Auto Insurance Pay Per Mile

Wednesday, May 21, 2025

Edit

Auto Insurance Pay Per Mile: What You Need To Know

What Is Auto Insurance Pay Per Mile?

Auto insurance pay per mile is a new, innovative way to pay for car insurance. Instead of paying a fixed premium each month or year, you pay for the miles you drive. You’ll start by estimating your annual mileage and then pay a set amount for each mile you drive. Depending on the insurer, you might have the option to pay for your mileage upfront or after you’ve driven it.

If you’re someone who doesn’t drive very often, you could save a ton of money with this type of insurance. You’ll only pay for the miles you actually drive, which could end up being a fraction of what you’d pay with traditional car insurance. On the other hand, if you’re someone who drives a lot, it might not be the best option since you’ll end up paying more than you would with a traditional policy.

What Types of Insurance Are Available With Pay Per Mile Insurance?

Most of the major auto insurance companies offer pay per mile insurance. This type of coverage usually includes liability coverage and uninsured or underinsured motorist coverage. Liability coverage will help cover the costs of damages and injuries you cause to others in an accident. Uninsured or underinsured motorist coverage helps cover the costs of damages or injuries you sustain in an accident with someone who doesn’t have insurance or doesn’t have enough coverage.

Some insurers may also offer additional coverage, such as collision and comprehensive coverage. Collision coverage helps pay for damages to your vehicle in an accident, while comprehensive coverage helps cover the costs of damages caused by something other than an accident, such as fire, theft, or vandalism.

Is Pay Per Mile Insurance Right For Me?

Pay per mile insurance could be a great option for people who don’t drive a lot. If you don’t drive more than a few thousand miles a year, you could save a lot of money with this type of insurance. It’s also a great option for people who don’t have a car but occasionally rent one for a road trip or to run errands. You’ll only have to pay for the miles you drive, which could save you a lot of money.

However, pay per mile insurance isn’t always the best option. If you drive a lot, you could end up paying more for your insurance than you would with a traditional policy. And if you have a car that’s older or has a lot of miles, you could end up paying more for coverage.

How Do I Get Started With Pay Per Mile Insurance?

If you’re interested in pay per mile insurance, the first step is to find an insurer that offers it. Most of the major auto insurers now offer pay per mile insurance, so you should have plenty of options to choose from. Once you’ve found an insurer, you’ll need to estimate your annual mileage and then set up a plan with them. You’ll also need to decide whether you want to pay for your mileage upfront or after you’ve driven it.

What Are The Benefits Of Pay Per Mile Insurance?

The biggest benefit of pay per mile insurance is that you’ll only pay for the miles you drive, which could save you a lot of money. You’ll also have the flexibility to choose when and how you pay for your mileage. And since you’re only paying for the miles you drive, you won’t have to worry about your premium going up if you drive more than you anticipated.

What Are The Drawbacks Of Pay Per Mile Insurance?

The biggest drawback of pay per mile insurance is that it could end up costing you more than a traditional policy if you drive a lot. And if you have an older car or a car with a lot of miles, you could end up paying more for coverage. Additionally, some insurers may have restrictions on how and when you can pay for your mileage.

Pay per mile insurance can be a great option for people who don’t drive a lot or who occasionally rent cars. If you’re someone who drives a lot or has an older or high-mileage car, it might not be the best option. Be sure to shop around and compare different insurers to find the best coverage and price for your needs.

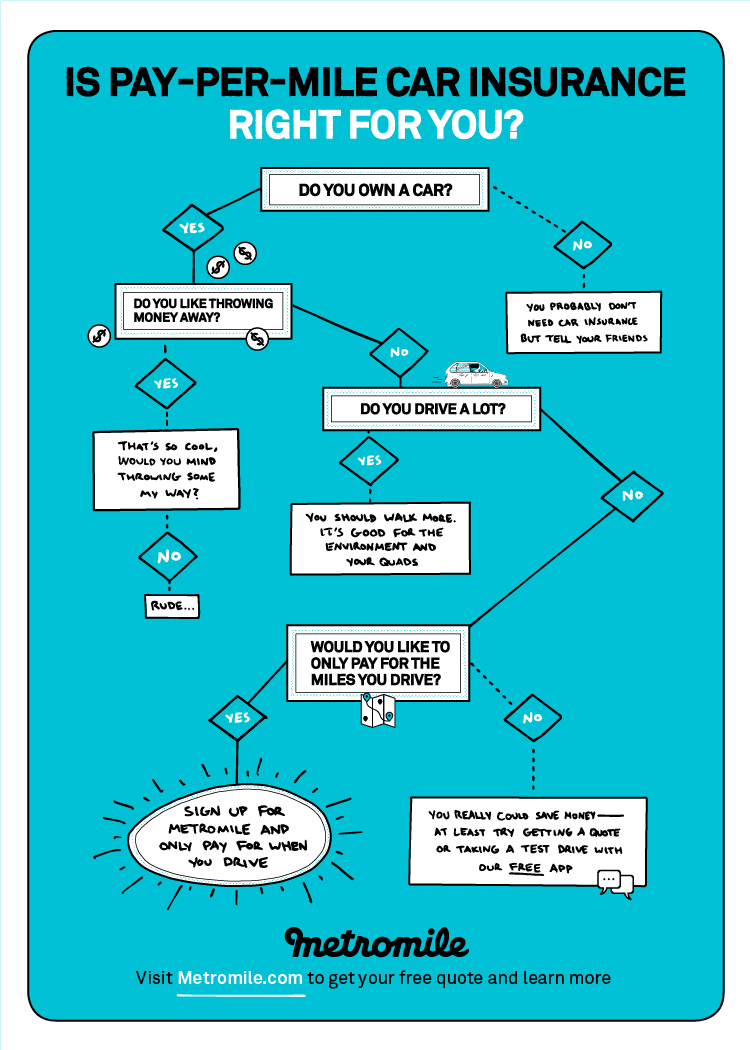

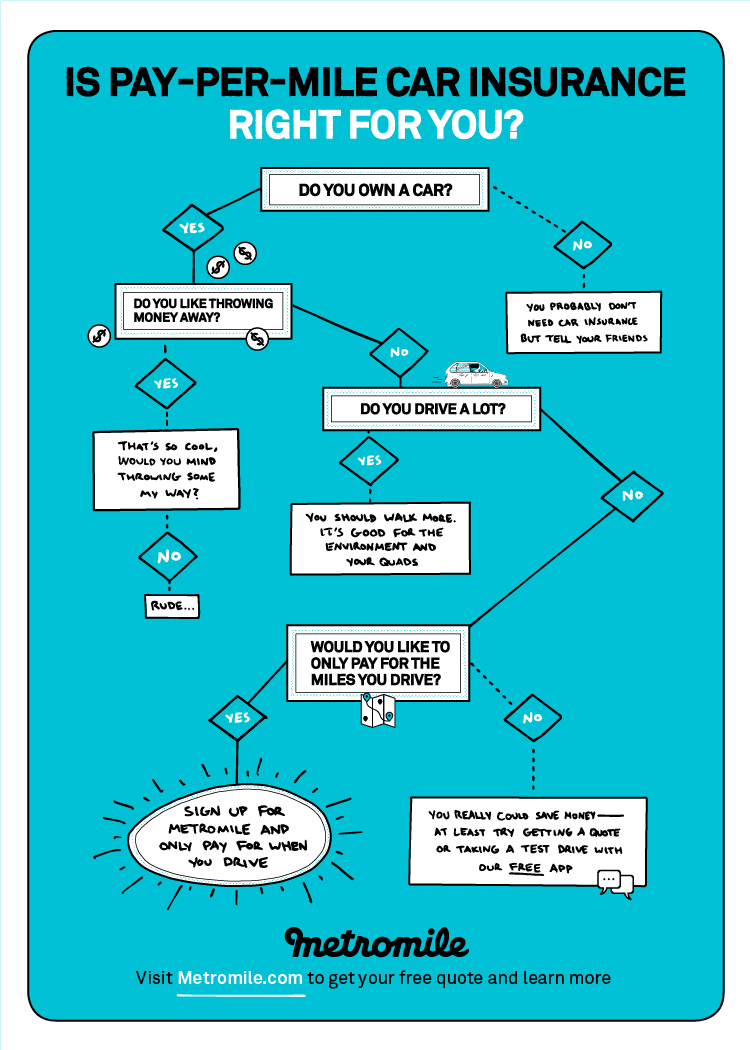

Quiz: Is Pay-per-mile Car Insurance Right for You?

Sardilli Says: A Family Insurance Agency: Pay-Per-Mile Auto Insurance

Pay Per Mile Car Insurance - Metromile

Pay-per-mile insurance is an affordable car insurance for low mileage

Metromile: Pay-Per-Mile Insurance For Casual Drivers