Future Generali Car Insurance Claim Settlement Ratio

Friday, April 11, 2025

Edit

Future Generali Car Insurance: Claim Settlement Ratio

Overview of Future Generali Car Insurance

Future Generali Car Insurance is a comprehensive policy that covers a wide range of risks associated with owning and driving a car. From cover against natural calamities and third-party liabilities to protection against personal accident and legal liabilities, this policy covers it all. Future Generali Car Insurance also provides coverage for the accessories of the insured car. It also provides an add-on cover for the coverage of engine and electronic circuit.

Future Generali Car Insurance Claim Settlement Ratio

Future Generali Car Insurance has a good claim settlement ratio. The claim settlement ratio is the ratio of the number of claims settled by the insurer to the total number of claims received. The higher the claim settlement ratio, the better it is for the policyholder. The claim settlement ratio for Future Generali Car Insurance for the year 2018-19 was 92.81%, which is significantly better than the industry average of 89.45%.

Advantages of Future Generali Car Insurance Claim Settlement Ratio

The claim settlement ratio of Future Generali Car Insurance is significantly better than the industry average, which makes it a great choice for car owners. A higher claim settlement ratio indicates that the insurance company is more likely to settle the claims of its customers quickly and efficiently. Moreover, a higher claim settlement ratio also implies that the insurance company is more reliable and trustworthy, which is an important factor for customers who are looking for an insurance provider.

Claim Process for Future Generali Car Insurance

The claim process for Future Generali Car Insurance is fairly straightforward. Customers can file a claim by visiting the nearest branch of the insurance company or by calling the customer service number. The insurance company will then initiate the claim process and the customer will be required to submit the relevant documents to the insurance company. The documents required for filing a claim may vary depending on the type of claim. Once the documents are submitted, the insurance company will review the documents and the claim will be processed.

Benefits of Future Generali Car Insurance

Future Generali Car Insurance offers a wide range of benefits to its customers. It provides coverage for a wide range of risks associated with owning and driving a car, such as natural calamities, third-party liabilities, personal accident, and legal liabilities. Moreover, it also provides coverage for the accessories of the insured car and an add-on cover for the coverage of the engine and electronic circuit. The insurance company also offers a cashless facility for repairs at its network of garages.

Conclusion

Future Generali Car Insurance is a comprehensive policy that provides a wide range of benefits to its customers. It has a good claim settlement ratio, which is significantly better than the industry average. The claim process of the insurance company is also straightforward. In addition to all these benefits, the insurance company also offers a cashless facility for repairs at its network of garages. All these features make Future Generali Car Insurance an attractive and reliable option for car owners.

Car Insurance Renewal - Check Claim Settlement Ratios

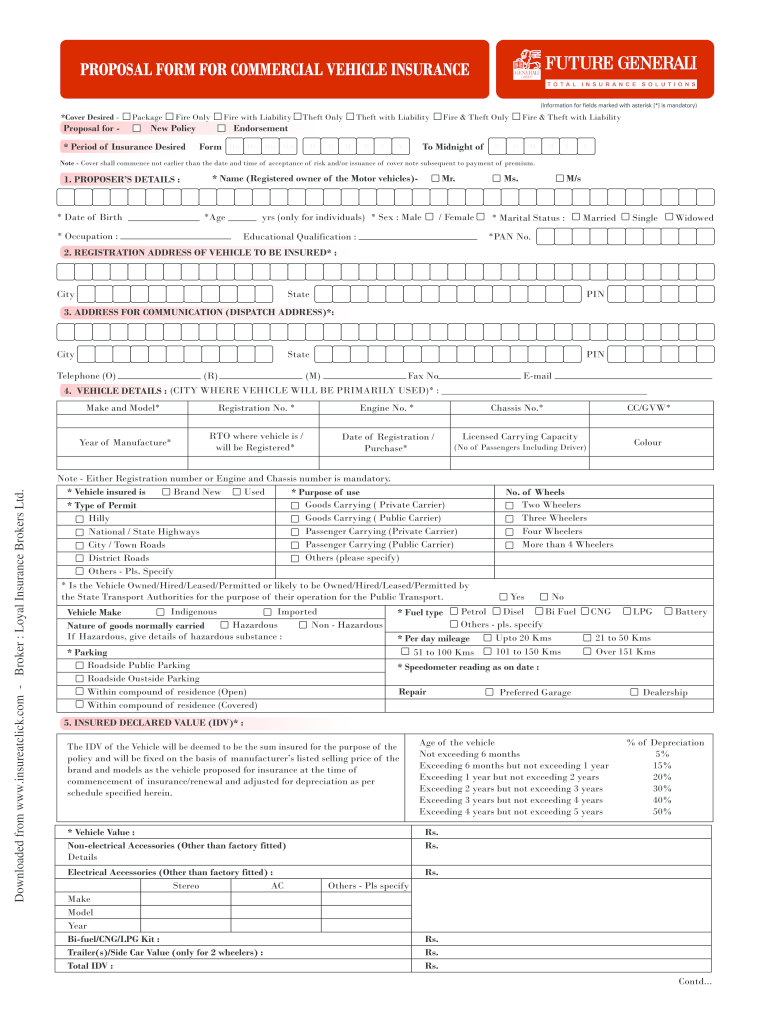

Future Generali Form - Fill Online, Printable, Fillable, Blank | pdfFiller

[PDF] Future Generali Motor Claim Form PDF Download in English – InstaPDF

![Future Generali Car Insurance Claim Settlement Ratio [PDF] Future Generali Motor Claim Form PDF Download in English – InstaPDF](https://instapdf.in/wp-content/uploads/pdf-thumbnails/future-generali-motor-claim-form-1769.jpg)

Best Health Insurance & Motor Insurance Companies

Claim Settlement Process In Insurance