How Much Liability Coverage Do I Need For Car Insurance

How Much Liability Coverage Do I Need For Car Insurance?

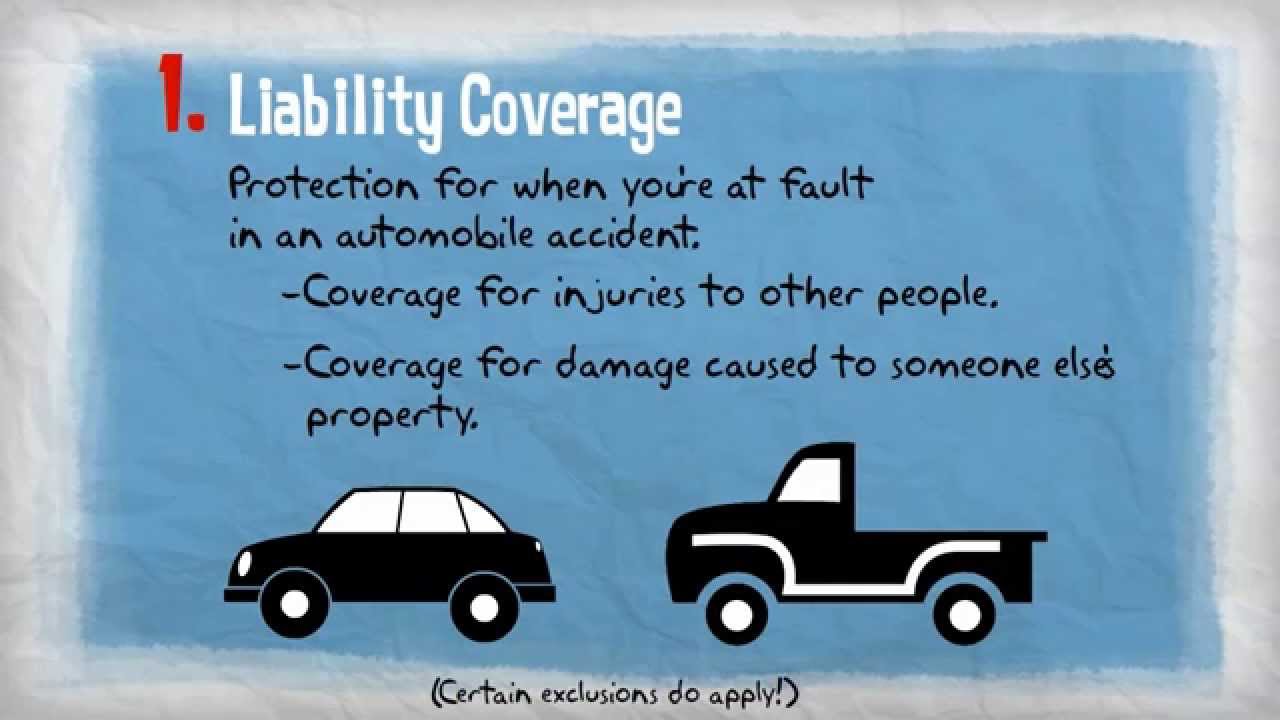

What is Liability Coverage?

Liability coverage is a type of car insurance that is designed to protect you if you are found to be at fault in a car accident. This type of coverage will cover the costs of any medical bills or property damage that you are found to be responsible for. It is important to understand that this type of coverage does not cover you or your passengers in the event of an accident. It only covers you if you are found to be at fault. Liability coverage is typically required by law in most states and is often the minimum coverage that is required.

How Much Liability Coverage Do I Need?

The amount of liability coverage you need will depend on the type of car you drive and the amount of risk you are willing to take. Generally speaking, the higher the value of your car and the more expensive it is to repair, the more liability coverage you should carry. Typically, the minimum amount of liability coverage for most states is $25,000 for property damage and $50,000 for bodily injury per person and $100,000 per accident. However, if you drive a more expensive car or if you are found to be at fault in a serious accident, you may need to carry higher limits of liability coverage.

When Do I Need to Increase My Liability Coverage?

If you own an expensive car or if you are found to be at fault in a serious accident, you may want to consider increasing your liability coverage. If you are found to be at fault in an accident and the damages exceed your limit of coverage, you could be held liable for any remaining costs. Additionally, if you are found to be at fault in an accident and you do not have enough liability coverage, your assets could be at risk. To protect yourself, it is important to make sure that you have the right amount of liability coverage.

How Can I Get More Liability Coverage?

The easiest way to get more liability coverage is to contact your insurance company and ask them about increasing your limits. Most insurance companies will allow you to increase your liability coverage up to certain limits, depending on the type of car you drive and the amount of risk you are willing to take. Additionally, some insurance companies may offer discounts if you purchase additional coverage.

Conclusion

Liability coverage is an important type of car insurance that is designed to protect you if you are found to be at fault in a car accident. The amount of coverage you need will depend on the type of car you drive and the amount of risk you are willing to take. Additionally, if you are found to be at fault in an accident and the damages exceed your limit of coverage, you could be held liable for any remaining costs. To protect yourself, it is important to make sure that you have the right amount of liability coverage. If you need more coverage, you can contact your insurance company to increase your limits.

What Is Liability Insurance? | Allstate

Simple, Cars and Home insurance on Pinterest

Auto Liability Insurance - What It Is and How to Buy

Car Insurance Coverage - edesignbooks

Insurance 101 - Personal Auto Coverages - YouTube