Does Adding A Named Driver Affect Their Insurance

Monday, April 7, 2025

Edit

Does Adding A Named Driver Affect Their Insurance?

What is a Named Driver?

If you own a car, you probably already know what a named driver is and how beneficial it can be. A named driver is someone who is listed on your car insurance policy who is allowed to drive the car. This person is usually a family member or a close friend who is trusted and knowledgeable about the car. They are also covered by the policy and can make claims if something happens to the car or if they are in an accident.

Adding a named driver to your car insurance policy can be beneficial for a variety of reasons. It can help reduce your insurance premium, as it can potentially lower the risk that you and your car will be involved in an accident. It can also provide additional coverage for the named driver if they are involved in an accident.

Does Adding A Named Driver Affect Their Insurance?

The answer to this question is yes, adding a named driver to your car insurance policy can affect their insurance. The way that adding a named driver can affect their insurance is by changing the risk profile of your car and the named driver.

When a named driver is added to your policy, the insurance company assumes that the named driver is a trusted and responsible driver who will not be involved in any accidents or incidents that could lead to a claim. This means that the risk of an accident or claim is reduced, and so the insurance company may lower your premium.

However, the named driver’s policy may also be affected by adding them to your policy. The named driver’s insurance premium may be higher if they are added to your policy. This is because the named driver’s risk profile is also taken into account when calculating the premium. If the named driver is deemed to be a higher risk driver, then their premium may be increased.

What Are The Benefits Of Adding A Named Driver?

Adding a named driver to your car insurance policy can be beneficial for a variety of reasons. As mentioned above, it can help you reduce your insurance premium, as it can potentially lower the risk of you and your car being involved in an accident.

It can also provide additional coverage for the named driver if they are involved in an accident. This means that the named driver will be covered by your insurance policy, and so they will not have to pay out of pocket for any damages or medical expenses they incur as a result of an accident.

Adding a named driver to your car insurance policy can also provide peace of mind. Knowing that your car is properly insured and that someone else is able to drive it if needed can be reassuring.

Are There Any Downsides To Adding A Named Driver?

As with anything, there are some potential downsides to adding a named driver to your car insurance policy. The first is that the named driver’s risk profile may be taken into account when calculating your premium, which could mean an increase in your premium.

The second is that the named driver may be held liable for any damages or medical expenses incurred in an accident, even if they were not driving the car. This means that they may have to pay out of pocket for any damages or medical expenses they incur as a result of an accident.

The third is that the named driver may not be as trustworthy or responsible as you think they are. It is important to make sure that you trust the named driver and that they are a safe and responsible driver before adding them to your policy.

Conclusion

Adding a named driver to your car insurance policy can have both benefits and potential downsides. It can be beneficial in that it can potentially reduce your premium and provide additional coverage for the named driver if they are involved in an accident. However, it can also be risky, as the named driver’s risk profile may be taken into account when calculating your premium and they may be held liable for any damages or medical expenses incurred in an accident. It is important to make sure that you trust the named driver and that they are a safe and responsible driver before adding them to your policy.

Does Adding A Named Driver Increase Insurance - Martin Lewis: Car

Named driver car insurance in Singapore

10 Ways to Avoid Invalidating Your Car Insurance - Number 8 | Regit

Named driver insurance – does adding a named driver reduce my insurance

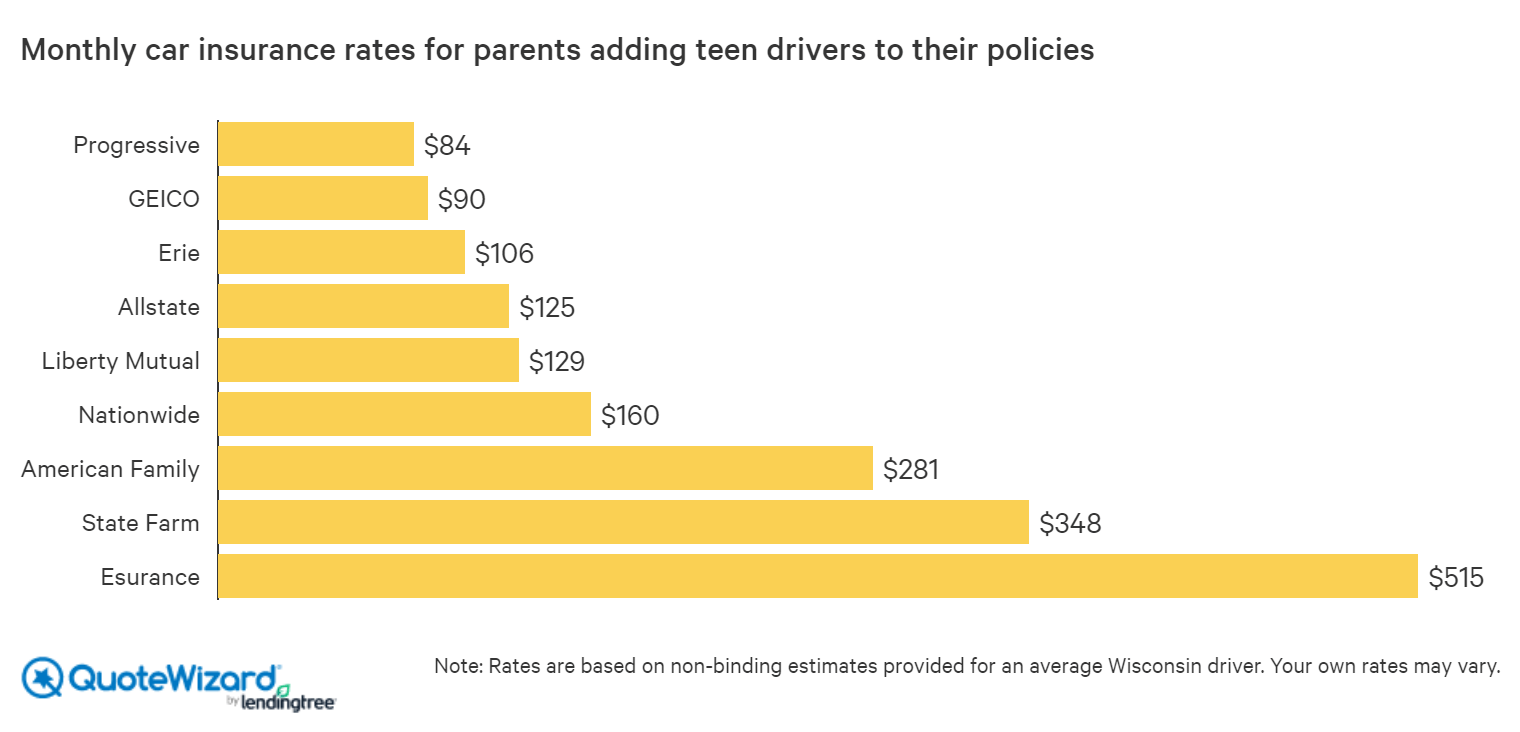

Best Car Insurance for Teens | QuoteWizard