Car Insurance Third Party Property Damage

What You Need to Know About Car Insurance Third Party Property Damage

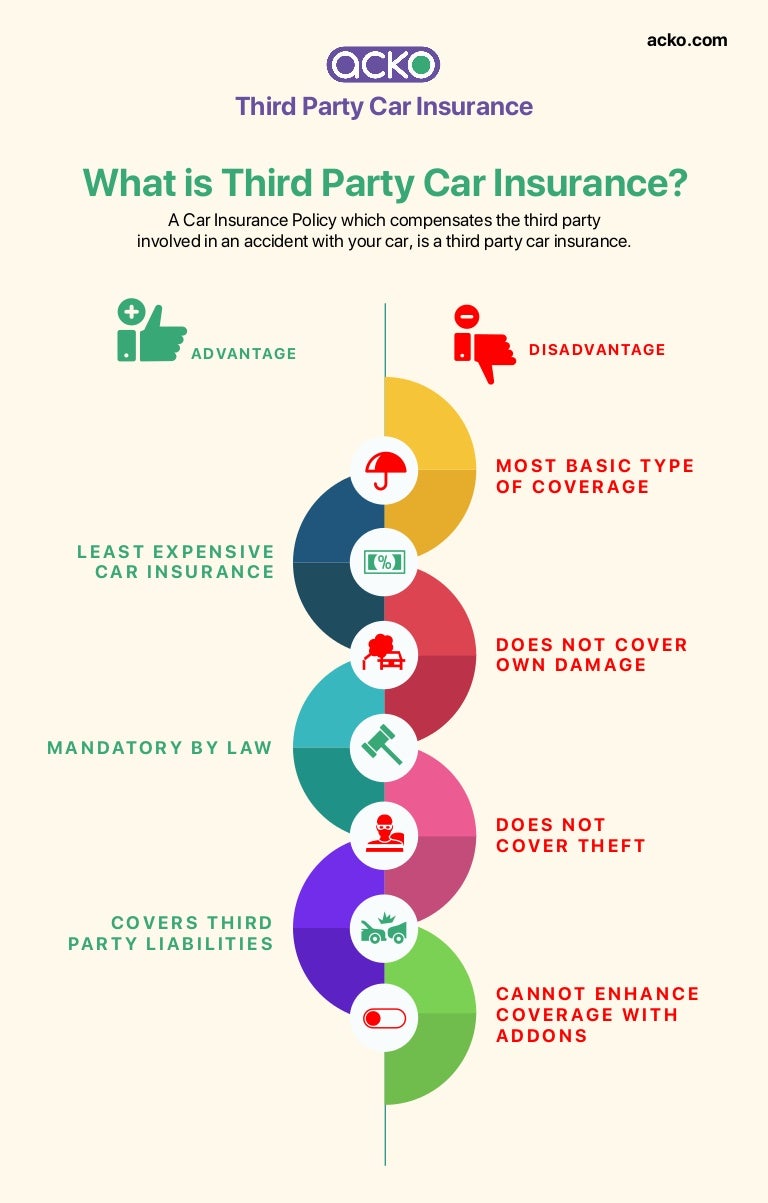

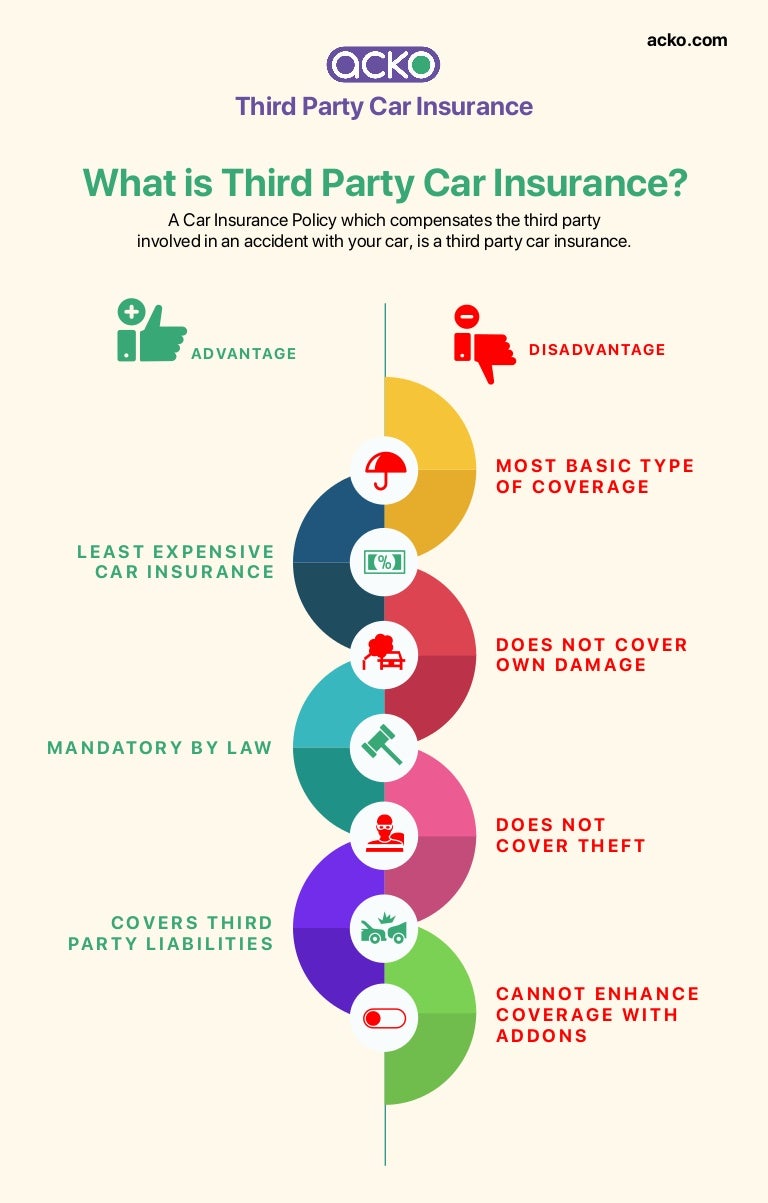

Car insurance is a type of insurance purchased for cars, trucks, motorcycles, and other road vehicles. Its primary purpose is to provide protection against losses incurred as a result of traffic accidents and against liability that could also arise therefrom. Third party property damage (TPPD) is a type of car insurance coverage that pays for damages to another person’s property caused by an accident you are responsible for.

What Does Third Party Property Damage Cover?

Third party property damage covers the cost of repair or replacement of another person’s property that you are liable for. This type of coverage is usually included in basic car insurance policies. It can also be purchased as a separate policy. This type of coverage pays for damage to property such as another person’s car, building, or other structure. It does not cover medical or legal expenses, or damages to your own car.

What is the Difference Between Third Party Property Damage and Comprehensive Coverage?

Comprehensive coverage is a type of car insurance that pays for damages to your car or property caused by events other than an accident. This includes damage caused by theft, vandalism, fire, hail, and other “acts of nature”. Comprehensive coverage is different from third party property damage in that it does not cover damage to another person’s property, only your own.

What Does Third Party Property Damage Cost?

The cost of third party property damage coverage varies depending on your location, driving record, and the type of car you drive. It is usually included in most basic car insurance policies, but can be purchased as a separate policy. Generally, the cost of this type of coverage is much less than comprehensive coverage.

Do I Need Third Party Property Damage Coverage?

Whether or not you need third party property damage coverage depends on your individual situation. If you are a safe driver with a clean record, you may not need this type of coverage. However, if you have a history of accidents or traffic violations, it may be a good idea to purchase this type of coverage to protect yourself against liability in the event of an accident.

Bottom Line

Third party property damage coverage is a type of car insurance that pays for damages to another person’s property caused by an accident you are responsible for. This type of coverage is usually included in basic car insurance policies, but can be purchased as a separate policy. The cost of this type of coverage varies depending on your location and driving record, but is typically much less than comprehensive coverage. Whether or not you need this type of coverage depends on your individual situation.

Acko Car Third Party Insurance / Which is best third party insurance or

Third Party Property Car Insurance | iSelect

What is third party insurance | Online insurance, Compare insurance

Car Insurance Online Third Party - Asuransi Terjamin 2022

Third Party - Property Damage