Auto Owners Life Insurance Payment

Auto Owners Life Insurance Payment: What You Need to Know

What is Auto Owners Life Insurance?

Auto Owners Life Insurance is a policy that provides coverage and protection to a policyholder’s family in the event of the policyholder’s death. With this policy, the policyholder’s dependents and beneficiaries can receive a lump sum payment as a death benefit. Auto Owners Life Insurance is designed to replace a policyholder’s lost income and ensure that their loved ones are financially secure. This policy is offered by Auto Owners Insurance, a large insurance company based in the United States.

What Does Auto Owners Life Insurance Cover?

Auto Owners Life Insurance is designed to provide a policyholder’s family with financial security in the event of their death. The policy covers the policyholder’s funeral expenses and can also provide money to cover any outstanding debts the policyholder may have. The policy also pays a lump sum of money to the policyholder’s beneficiaries. This money can be used to help with living expenses, such as groceries, rent, or medical bills.

How Much Does Auto Owners Life Insurance Cost?

The cost of Auto Owners Life Insurance depends on the policyholder’s age and health. The cost is typically lower for younger policyholders and increases as the policyholder gets older. The cost also depends on the policyholder’s lifestyle and risk factors, such as smoking. It is important to note that Auto Owners Life Insurance does not cover pre-existing conditions. The policyholder must also pay an annual premium to keep the policy active.

How Does Auto Owners Life Insurance Payment Work?

When a policyholder dies, their beneficiaries will receive a lump sum payment from Auto Owners Life Insurance. The amount of the payment depends on the policyholder’s coverage amount and the insurer’s payout rate. The payment is typically made within 30 days of the policyholder’s death. The payment can be used to cover the policyholder’s funeral expenses, outstanding debts, and living expenses for the policyholder’s family.

What Are the Benefits of Auto Owners Life Insurance?

Auto Owners Life Insurance is designed to provide financial security for a policyholder’s family in the event of the policyholder’s death. With this policy, the policyholder’s family can receive a lump sum payment to help cover the costs associated with the policyholder’s death. The policy also provides peace of mind that the policyholder’s family will be taken care of financially in the event of their death.

Where Can I Get Auto Owners Life Insurance Payment?

Auto Owners Life Insurance is available through Auto Owners Insurance. The company offers a variety of life insurance policies, including term life, whole life, and universal life insurance. In addition, Auto Owners Insurance also offers a variety of other insurance products, such as auto, home, and business insurance. To find out more about Auto Owners Life Insurance, contact a local Auto Owners Insurance agent or visit their website.

Page for individual images | Quoteinspector.com - QuoteInspector.com

Auto-Owners Insurance – Logos Download

AUTO OWNERS INSURANCE BILL PAY - Quick Bill Pay

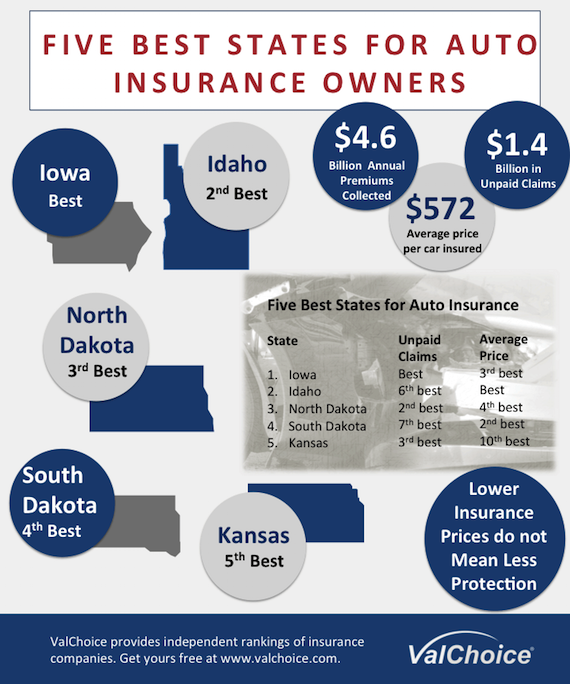

Five Best States for Auto Insurance Owners - ValChoice

AARP Life Insurance Payment - Easy Methods - Pay My Bill Guru