Ami Car Insurance Agreed Value

What is Ami Car Insurance Agreed Value?

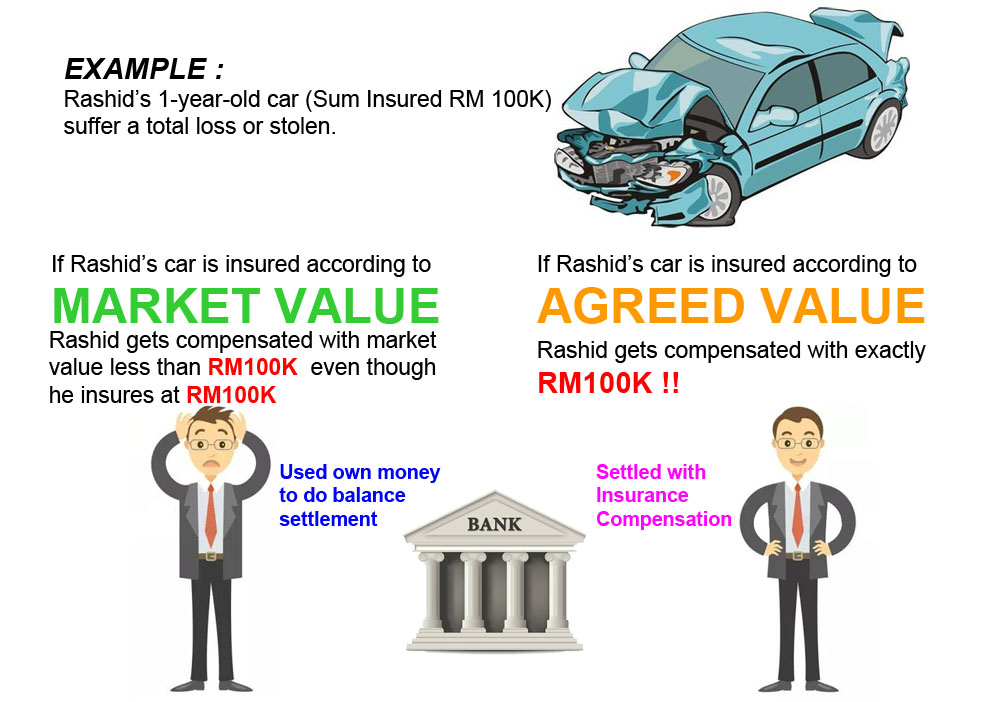

AMI car insurance agreed value is a type of cover that offers you a predetermined, agreed-upon amount of money in the event of a total loss claim, regardless of the age, condition and market value of your car. This type of cover is suitable for cars that are older, have higher kilometres, have been modified, or are no longer able to be insured for a market value.

Basically, car insurers with an agreed value policy will settle your total loss claim for the predetermined amount of money, regardless of what the market value of your vehicle is at the time of the claim. This means that you don’t have to worry about being short-changed on your claim if your car is older or has been modified.

What are the Benefits of Ami Car Insurance Agreed Value?

The main benefit of an agreed value policy is the assurance that you will receive the predetermined amount of money if your car is stolen or written off in an accident. This gives you peace of mind that you won’t lose out financially in the event of a total loss claim.

In addition to the financial security, an AMI car insurance agreed value policy also offers a hassle-free claims process. This means that you won’t have to spend time and energy negotiating with your insurer over the amount of your claim. All you need to do is provide the necessary paperwork, and you can be confident that your claim will be settled quickly and efficiently.

Are There Any Disadvantages to Ami Car Insurance Agreed Value?

The main disadvantage to an agreed value policy is that you may end up paying a higher premium for your cover. This is because the insurer is taking on more risk by agreeing to a predetermined amount of money in the event of a total loss claim. You may also be limited in the number and type of modifications that you can make to your car.

It’s important to consider all of your options before you decide to take out an agreed value policy. You should always read the fine print and make sure that you understand all of the terms and conditions before you commit to a policy.

What are the Alternatives to Ami Car Insurance Agreed Value?

If you’re looking for cover for an older car or a car that has been modified, then you may want to consider a market value policy. With this type of cover, your insurer will settle your claim based on the current market value of your vehicle. This means that you may receive less money than you would with an agreed value policy, but you’ll also pay a lower premium.

It’s important to compare the different types of policies available so that you can find the most suitable cover for your needs. It’s also essential that you read the product disclosure statement, so that you know exactly what is and isn’t covered by your policy.

Classic Car Insurance: The Agreed Value Impact - YouTube

$50 Z Gift Card with AMI Comprehensive Car Insurance Policy

Classic / Antique Auto Insurance - Agreed Value vs. Stated Value

Best Comprehensive

The Best How To Get Agreed Value Car Insurance Ideas - SPB