Auto Insurance By Miles Driven

Auto Insurance by Miles Driven: Everything You Need to Know

What is Auto Insurance by Miles Driven?

Auto insurance by miles driven is a type of insurance policy that rewards drivers for driving less. This type of policy is ideal for people who don’t drive very often, such as those who live in rural areas or who primarily use public transportation. It’s also great for people who work from home and don’t need to drive very often. With auto insurance by miles driven, you pay only for the miles you drive. This means that you can save money if you don’t drive much.

How Does Auto Insurance by Miles Driven Work?

Auto insurance by miles driven works by tracking your mileage with a device installed in your car. This device records your mileage and sends the data to your insurance company. Your insurance company then calculates your premium based on your mileage. The less you drive, the lower your premium. This type of insurance policy can be very beneficial for people who don’t drive very often, as they can save money on their premiums.

How Much Can You Save with Auto Insurance by Miles Driven?

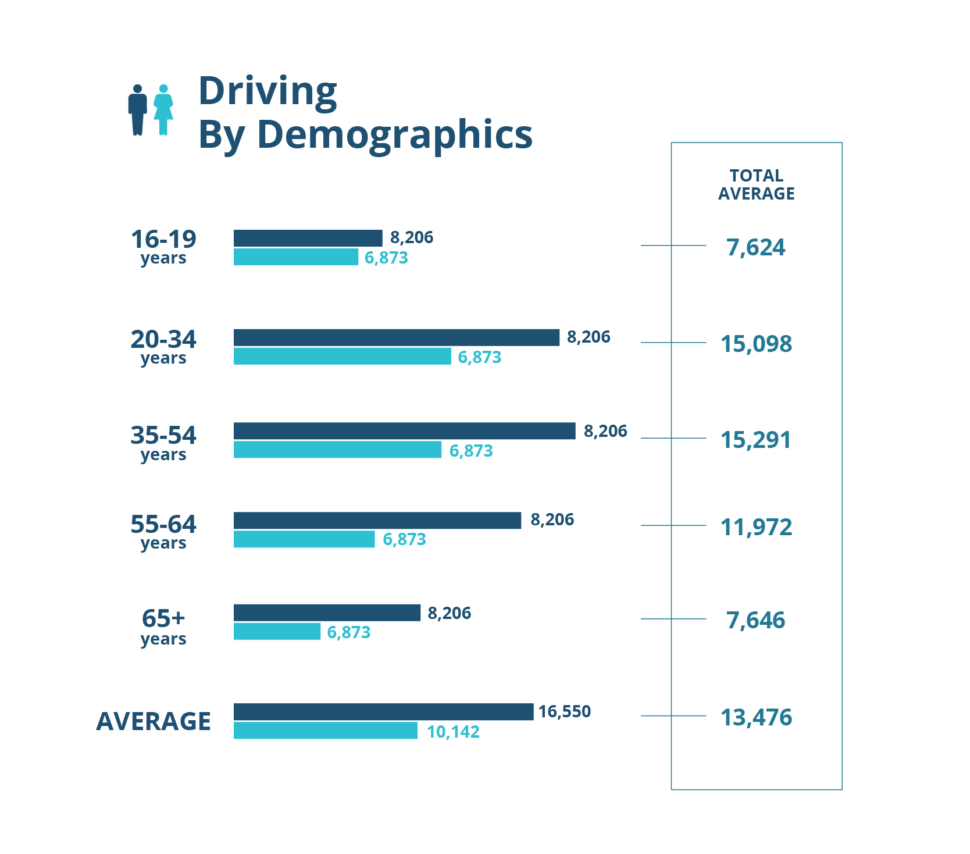

The amount of money you can save with auto insurance by miles driven depends on how much you drive. If you drive less than the average driver, you can save up to 30% on your premiums. However, if you drive more than the average driver, your premiums may be higher than normal. It’s important to compare different auto insurance policies and find the one that’s right for you.

What are the Benefits of Auto Insurance by Miles Driven?

The main benefit of auto insurance by miles driven is that it can save you money. If you don’t drive very often, you can save up to 30% on your premiums. In addition, you can also save time and hassle. With auto insurance by miles driven, you don’t have to worry about filling out paperwork or having your car inspected. You can simply install the device in your car and start tracking your mileage.

Are There Any Downsides to Auto Insurance by Miles Driven?

One of the downsides to auto insurance by miles driven is that it requires you to have a device installed in your car. This device must be connected to your car’s computer and can be difficult to install. In addition, you may be required to pay a monthly fee for the device. Finally, some insurance companies may not offer auto insurance by miles driven, so it’s important to check with your insurance company to see if this type of policy is available.

Should You Get Auto Insurance by Miles Driven?

Auto insurance by miles driven is a great option for people who don’t drive very often. If you live in a rural area or primarily use public transportation, this type of policy can help you save money on your premiums. However, if you drive a lot, it may not be the best option for you. It’s important to compare different auto insurance policies and find the one that’s right for you.

Average Miles Driven Per Year by State [Infographic]

![Auto Insurance By Miles Driven Average Miles Driven Per Year by State [Infographic]](https://www.4autoinsurancequote.com/wp-content/uploads/AUTO-Infographic-Average-Miles-Driven-Per-Year-in-Each-State-Infographic_02-1-970x854.png)

Average Miles Driven Per Year by State [Infographic]

![Auto Insurance By Miles Driven Average Miles Driven Per Year by State [Infographic]](https://www.4autoinsurancequote.com/wp-content/uploads/AUTO-Infographic-Average-Miles-Driven-Per-Year-in-Each-State-Infographic_01-970x764.png)

Average Miles Driven Per Year by State [Infographic]

![Auto Insurance By Miles Driven Average Miles Driven Per Year by State [Infographic]](https://www.4autoinsurancequote.com/wp-content/uploads/AUTO-Infographic-Average-Miles-Driven-Per-Year-in-Each-State-Infographic_04-970x967.png)

Average miles driven per year by state - CarInsurance.com

A different approach to Car Insurance - By Miles [ad]

![Auto Insurance By Miles Driven A different approach to Car Insurance - By Miles [ad]](https://www.mrsmummypenny.co.uk/wp-content/uploads/2019/09/21-9-19-pinterest-by-miles.jpg)