1st Party Or 3rd Party Insurance

What is 1st Party and 3rd Party Insurance?

Insurance is a necessary part of life, but what many people don’t know is that there are two distinct kinds of insurance: 1st party and 3rd party insurance. Both types of insurance are important, and it’s necessary to understand the difference between the two in order to make an informed decision when selecting an insurance policy. That’s why we’re here to explain the difference between 1st party and 3rd party insurance and why each type is important.

1st Party Insurance

1st party insurance is a type of insurance policy that is taken out by an individual or company to cover their own losses. This type of insurance is also known as “direct” insurance, as it covers the policyholder directly. Examples of 1st party insurance include auto, health, home, and life insurance. 1st party insurance is important because it covers the policyholder for losses that they may incur in the event of an accident or other unforeseen circumstance.

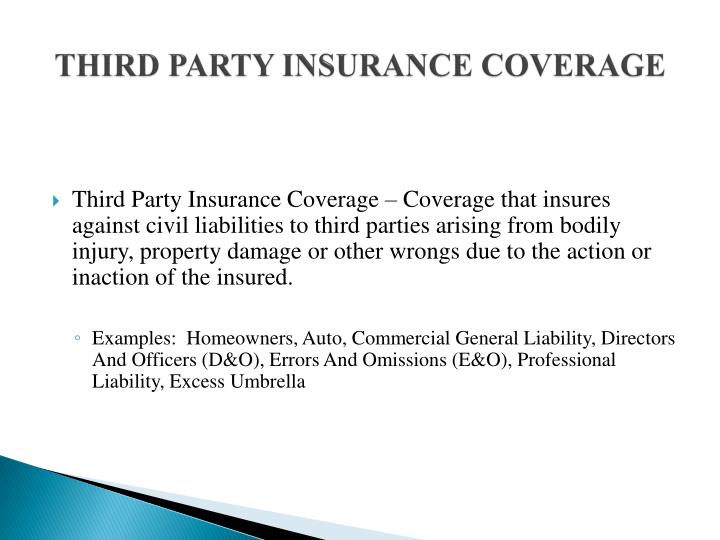

3rd Party Insurance

3rd party insurance is a type of insurance policy taken out by an individual or company to cover the losses of another person or company. This type of insurance is also known as “indirect” insurance, as it covers someone other than the policyholder directly. Examples of 3rd party insurance include professional liability, product liability, and employer’s liability insurance. 3rd party insurance is important because it covers the policyholder for losses that they may incur due to the negligence or misconduct of another person or company.

The Difference Between 1st and 3rd Party Insurance

The primary difference between 1st party and 3rd party insurance is that 1st party insurance covers the policyholder for their own losses, while 3rd party insurance covers someone other than the policyholder for their losses. 1st party insurance is typically taken out by individuals or companies to cover their own losses, while 3rd party insurance is typically taken out by companies to cover the losses of their customers, employees, or other third parties.

Why Each Type is Important

Both 1st party and 3rd party insurance are important and necessary for individuals and companies. 1st party insurance is important because it provides coverage for the policyholder in the event of an accident or other unforeseen circumstance. 3rd party insurance is important because it provides coverage for the policyholder in the event of negligence or misconduct by another person or company. Without either type of insurance, individuals and companies would be left vulnerable to the financial losses caused by unexpected events or the negligence of others.

How to Choose the Right Insurance Policy

Choosing the right insurance policy is an important decision, and it’s essential to understand the difference between 1st party and 3rd party insurance in order to make an informed decision. It’s important to consider the types of risks that an individual or company may face, and to select an insurance policy that will provide adequate coverage for those risks. It’s also important to shop around and compare different insurance policies in order to find the best value for money.

What is 1st party & Third party Insurance in Short. - YouTube

What Is The Difference Between First-Party And Third-Party Insurance?

1st Party 3rd Party Insurance, थर्ड पार्टी इंश्योरेंस, तृतीय पक्षीय

Third Party Insurans : First Party Insurance vs Third Party Insurance

Party Insurance / Must Read | How to make a claim on the Third Party