Average Semi Truck Insurance Cost Per Month

Average Semi Truck Insurance Cost Per Month

What is Semi Truck Insurance?

Semi truck insurance is a type of commercial insurance that covers the costs associated with operating a semi truck or commercial truck. This type of insurance is designed to protect the driver and the truck itself from any liability that may arise from an accident or other incident while on the road. Semi truck insurance can be divided into two main categories: liability and physical damage. Liability coverage pays for any damages or injuries caused by the driver, while physical damage coverage pays for any damage to the truck itself.

How Much Does Semi Truck Insurance Cost?

The average cost of semi truck insurance can vary greatly depending on the type of coverage purchased, the state in which the truck is registered, as well as the type of truck and its age. Generally speaking, liability coverage for a semi truck can range from $500 to $4,000 per year, while physical damage coverage can range from $1,000 to $8,000 per year. In addition, some states may require additional coverage, such as cargo coverage and uninsured motorist coverage, which can increase the overall cost of insurance.

Factors That Impact Semi Truck Insurance Rates

When calculating semi truck insurance costs, there are several factors that can affect the rate. These include the type of truck, its age, its use, the driver’s experience and driving record, the truck’s location, and the amount of coverage purchased. Additionally, many insurance companies also consider the value of the truck, its cargo, and the type of cargo being hauled. For example, if the truck is carrying hazardous materials, the cost of insurance may be higher than if it was carrying general cargo.

How to Save on Semi Truck Insurance

There are several ways to save money on semi truck insurance. One of the most effective is to shop around for the best rate for the coverage you need. Additionally, some insurance companies offer discounts for safe drivers, so it’s important to keep your driving record clean. Many companies also offer discounts for bundling different types of coverage, such as cargo and liability, so it’s important to consider your needs before committing to a single policy. Finally, it’s important to be aware of any state-mandated coverage requirements, as these can increase the overall cost of your insurance.

Conclusion

Semi truck insurance can be an expensive but necessary expense for truckers. The cost of coverage depends on several factors, including the type of coverage purchased, the state in which the truck is registered, and the type of truck and its age. Additionally, there are several ways to save money on semi truck insurance, such as shopping around for the best rate and taking advantage of discounts offered by insurance companies. By understanding all of the factors involved in semi truck insurance, truckers can ensure they get the coverage they need at a price they can afford.

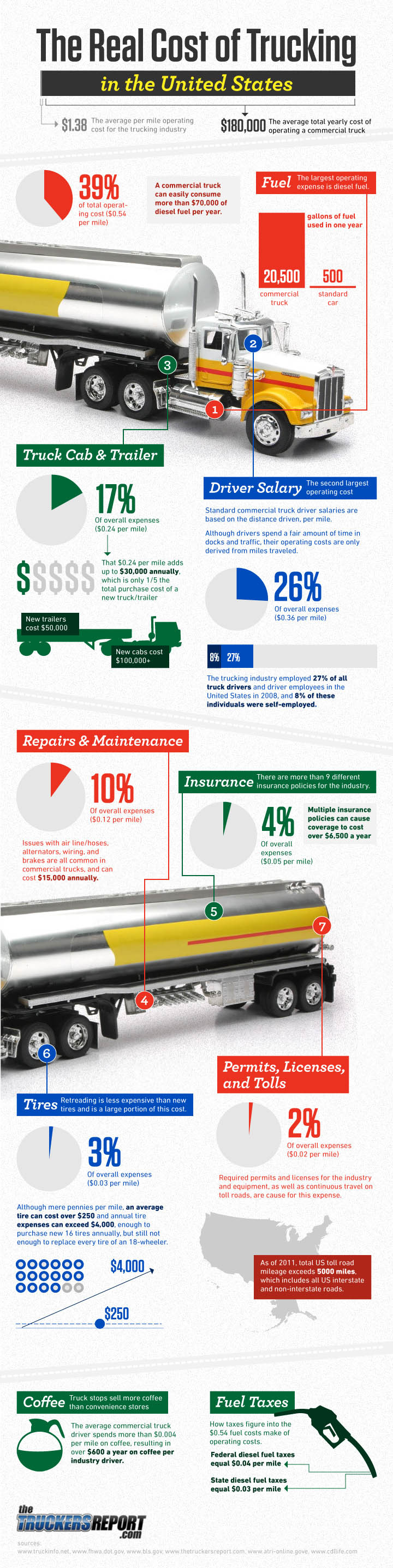

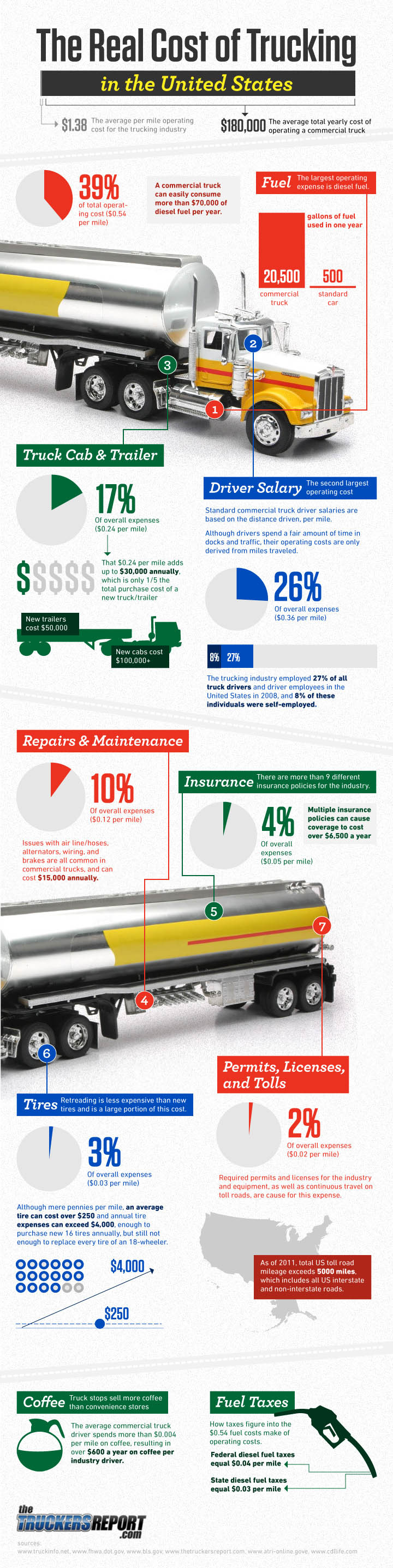

The Real Cost of Trucking - Per Mile Operating Cost of a Commercial

Midsize Truck Insurance Rates - Cost and Rankings for all Models

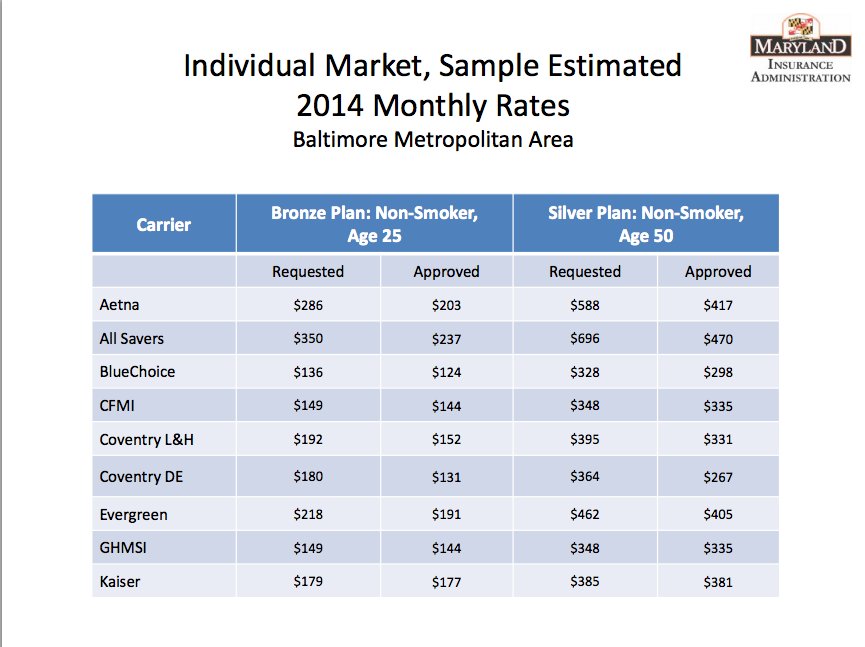

Maryland Touts Low Obamacare Health Insurance Premiums

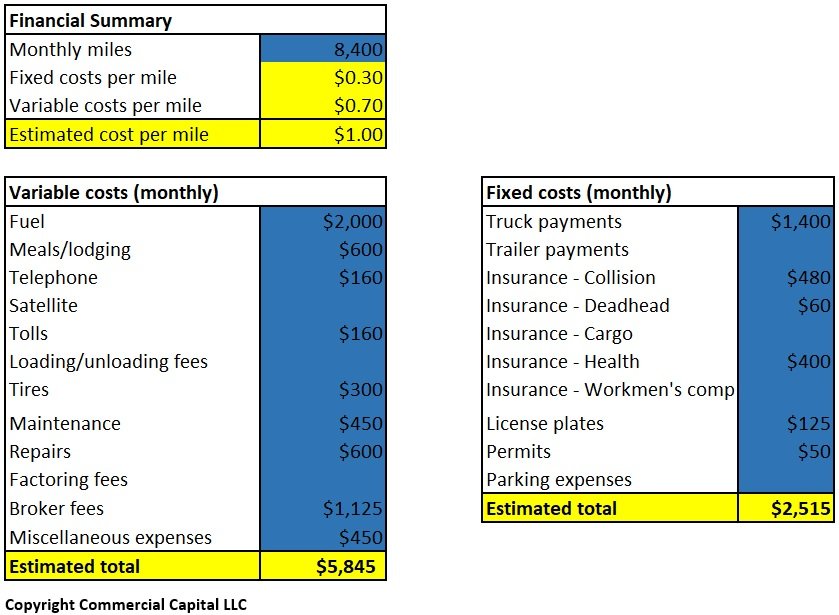

average trucking cost per mile – Spreadsheets

Calculate Your Cost Per Mile – Truckers & Owner-Operators