Is Managed Care Private Insurance

What is Managed Care Private Insurance?

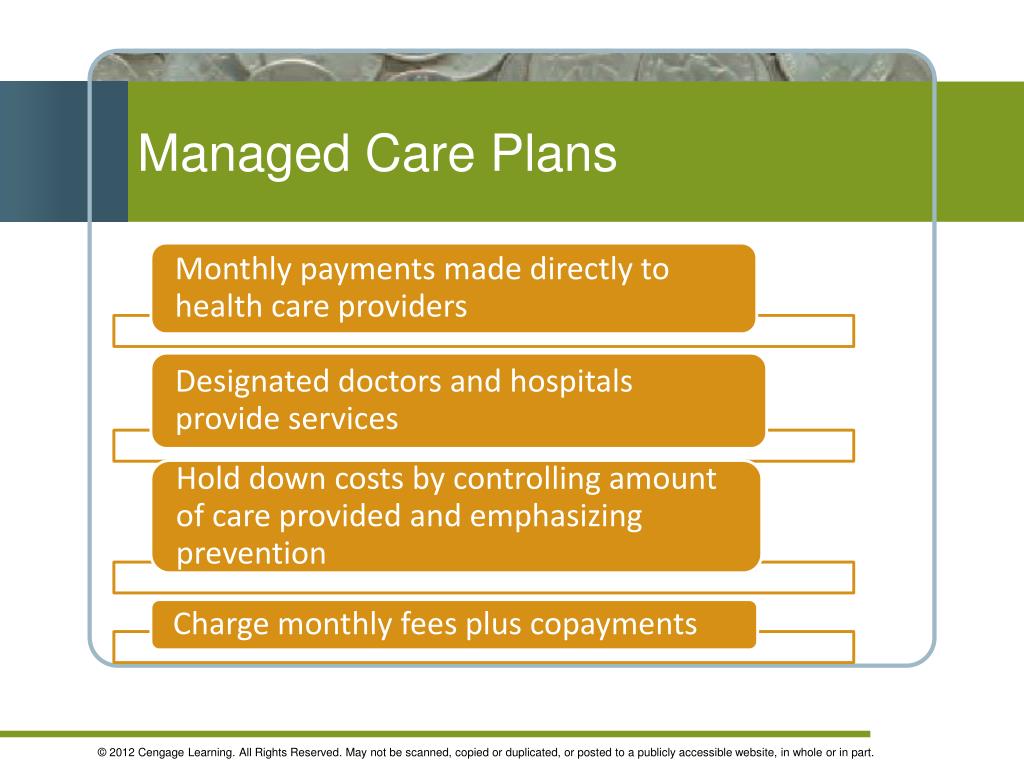

Managed care private insurance is a type of health insurance that is provided to individuals or families by a private, for-profit health insurance company. The goal of managed care is to provide cost-effective, quality health care services to its members. Managed care plans typically provide coverage for preventive care and medical services such as doctor visits, hospital stays, surgeries, lab tests, and prescription drugs. They also provide access to a network of health care providers, including doctors, specialists, and hospitals.

Types of Managed Care Insurance Plans

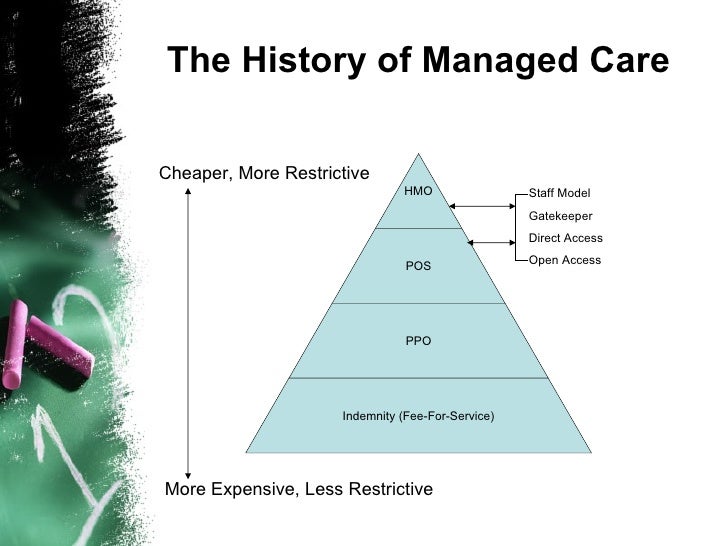

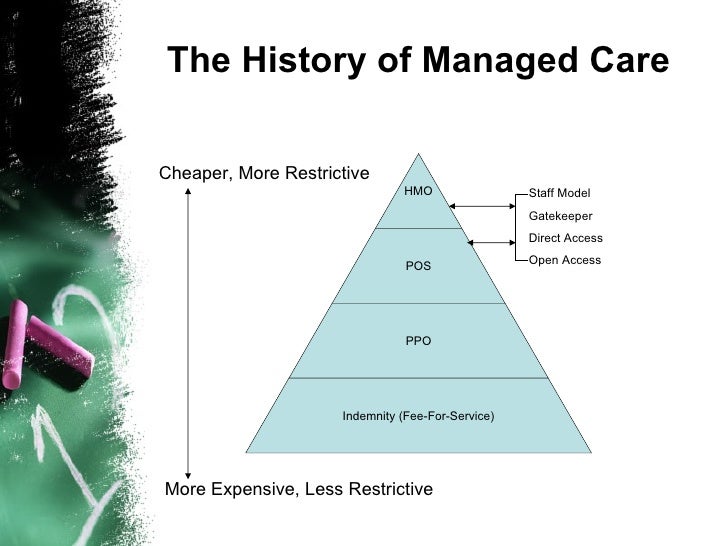

There are several different types of managed care private insurance plans. The two main types are Preferred Provider Organizations (PPO) and Health Maintenance Organizations (HMOs). PPOs are the most common type of managed care plans, and they provide members with access to a network of providers who have agreed to provide services at discounted rates. HMOs are more restrictive than PPOs, and they require members to select a primary care doctor who must coordinate all medical care. Another type of managed care plan is Point of Service (POS) plans, which are a hybrid of PPOs and HMOs.

Advantages of Managed Care Private Insurance

Managed care private insurance plans have several advantages. One of the main benefits of these plans is that they usually have lower premiums than traditional health insurance plans. They also provide access to a wide network of health care providers who have agreed to provide services at discounted rates. Additionally, managed care plans typically provide coverage for preventive care, which can help members avoid more expensive medical bills down the road. Finally, managed care plans may provide additional benefits such as dental coverage, vision coverage, and mental health services.

Disadvantages of Managed Care Private Insurance

Managed care private insurance plans also have some drawbacks. One of the main disadvantages is that they typically require members to select a primary care doctor who must coordinate all medical care. This means that members may not be able to choose their own doctor or specialist. Additionally, managed care plans may not cover certain services or treatments, and they may require members to pay a co-payment or coinsurance for certain services. Finally, managed care plans may not cover services that are deemed “experimental” or “not medically necessary.”

Conclusion

Managed care private insurance plans can be a great option for individuals and families who are looking for affordable, quality health care coverage. These plans typically have lower premiums than traditional health insurance plans and provide access to a wide network of health care providers. However, managed care plans also have some drawbacks, such as requiring members to select a primary care doctor who must coordinate all medical care, not covering certain services or treatments, and requiring members to pay a co-payment or coinsurance for certain services. Therefore, it is important to carefully review the benefits, restrictions, and costs of a managed care plan before selecting one.

The ABC’S Of Managed Care

Managed Care Plans-HMO,PPO and POS of United States

Continuity Health Solutions » Managed Care Organizations

PPT - Insuring Your Health PowerPoint Presentation, free download - ID

PPT - Indirect Compensation: Benefits PowerPoint Presentation, free