Car Insurance Third Party Price

What Is Car Insurance Third Party Price?

Car insurance is an absolute necessity for anyone who owns a vehicle and plans to drive it on public roads. Not only is it a legal requirement, but it also provides invaluable protection against financial loss in the event of an accident or other catastrophic event. One type of car insurance is called third party insurance, and it is a popular option for many drivers due to its affordability. In this article, we will discuss what car insurance third party price is, how it works, and why it might be right for you.

What Is Third Party Insurance?

Third party insurance is a type of car insurance that provides basic protection against financial losses related to an accident or other incident involving your vehicle. It is the most basic type of car insurance and generally the least expensive. It is designed to cover the costs of damage to other people and their property if you are found to be at fault in an accident. It does not provide any coverage for your own vehicle or any other personal property.

What Does Third Party Insurance Cover?

Third party insurance covers the costs of repairing or replacing any property that is damaged or destroyed when you are at fault in an accident. This includes damage to other vehicles, structures, and personal property. It also covers the medical costs of any passengers in the other vehicle who are injured in the accident, as well as any legal costs associated with defending or settling a lawsuit stemming from the accident. Third party insurance does not provide any coverage for the costs of repairing or replacing your own vehicle or any other personal property that may have been damaged in the accident.

How Much Does Third Party Insurance Cost?

The cost of third party insurance can vary widely depending on a number of factors, such as the make and model of your vehicle, your age, your driving record, and where you live. Generally speaking, however, third party insurance is usually much cheaper than comprehensive insurance, which covers both your vehicle and any property that may be damaged in an accident. Third party insurance can also be a good option for drivers who only use their car occasionally, as it is generally much cheaper than comprehensive insurance.

Should I Get Third Party Insurance?

Third party insurance can be a great option for drivers who are looking for basic coverage at a lower cost. However, it is important to remember that it does not provide any coverage for your own vehicle or any other personal property that may be damaged in an accident. If you are looking for more comprehensive coverage, you may want to consider a more comprehensive policy that includes coverage for your own vehicle and any other personal property.

Conclusion

Car insurance third party price is a great option for drivers who are looking for basic coverage at a lower cost. It provides coverage for damage to other people and their property if you are found to be at fault in an accident. However, it does not provide any coverage for your own vehicle or any other personal property. Before making a decision, it is important to consider the type of coverage you need and the costs associated with the different types of insurance.

Third Party Insurance Price Uae - akuapprovesing

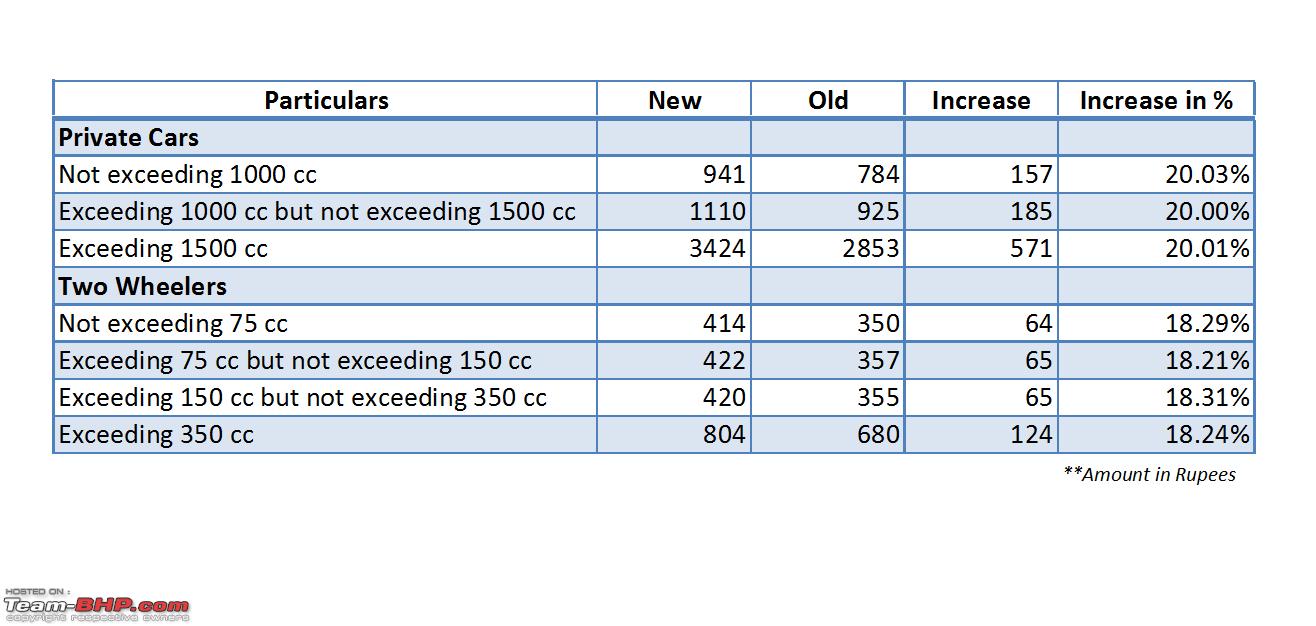

Third Party Insurance Premium to go up W.e.f 1st April 2013 - Team-BHP

Third Party Property Car Insurance | iSelect

Third Party Insurance Price Uae - akuapprovesing

13 best Car Insurance images on Pinterest | Car insurance, Life