Typical Car Insurance Costs Group

Average Car Insurance Costs by Group

Car insurance is an important investment for drivers, as it provides financial protection in the event of an accident. But figuring out the average cost of car insurance is no easy task. Car insurance rates vary widely according to a variety of factors, including age, location, driving history, type of car and more. To determine the average cost of car insurance, it’s important to first understand the different types of car insurance and the different groups that determine car insurance rates.

Different Types of Car Insurance

Generally, car insurance is divided into two categories: liability and collision. Liability car insurance covers the cost of damages to other people and their property caused by an accident for which the policyholder is at fault. Collision car insurance covers the cost of damages to the policyholder’s car caused by an accident, regardless of fault. Many states require drivers to have liability insurance, while collision insurance is typically optional.

Car Insurance Groups

Car insurance companies use a variety of different factors to determine car insurance rates. One of the most important factors is the group that a vehicle is assigned to. Car insurance groups are determined by a variety of factors, including the cost of repairs, the performance of the vehicle and the cost of replacement parts. Generally, cars that are more expensive to repair and/or replace are assigned to higher groups, while cars that are cheaper to repair and/or replace are assigned to lower groups. This means that drivers who own cars in higher groups will typically pay more for car insurance.

Average Car Insurance Costs by Group

The average cost of car insurance varies widely according to the group that a vehicle is assigned to. Generally, cars in the lowest groups will have the lowest insurance premiums, while cars in the highest groups will have the highest insurance premiums. Factors such as driving history, location, age and other factors will also affect the cost of car insurance. In general, however, the average cost of car insurance for the lowest group is around $1,000 per year, while the average cost of car insurance for the highest group is around $3,000 per year.

Tips for Lowering Car Insurance Costs

There are a few ways for drivers to lower their car insurance costs, regardless of the group their car is assigned to. One of the easiest ways to lower car insurance costs is to shop around for the best rates. Different insurance companies offer different rates, so it’s important to compare quotes from multiple companies. Additionally, drivers should consider raising their deductible, as this can lower the cost of the insurance premium. Finally, drivers should consider taking a defensive driving course, as some insurance companies offer discounts for those who have completed such a course.

Conclusion

Car insurance is a necessary expense for all drivers, as it provides financial protection in the event of an accident. The cost of car insurance varies widely according to a variety of factors, including the group that a vehicle is assigned to. Generally, cars in the lowest groups will have the lowest insurance premiums, while cars in the highest groups will have the highest insurance premiums. Drivers should shop around for the best rates and consider raising their deductible and/or taking a defensive driving course in order to lower their car insurance costs.

The average cost of car insurance in the US, from coast to coast

ALL You Need to Know About the Average Car Insurance Cost

Car Insurance Cost by State [OC] : visualization

![Typical Car Insurance Costs Group Car Insurance Cost by State [OC] : visualization](https://i.redd.it/ch7cf4ukdyz41.png)

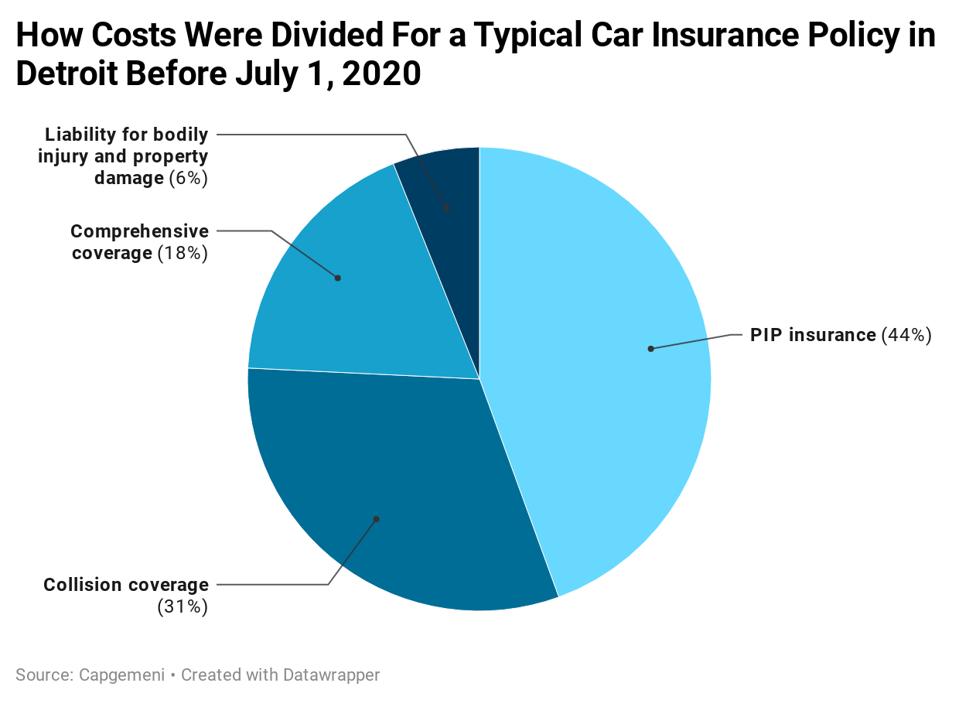

What To Expect From Michigan’s New Auto Insurance Laws On July 1

Average Cost of Car Insurance UK 2020 | NimbleFins