Allstate Vs Nationwide Auto Insurance

Allstate vs Nationwide Auto Insurance

An Overview of Allstate and Nationwide Auto Insurance

When it comes to auto insurance, there are many companies that offer competitive policies and prices. Two of the most well-known companies are Allstate and Nationwide. Allstate is one of the largest insurance companies in the United States, with over 16 million policies in force. Nationwide is a top-rated company that has been in business for over 80 years. Both companies offer a range of auto insurance policies, including liability, comprehensive, collision, and uninsured motorist coverage.

Comparing Allstate and Nationwide Auto Insurance

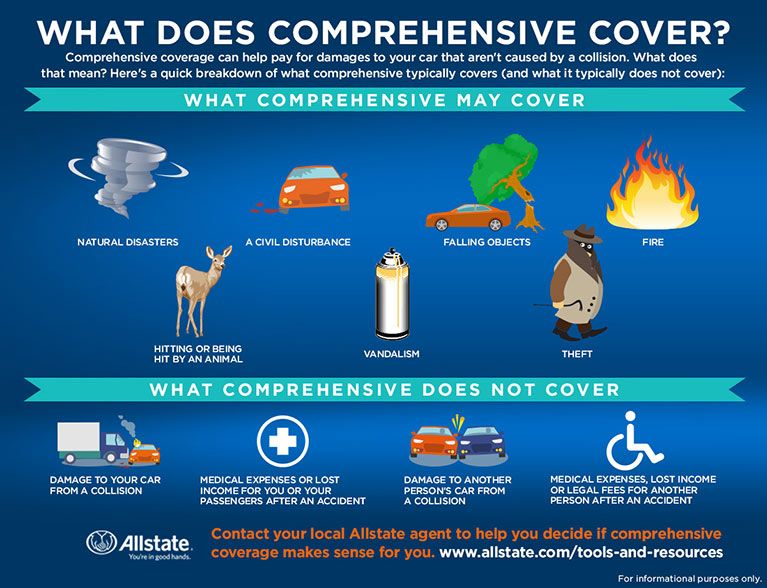

Both Allstate and Nationwide offer a range of auto insurance policies that can meet the needs of most drivers. Allstate’s standard coverage includes liability, comprehensive, collision, and uninsured motorist coverage. They also offer additional coverage options such as rental car reimbursement, towing and labor, and personal injury protection. Nationwide also offers a range of standard coverage options, with additional coverage options such as towing and labor, rental car reimbursement, and gap insurance.

Comparing Prices

When it comes to auto insurance, prices can vary widely depending on a number of factors. These factors include the type of vehicle, driving record, credit score, and location. Both Allstate and Nationwide offer competitive prices, with Allstate typically offering slightly lower rates than Nationwide. However, it is important to shop around and compare rates from multiple companies in order to get the best deal.

Discounts and Benefits

Both Allstate and Nationwide offer a range of discounts and benefits to their customers. Allstate offers discounts for safe drivers, multi-car policies, and good student discounts. Nationwide offers discounts for good drivers, multi-car policies, and defensive driving courses. Both companies also offer a variety of additional benefits such as accident forgiveness, new car replacement, and roadside assistance.

Conclusion

When it comes to auto insurance, Allstate and Nationwide both offer competitive policies and prices. Allstate typically offers lower rates than Nationwide, but it is important to shop around and compare rates from multiple companies in order to get the best deal. Both companies offer a range of discounts and benefits, so it is important to consider all of the options before making a decision.

Auto Insurance Provider Review – Allstate VS Nationwide – From General

The 5 Best Auto Insurance Companies According to Customer Reviews

Allstate vs Nationwide Insurance | Comparably

Allstate Car Insurance Review – Forbes Advisor

What Is Comprehensive vs. Collision Coverage | Allstate