State Farm Long term Care Insurance Cost

What is Long Term Care Insurance and How Much Does It Cost?

Long term care insurance is an important form of insurance that can help protect you and your loved ones from the rising costs of long term care. It can help pay for nursing or home care, or provide coverage for some of the other costs associated with long term care.

Long term care insurance is a type of insurance that is designed to cover the costs of long term care services when a person is unable to perform the activities of daily living (ADLs) due to a physical or cognitive disability. It pays for services such as home health care, adult day care, and assisted living. It is important to understand that long term care insurance is different from health insurance, which covers medical expenses and hospitalizations.

State Farm is one of the leading providers of long term care insurance. It offers a variety of plans and coverage levels to meet your needs. The cost of long term care insurance depends on the type of plan you choose, your age and health, and your coverage needs.

State Farm long term care insurance is offered in two main types: traditional and hybrid. Traditional plans are designed to provide coverage for a specific period of time, such as 5 or 10 years. Hybrid plans combine traditional long term care insurance with life insurance, so that if you die before the end of the policy period, your beneficiaries will receive a death benefit.

The cost of traditional long term care insurance plans from State Farm can range from about $200 to $1,000 per month, depending on the type of plan you choose and your coverage needs. Hybrid plans are typically more expensive, with premiums ranging from $2,000 to $10,000 per year.

State Farm also offers a variety of discounts and incentives to help make long term care insurance more affordable. These include discounts for couples, discounts for healthy individuals, and discounts for individuals who choose to pay their premiums in one lump sum.

In addition, State Farm offers a wide range of options for long term care insurance riders, which can be added to your policy to provide additional coverage for a variety of long term care services. These riders can help you customize your coverage to meet your specific needs.

When considering long term care insurance, it is important to compare plans and prices from different providers to make sure you get the best coverage for your budget. State Farm is a great option for those looking for long term care insurance, as it offers a variety of plans and discounts to help make coverage more affordable.

State Farm Long Term Care Insurance Rate Increases

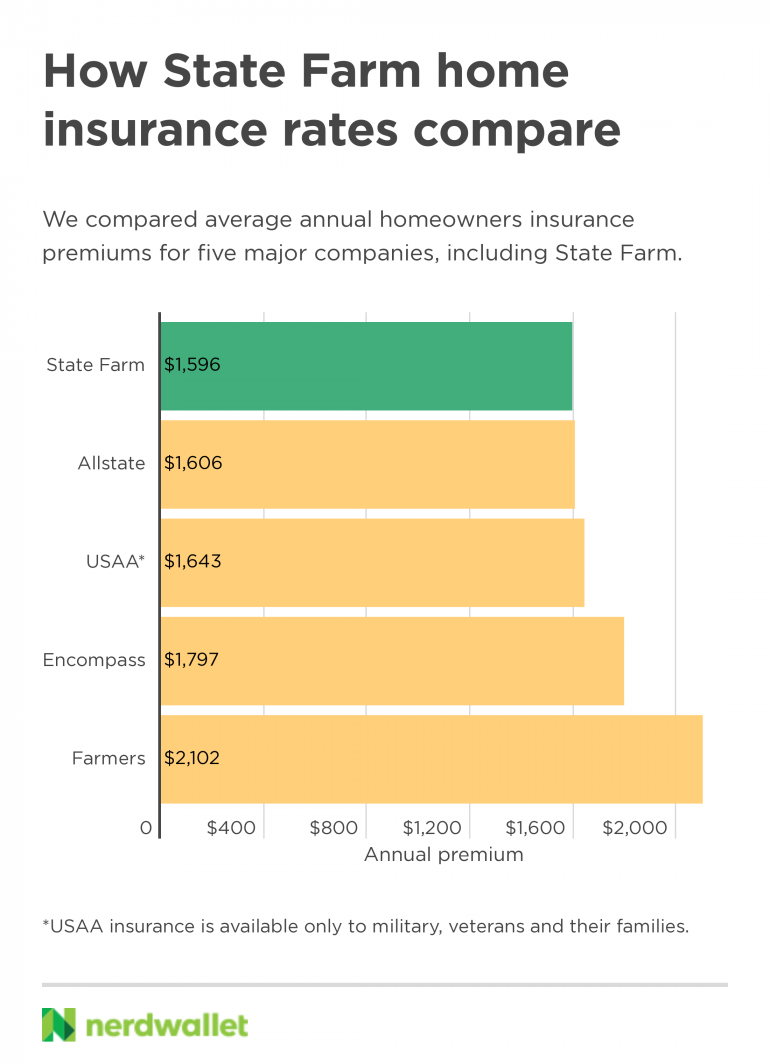

State Farm Home Insurance Review 2021 - NerdWallet

State Farm Stays Profitable Despite Higher Losses, Lower Premiums | WGLT

Should you get car insurance through your credit union? - Clark Howard

The Real Cost of Long-Term Care (INFOGRAPHIC) | HuffPost