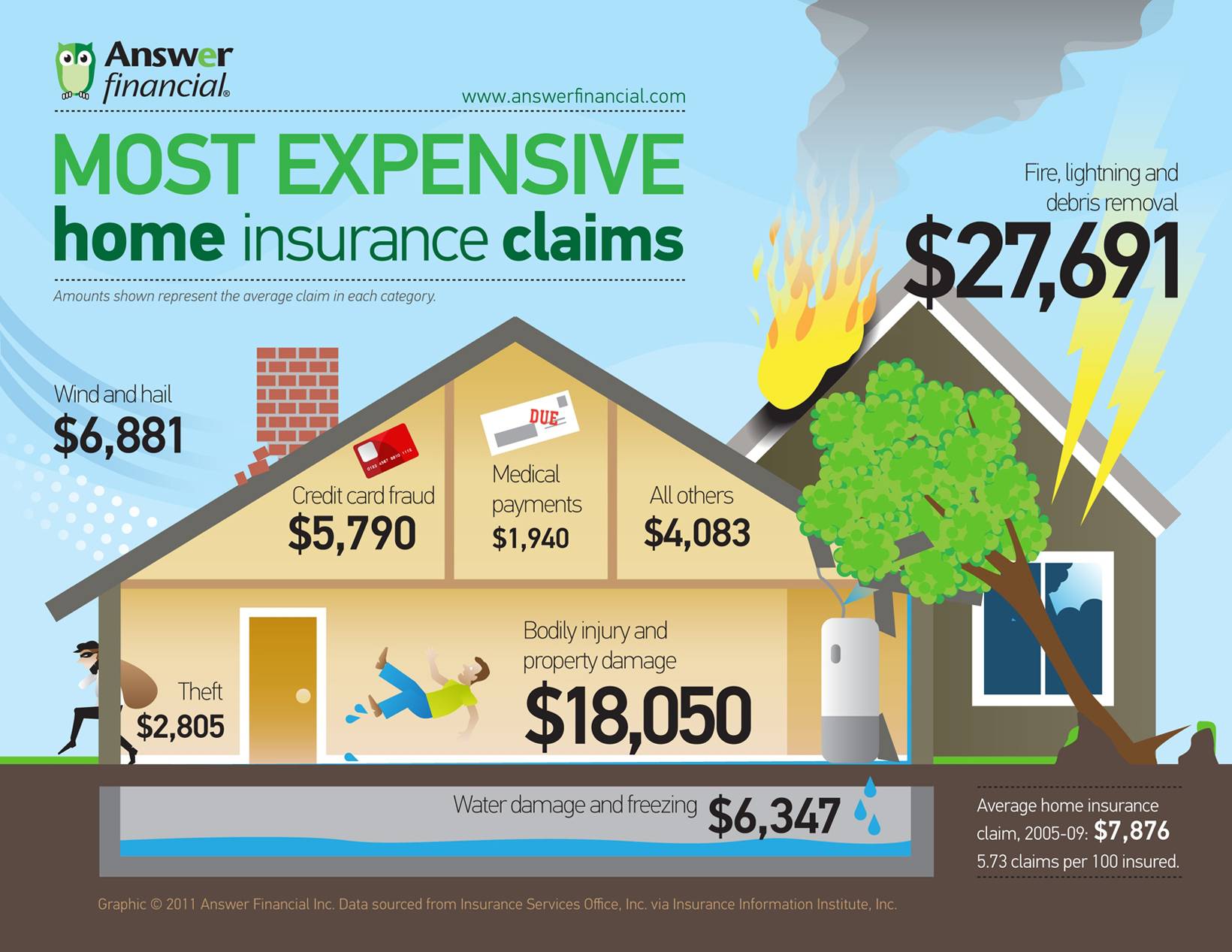

Most Expensive Home Insurance Claims

Five reasons why you need home contents insurance - The Mortgage

7 Ways You Could Be Saving Money on your Home Insurance – Hightower

Importance of home insurance today