Motor Trade Insurance Brokers Uk

Motor Trade Insurance Brokers UK - An Overview

Motor trade insurance brokers UK are specialised insurance brokers that provide a range of insurance policies that are tailored to the needs of motor traders. Motor trade insurance policies are designed to provide financial protection to motor traders in the event of an accident, theft or damage to vehicles or property. There are a number of different types of motor trade insurance policies available, including public liability insurance, employers' liability insurance and motor trade liability insurance.

What Does Motor Trade Insurance Cover?

Motor trade insurance covers a variety of different aspects of a motor trader’s business. Depending on the specific type of policy, motor trade insurance can cover damage to vehicles or property, liability for injuries to customers or employees, and legal expenses. Motor trade insurance can also provide cover for the cost of repairs, the replacement of parts or materials, and any other associated costs. In addition, motor trade insurance can provide cover for the costs of any tools or equipment that are damaged in an accident or lost in a fire.

Types of Motor Trade Insurance

Motor trade insurance brokers UK provide a range of different types of motor trade insurance policies. These include public liability insurance, employers' liability insurance and motor trade liability insurance. Public liability insurance provides protection for motor traders in the event that they are held liable for any damage caused to third party property or persons. Employers' liability insurance provides protection for motor traders in the event that an employee is injured or killed while working for them. Motor trade liability insurance provides protection for motor traders in the event that they are held liable for any damage caused to customers or vehicles.

The Benefits of Motor Trade Insurance

Motor trade insurance can provide motor traders with financial protection in the event of an accident, theft or damage to vehicles or property. In addition, it can provide motor traders with peace of mind, knowing that they are covered in the event of a claim. Motor trade insurance also ensures that motor traders are compliant with the law and that they are taking all necessary steps to protect their business from any potential risks or liabilities. Furthermore, motor trade insurance can help motor traders to save money in the long run by providing cover for any costs associated with repairs or replacements.

Finding the Right Motor Trade Insurance Broker UK

When searching for a motor trade insurance broker UK, it is important to consider the level of cover that is offered, the premiums and the level of customer service. It is also important to ensure that the motor trade insurance broker is reputable and reliable. It is advisable to compare quotes from a number of different motor trade insurance brokers in order to find the best policy for your needs. It is also important to read the terms and conditions of the policy carefully, in order to ensure that you are adequately covered.

Conclusion

Motor trade insurance brokers UK can provide motor traders with the financial protection they need in the event of an accident, theft or damage to vehicles or property. It is important to choose the right motor trade insurance broker, in order to ensure that you are adequately covered and that you are receiving the best value for money. Motor trade insurance can provide motor traders with peace of mind, knowing that they are covered in the event of a claim.

Motor Trade - James Tricketts Insurance Rossendale Lancashire

Motor Trade Insurance - Insurance Brokers - SJL Insurance Services

Motor Trade Insurance Quote - Commercial Insurance Brokers - Business

Motor Fleet Insurance | Prospero Insurance Brokers Ltd | Kilsyth

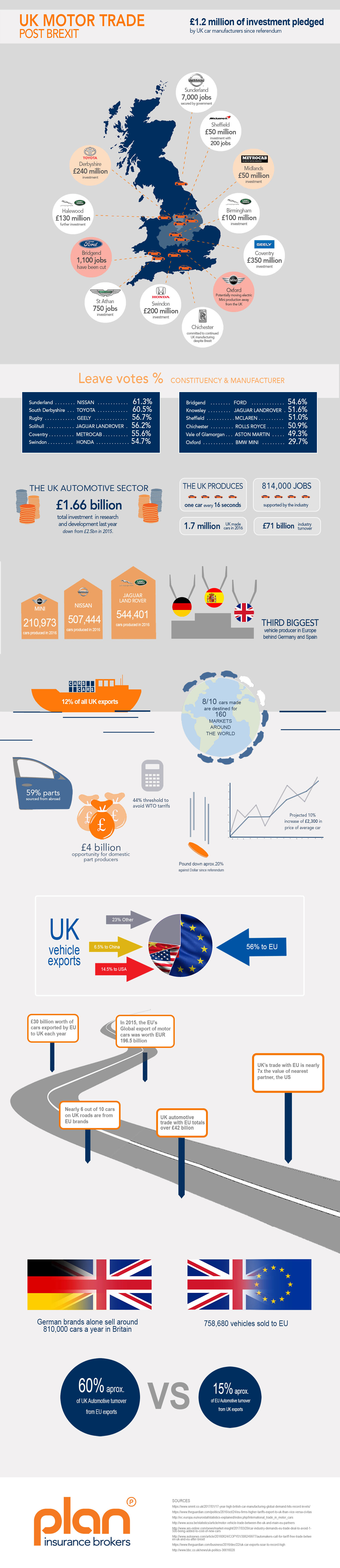

Brexit and the effects it will have on the motor industry