How Much Does Turos Supreme Insurance Plan Cost

Turo's Supreme Insurance Plan: Cost & Benefits

If you’re an avid traveler and are looking for a comprehensive insurance plan for your trips, Turo’s Supreme Insurance Plan is the best option for you. This plan is designed for travelers who want to get the best coverage for their trips without breaking the bank. In this article, we’ll talk about the cost and benefits of the Turo Supreme Insurance Plan.

What is Turo’s Supreme Insurance Plan?

Turo’s Supreme Insurance Plan is a comprehensive insurance plan that covers all of your trips. This plan includes trip cancellation coverage, baggage loss coverage, medical and dental coverage, and more. It also provides coverage in case of an accident, as well as coverage for rental car damage and rental car liability. The plan also provides coverage for personal items, such as electronics and jewelry.

How Much Does the Plan Cost?

The cost of the Turo Supreme Insurance Plan depends on the length of your trip. The plan is available for short trips (up to 30 days), medium trips (31 to 90 days), and long trips (91 to 180 days). The cost of the plan for short trips is $29.99, for medium trips it’s $59.99, and for long trips it’s $89.99. The cost of the plan is usually lower than other insurance plans, so it’s a great option for travelers who want to save money.

What Does the Plan Cover?

The Turo Supreme Insurance Plan covers a variety of different things, including trip cancellation coverage, baggage loss coverage, medical and dental coverage, rental car damage coverage, rental car liability coverage, and personal items coverage. The plan also provides coverage in case of an accident and coverage for emergency medical expenses. Additionally, the plan also covers lost or stolen passports and emergency cash.

Are There Any Limitations?

Yes, there are some limitations to the Turo Supreme Insurance Plan. For example, the plan does not cover pre-existing medical conditions, and the coverage for rental car damage and liability is limited. Additionally, the plan does not cover personal liability or damage to third-party property. It’s important to read the plan’s terms and conditions carefully to understand the limitations of the plan.

Conclusion

Turo’s Supreme Insurance Plan is a great option for travelers who want comprehensive coverage without breaking the bank. The cost of the plan depends on the length of your trip, but it’s usually lower than other insurance plans. The plan covers a variety of different things, including trip cancellation coverage, baggage loss coverage, medical and dental coverage, and more. However, it’s important to read the plan’s terms and conditions carefully to understand the limitations of the plan.

Cost Of Family Health Insurance - KALIMANTAN INFO

What is the best senior citizen health insurance plan for my 65 years

How Much Do Supplemental Health Insurance Products Cost? | eHealth

How Much Does the Health Insurance Plan Cost? - YouTube

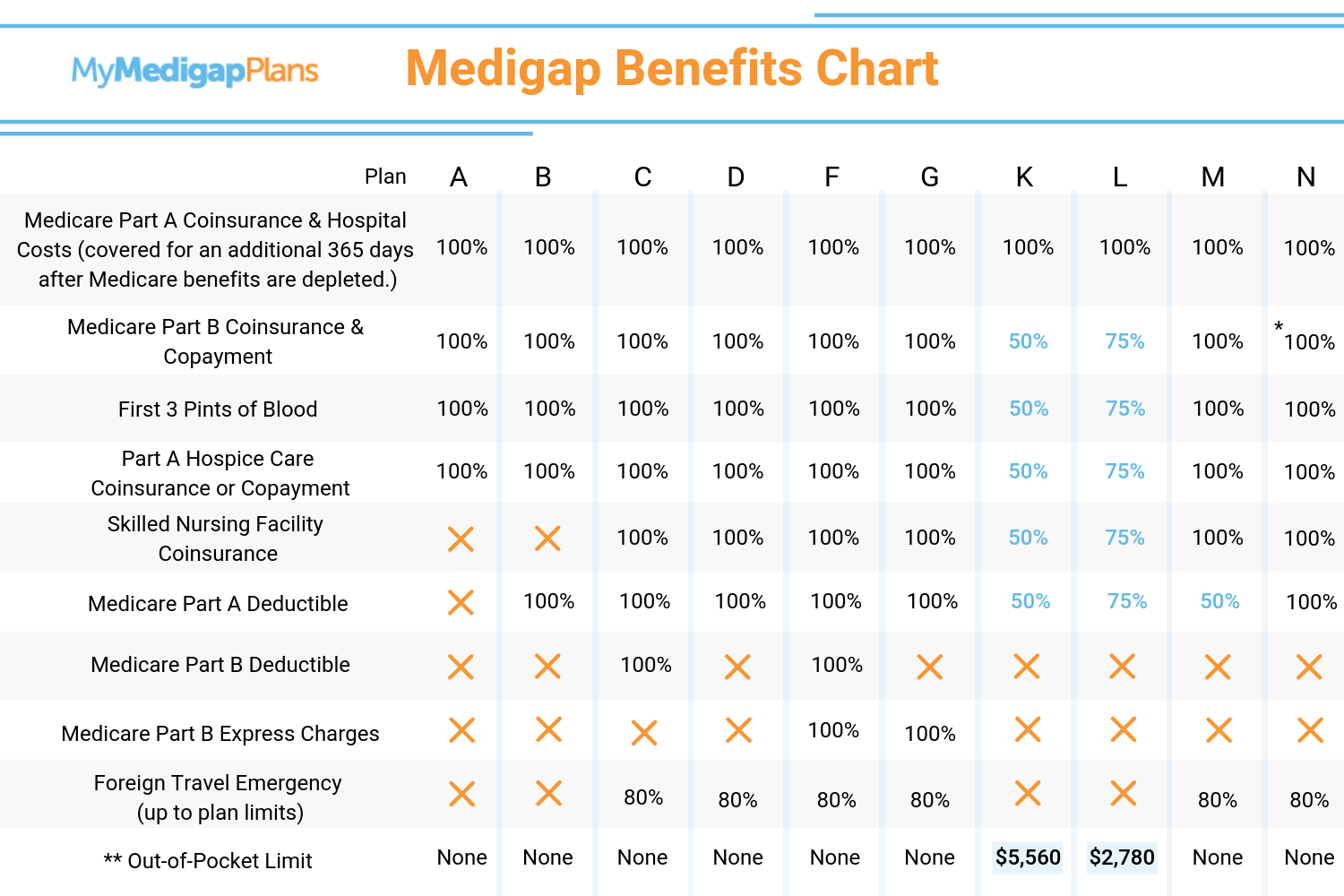

Medicare Supplement Plans Comparison Chart for 2022