Full Coverage Insurance Quotes State Farm

Monday, April 14, 2025

Edit

Full Coverage Insurance Quotes State Farm

Why is Full Coverage Insurance Important?

Full coverage insurance is one of the most important investments you can make for yourself and your family. It provides you with the peace of mind that comes with knowing you are protected in the event of an accident or other mishap. Whether you’re driving a car, a boat, or a motorcycle, full coverage insurance is an absolute must. It is the only way to ensure that you and your family are financially secure in the event of an accident or other mishap.

When you purchase full coverage insurance, you’re purchasing a policy that covers a variety of different types of losses. This includes third-party liability coverage, which pays for any damages you may cause to another person or property. You’ll also have collision coverage, which pays for any damage you may cause to your own vehicle. Additionally, you’ll have comprehensive coverage, which pays for damages to your vehicle caused by weather, animals, or other non-collision incidents. Finally, you’ll have personal injury protection coverage, which pays for medical bills and lost wages if you’re injured in an accident.

What Does Full Coverage Insurance from State Farm Include?

When you purchase full coverage insurance from State Farm, you’ll receive coverage for a variety of different types of losses. This includes third-party liability coverage, which pays for any damages you may cause to another person or property. You’ll also have collision coverage, which pays for any damage you may cause to your own vehicle. Additionally, you’ll have comprehensive coverage, which pays for damages to your vehicle caused by weather, animals, or other non-collision incidents. Finally, you’ll have personal injury protection coverage, which pays for medical bills and lost wages if you’re injured in an accident.

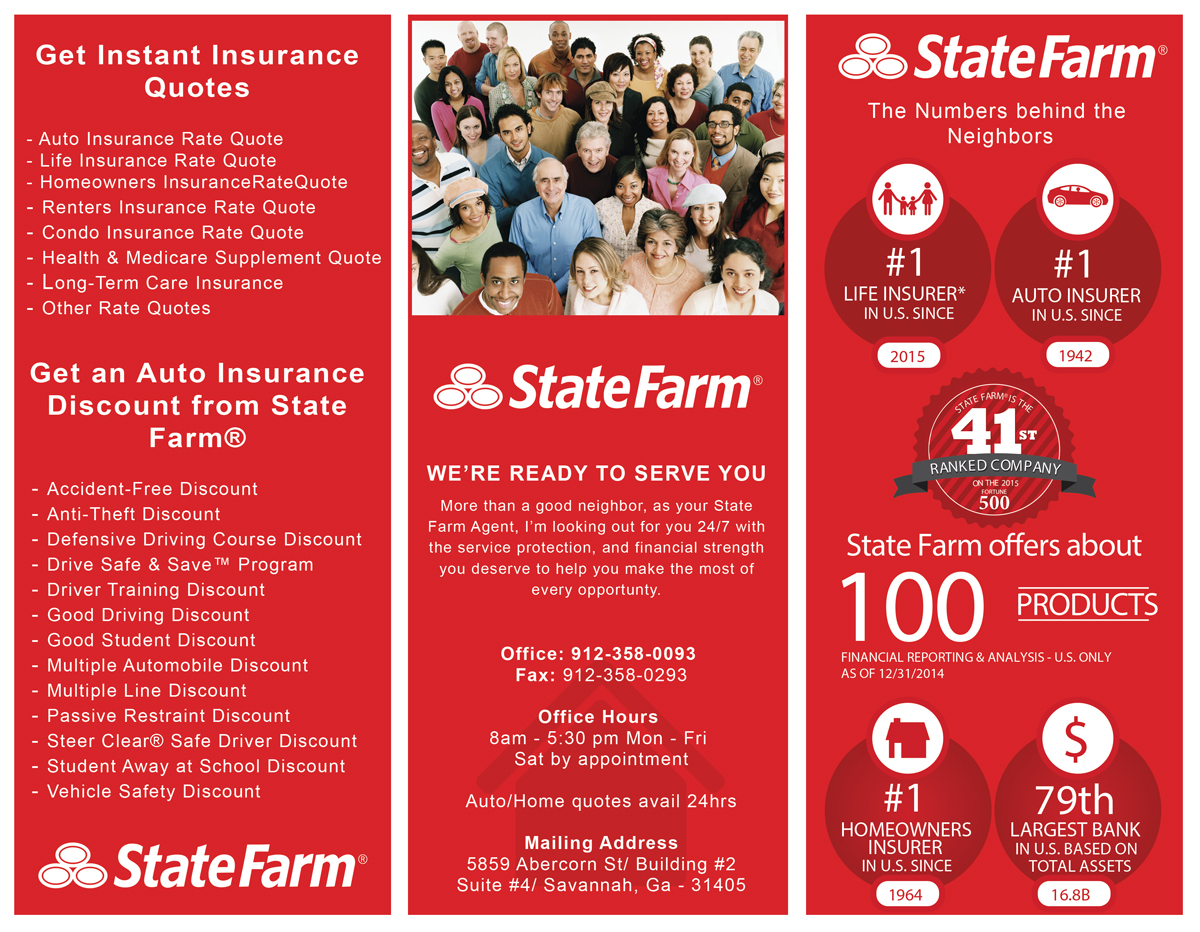

State Farm also offers a variety of other benefits, such as rental car reimbursement, towing, and roadside assistance. Additionally, if you’re a State Farm customer you can also take advantage of their exclusive discounts, such as safe driver discounts, multi-line discounts, and more.

What Are the Benefits of Full Coverage Insurance from State Farm?

There are many benefits to buying full coverage insurance from State Farm. One of the biggest benefits is that you’ll have peace of mind knowing your vehicle is fully protected in the event of an accident. Additionally, State Farm offers a variety of discounts, such as safe driver discounts, multi-line discounts, and more, which can help you save money on your coverage. Finally, State Farm’s customer service has a reputation for being friendly and helpful, so you can feel confident that you’ll be taken care of if you ever have a question or concern.

How Can I Get a Full Coverage Insurance Quote from State Farm?

Getting a full coverage insurance quote from State Farm is easy and convenient. You can get a quote online, over the phone, or in-person at a local State Farm agent’s office. When you get a quote, you’ll need to provide information such as your vehicle’s make and model, driving history, and other personal information. After you provide this information, you’ll be able to compare quotes from different companies and select the one that best fits your needs.

What Should I Consider When Shopping for Full Coverage Insurance?

When shopping for full coverage insurance, it’s important to consider a few different factors. First, you should consider the coverage limits of the policy you’re considering. You should also consider the deductible, which is the amount you’ll have to pay out-of-pocket before your insurance company will pay out. Additionally, you should consider the customer service ratings of the company you’re considering, as well as any discounts they may offer. Finally, you should compare multiple quotes from different companies in order to get the best rate.

Conclusion

Full coverage insurance is an important investment that can provide you with peace of mind in the event of an accident or other mishap. State Farm offers a variety of coverage options, including third-party liability, collision, comprehensive, and personal injury protection coverage. Additionally, State Farm offers a variety of discounts, as well as an excellent customer service rating. When shopping for full coverage insurance, it’s important to compare quotes from multiple companies in order to get the best rate.

80+ Car Insurance Full Coverage Quotes - Hutomo Sungkar

State Farm Stays Profitable Despite Higher Losses, Lower Premiums | WGLT

State Farm Renters Insurance Payment - Home Collection

State Farm Mobile Home Insurance Review (2020)

State Farm Homeowners Insurance Declaration Page Sample