Average Cost Of Car Insurance For Teen Driver In Pa

Friday, May 9, 2025

Edit

Average Cost Of Car Insurance For Teen Driver In Pa

Why You Need Insurance

When it comes to being a teen driver in Pennsylvania, you need to make sure that you are properly insured. Not only is it the law, but it is also essential for your safety and the safety of others. There are a variety of different factors that go into determining what the average cost of car insurance for a teen driver in Pennsylvania is. Knowing this information can help you to make the best decision when it comes to choosing a policy.

Factors That Impact Cost

There are a variety of different factors that can influence the cost of car insurance for teen drivers in Pennsylvania. Some of these factors include the type of car that you drive, the age of the teen driver, their driving record, and even their credit score. Insurance companies take all of these factors into consideration when determining the cost of a policy.

The type of car that you drive is one of the biggest factors that will impact the cost of your car insurance. Typically, cars that are considered to be safer are going to cost less to insure. This is because these types of cars are less likely to be involved in an accident. The age of the teen driver is another factor that will affect the cost of their car insurance. Teen drivers are typically considered to be a higher risk and therefore the cost of their policy is usually higher than that of an older driver.

The Benefits Of Shopping Around

Another factor that will have an impact on the cost of car insurance for teen drivers in Pennsylvania is their driving record. Teen drivers who have a good driving record will typically be able to get a lower rate on their policy. It is important to shop around and compare rates from different companies in order to get the best deal.

It is also important to keep in mind that some insurance companies may offer discounts for certain types of drivers. For example, some companies may offer discounts for teen drivers who have taken a defensive driving course. Additionally, there may be discounts available for teen drivers who have taken a driver’s education course.

The Importance Of A Good Credit Score

Finally, the credit score of the teen driver can also have an impact on the cost of their car insurance. Insurance companies take into consideration the credit score of a driver when determining the cost of their policy. A good credit score can help to lower the cost of the policy. Therefore, it is important for teen drivers to maintain a good credit score in order to get the best rates on their car insurance.

Conclusion

In conclusion, there are a variety of different factors that can influence the cost of car insurance for teen drivers in Pennsylvania. It is important to shop around and compare rates from different companies in order to get the best deal. Additionally, maintaining a good driving record and credit score can help to lower the cost of a policy. By understanding the factors that can affect the cost of car insurance for teen drivers in Pennsylvania, you can make an informed decision when it comes to choosing the best policy for your needs.

The average cost of car insurance in the US, from coast to coast

Average Cost of Car Insurance for Young Drivers 2020 | NimbleFins

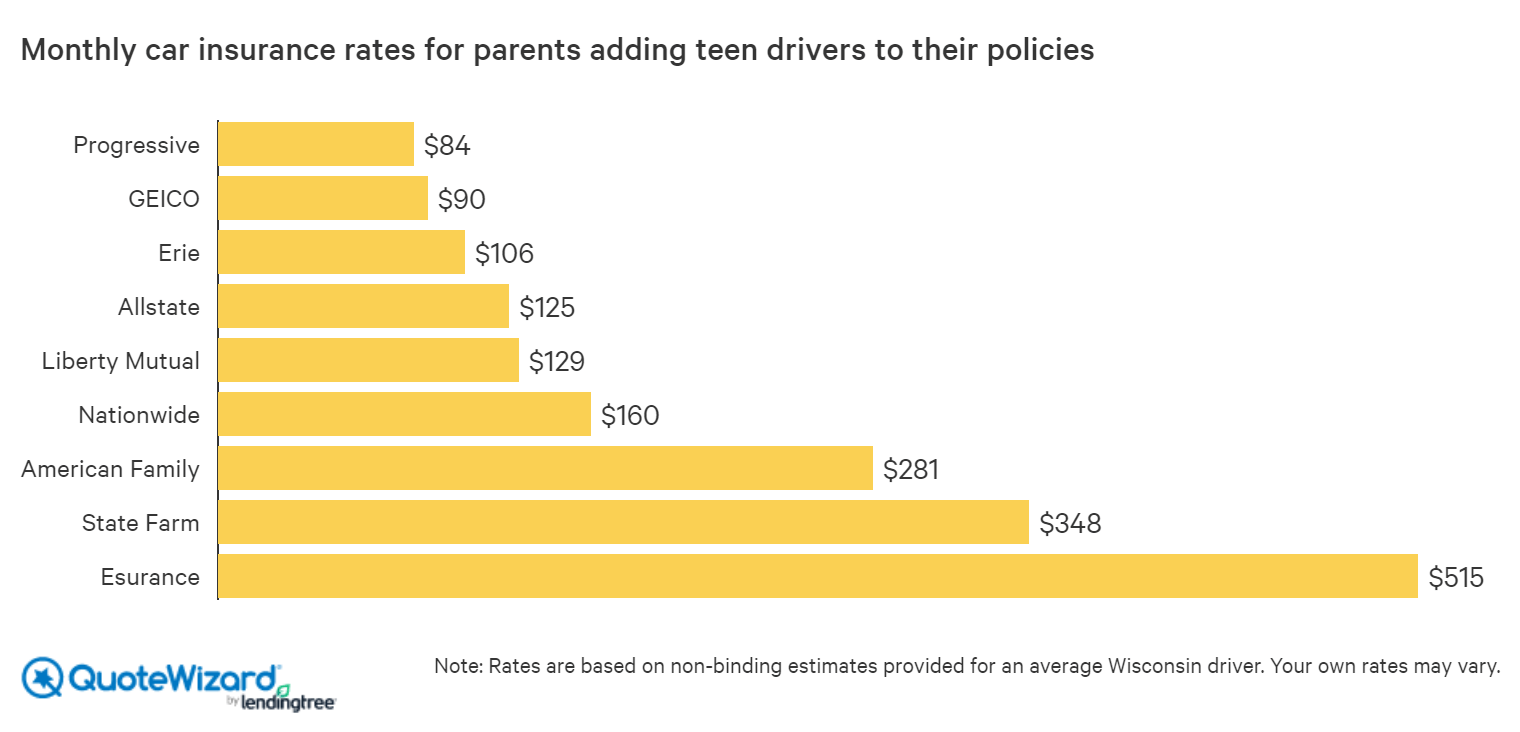

Best Car Insurance for Teens | QuoteWizard

Quick Answer: What Is The Average Car Insurance Rate?? - AutoacService

What's the Average Auto Insurance Cost Per Month? | The Lazy Site