Is Florida A No Fault State For Auto Insurance

Tuesday, April 29, 2025

Edit

Is Florida A No Fault State For Auto Insurance?

What is No Fault Insurance?

No Fault Insurance is a type of car insurance policy that provides protection to all the parties involved in an accident, regardless of who is at fault. In No Fault Insurance, the policyholder’s insurance company pays the medical expenses and other damages arising out of an accident. This type of insurance eliminates the need to determine who is at fault in an accident, as the policyholder’s insurance company will pay for the damages regardless. No Fault Insurance is also known as Personal Injury Protection, or PIP.

What is a No Fault State?

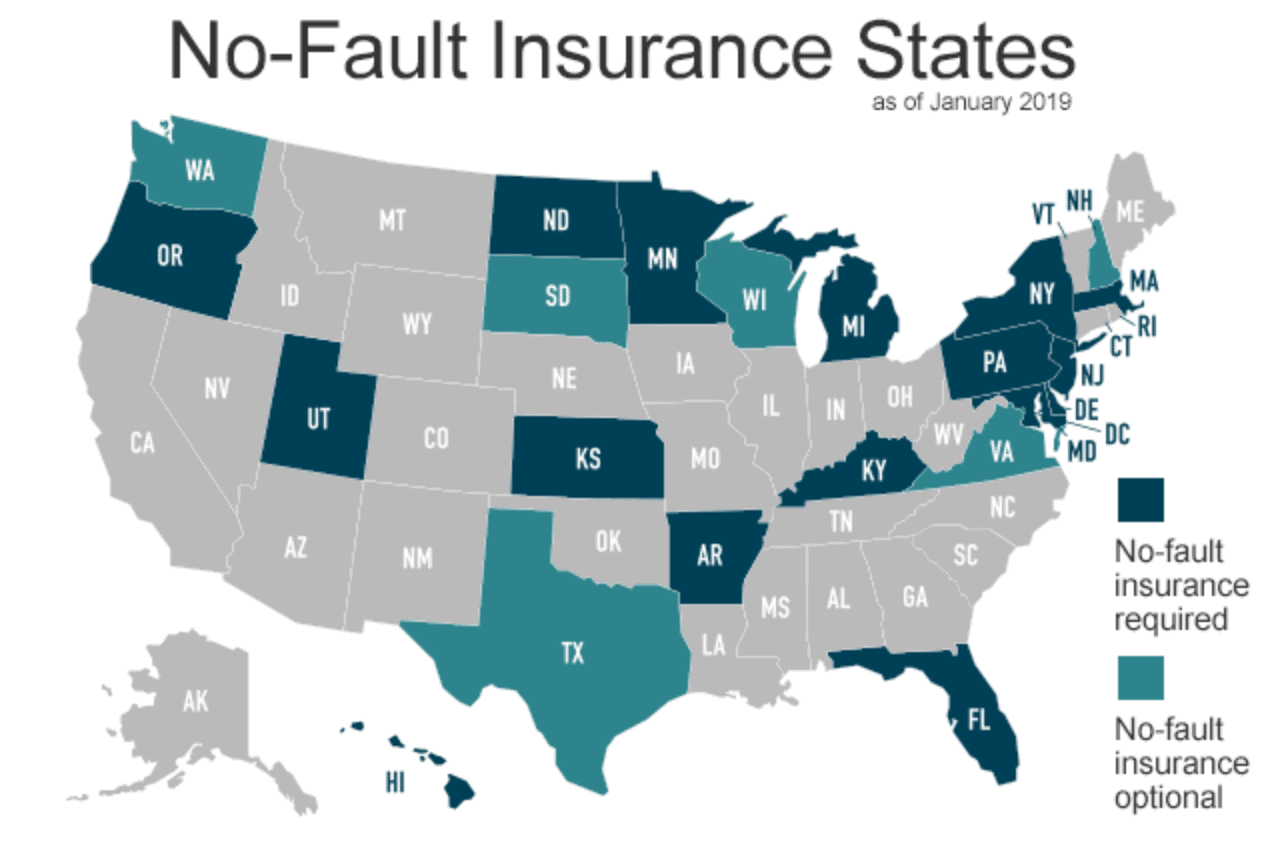

No Fault States are states that have adopted the No Fault Insurance system. In these states, the policyholder’s insurance company is responsible for paying the medical expenses and other damages arising out of an accident, regardless of who is at fault. This eliminates the need for litigation and helps to reduce the number of lawsuits that are filed related to car accidents.

Is Florida A No Fault State?

Yes, Florida is a No Fault State. Florida is one of the twelve states that have adopted the No Fault Insurance system, along with New York, Michigan, Pennsylvania, New Jersey, Hawaii, Massachusetts, Kentucky, Minnesota, North Dakota, and Utah. In Florida, all drivers are required to carry Personal Injury Protection (PIP) coverage in order to pay for medical expenses and other damages resulting from an accident.

What Does No Fault Insurance Cover?

No Fault Insurance covers medical expenses, lost wages, and other damages arising out of an accident. It does not cover property damage, however. Property damage must be covered by a separate policy. Additionally, No Fault Insurance does not cover intentional acts of harm or negligence.

Are There Any Exceptions To The No Fault Insurance Coverage?

Yes, there are some exceptions to the No Fault Insurance coverage in Florida. For example, if the policyholder has been convicted of a DUI or DWI, the policyholder’s insurance company may not be responsible for paying the medical expenses and other damages resulting from an accident. Additionally, if the policyholder has been found to be at fault in an accident, the other party’s insurance company may be responsible for paying the damages.

Conclusion

In conclusion, Florida is a No Fault State for auto insurance. This means that the policyholder’s insurance company is responsible for paying the medical expenses and other damages resulting from an accident, regardless of who is at fault. However, there are some exceptions to the No Fault Insurance coverage, such as convictions for DUI or DWI, and if the policyholder is found to be at fault in an accident.

What No Fault Car Insurance Is?

Florida No-Fault Auto Insurance Under Annual Review | Terrell • Hogan

Out of State Visitors Hurt in Car Accidents in Florida (Settlements)

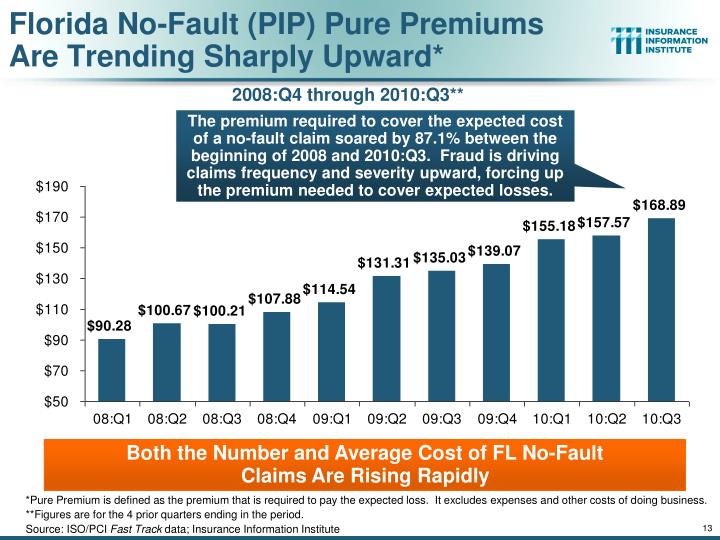

PPT - No-Fault Auto Insurance Fraud in Florida Trends, Challenges

An Overview of Florida's No Fault Insurance Laws - Horst Law Firm - YouTube