How Much Insurance For New Driver

How Much Insurance for New Drivers?

Getting your first driver’s license is a major milestone for any young person. Having the freedom to drive yourself around is a great feeling. But before you hit the open road, you need to make sure you’re properly insured. There are a lot of factors that can affect how much insurance for new drivers will cost, but there are a few key points that all new drivers should know.

Do I Need Insurance?

The short answer is yes. In most states, it’s illegal to drive without basic insurance coverage. Even if you’re a careful driver, you’ll still need to be insured in case of an accident. The minimum coverage requirements vary from state to state, so you should check with your local DMV or insurance provider to learn more.

How Much Insurance Do I Need?

The amount of insurance you need will depend on a few factors. Most states require basic coverage for all drivers, but you may want to purchase additional coverage for more protection. If you’re financing a vehicle, the lender may also require additional coverage. Your driving record, the type of vehicle you’re driving, and the amount of time you spend on the road can all affect your insurance premiums.

What Factors Affect the Cost of Insurance?

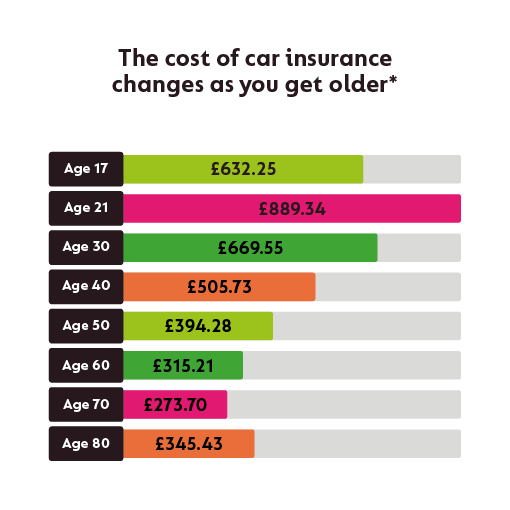

The cost of insurance for new drivers is often higher than for experienced drivers. This is because insurers see new drivers as a greater risk. Young drivers are more likely to be involved in an accident due to inexperience. Additionally, the type of vehicle you drive and your driving record can affect your premium. If you have a history of traffic violations, you may find that your premiums are higher.

What Are the Different Types of Coverage?

There are several types of coverage available for new drivers. Liability coverage is required in most states and covers damage to other people’s property and bodily injury. Collision and comprehensive coverage covers damage to your own vehicle. Uninsured/underinsured motorist coverage helps cover costs associated with an accident with an uninsured or underinsured driver. Personal injury protection and medical payments coverage can help cover medical expenses. Lastly, roadside assistance can help if you need help changing a tire or if your car breaks down.

Where Can I Get the Best Insurance Rates?

Shopping around is the best way to get the best rates. Comparing different providers and their coverage options can help you find the best deal. Also, some insurers may offer discounts to new drivers, so be sure to ask about any available discounts. Finally, make sure you’re taking advantage of any safety features in your vehicle, as these can often reduce your insurance premiums.

Getting the right insurance coverage is an important part of being a responsible driver. Understanding the different types of coverage and shopping around for the best rates is the best way to ensure you’re getting the protection you need at the best price. With the right coverage in place, you can hit the open road with peace of mind.

New Driver Insurance Cost Varies Widely Depending on Your Situation

Average Cost of Car Insurance for Young Drivers 2020 | NimbleFins

2021 Car Insurance Rates by Age and Gender - NerdWallet

Average Cost Of Car Insurance For 19 Year Old Female - Car Retro

Car Insurance For New Drivers Over 21 - A Life of Luxury - Personal