Non Owned Auto Liability Coverage Definition

What is Non Owned Auto Liability Coverage?

Non Owned Auto Liability Coverage is a type of insurance coverage that provides financial protection, should a vehicle owned by someone else cause an accident or property damage. This type of coverage is important for those who travel for their job or use a personal vehicle for business errands. It provides protection from any resulting liability costs, like medical bills and legal fees.

What Does Non Owned Auto Liability Coverage Cover?

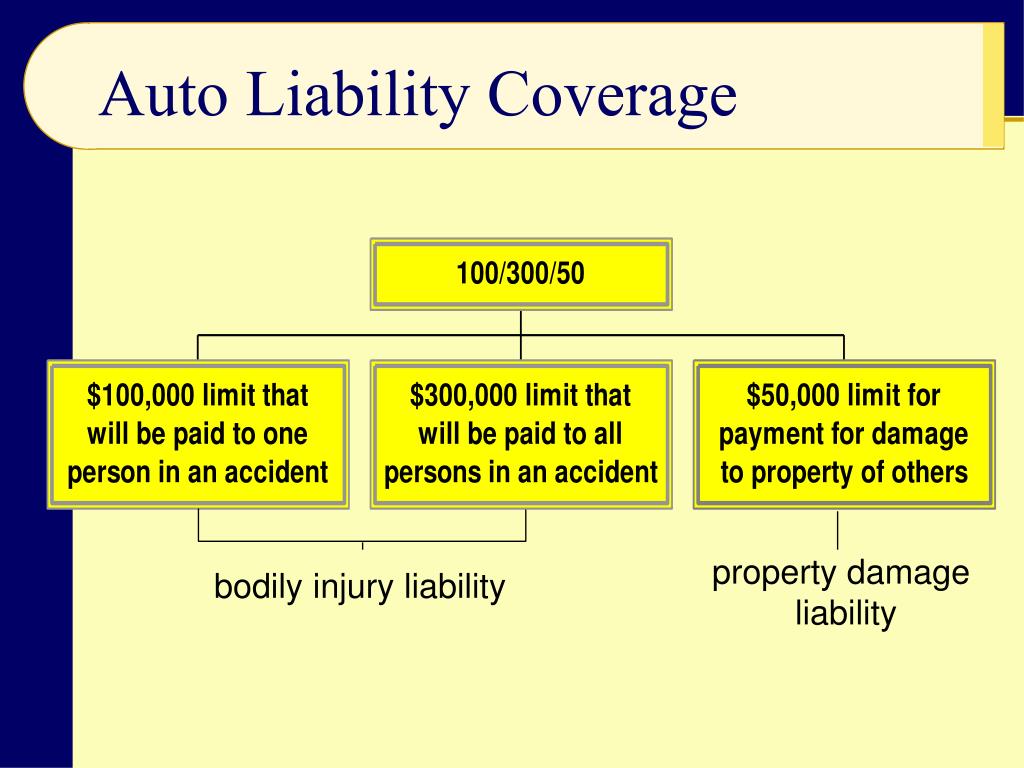

Non Owned Auto Liability Coverage is designed to cover any damages or injuries caused by a vehicle owned by someone else. This could include an accident with a rental car, a borrowed car, or a vehicle leased by the policyholder. It also covers any resulting liability costs, like medical bills and legal fees, that arise from the accident.

Who Needs Non Owned Auto Liability Coverage?

Non Owned Auto Liability Coverage is important for those who travel for their job or use a personal vehicle for business errands. It can provide peace of mind and financial protection should an accident occur. This type of coverage is often included in a business’s commercial auto insurance policy, but it can be purchased separately if needed.

What Else Should I Know About Non Owned Auto Liability Coverage?

It is important to note that Non Owned Auto Liability Coverage does not cover any damage to the vehicle itself. For this, you would need to purchase separate insurance coverage. Additionally, it is important to make sure that you are adequately covered. Check with your insurer to make sure that you have enough coverage to cover any potential losses.

Where Can I Get Non Owned Auto Liability Coverage?

Non Owned Auto Liability Coverage can typically be purchased from any major insurer. Speak with an agent to discuss your needs and ask about any discounts or special offers that may be available. It is important to compare rates and coverage options to make sure that you are getting the best deal.

Conclusion

Non Owned Auto Liability Coverage is an important type of insurance coverage for anyone who travels for their job or uses a personal vehicle for business errands. It provides financial protection should an accident occur and the resulting liability costs, like medical bills and legal fees, arise. Be sure to speak with an insurance agent to discuss your coverage needs and compare rates and coverage options before purchasing a policy.

Non-Owned Auto Liability

Non-Owner Car Insurance Quote - Liability Coverage for Car-Free Drivers

PPT - Grey Fleet (non-owned) You have the exposure - do you have the

PPT - Chapter 10: Risk Management and Property/Liability Insurance

PPT - Grey Fleet (non-owned) You have the exposure - do you have the