Buy Third Party Insurance For Car Online

Buy Third Party Insurance For Car Online

Why You Should Buy Third Party Insurance?

In India, it is mandatory to have a third party insurance for your car. It is designed to protect you from the financial losses caused by damage to a third-party vehicle or property. In a nutshell, third party insurance is a legal requirement for anyone driving a car. It is also a good idea to check with your insurance provider if you are unsure of your legal obligations.

The benefits of having third party insurance are clear. If you are involved in an accident, the other party involved can be compensated for any damage that your vehicle may have caused. This helps to protect you financially, as well as helping to ensure that the other party is not left out of pocket due to your negligence.

Another advantage of having third party insurance is that it can provide protection against legal costs, as well as medical costs for the injured parties. This can help to ensure that you are not left out of pocket due to an accident which was not your fault.

Advantages of Buying Third Party Insurance Online

The internet has revolutionised the way we shop for almost anything, and insurance is no exception. By buying your car insurance online, you are able to compare multiple policies from a variety of providers, and get the best deal for your needs.

By buying online, you can also save yourself time and effort, as there is no need to visit each provider in person. You are also able to find out more about the different policies available, and the coverage they provide. This can help you to make an informed decision about which policy is best for you.

Another advantage of buying third party insurance online is the convenience it provides. You can do your comparison shopping from the comfort of your own home, and you can also take advantage of special offers and discounts that are often available online.

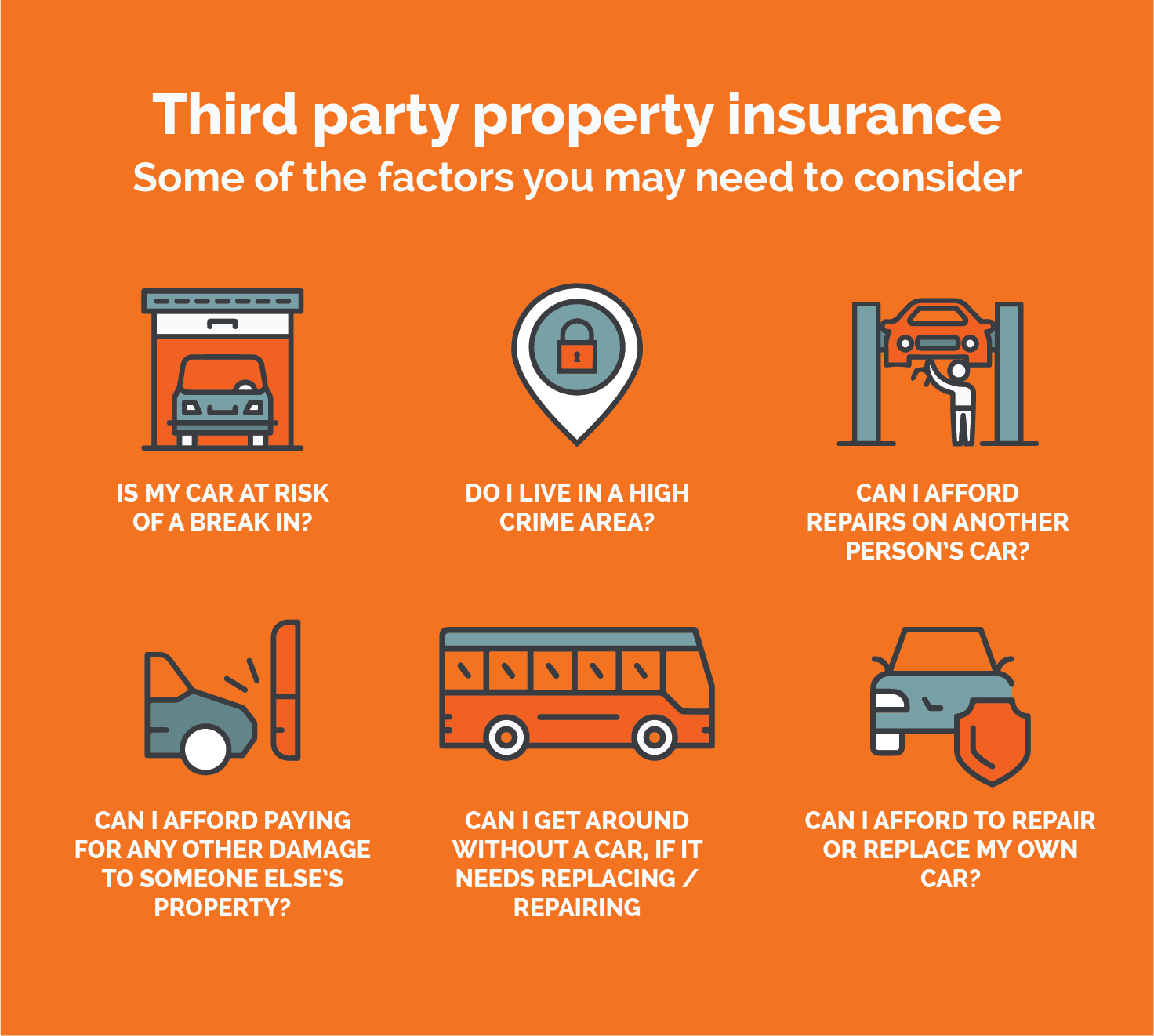

Things to Consider Before Buying Third Party Insurance Online

Before you buy third party insurance online, it is important to make sure that you are dealing with a reputable provider. You should read reviews of the provider, and try to find out how reliable they are. It is also a good idea to contact the provider directly and ask any questions you may have regarding the policy.

It is also important to make sure that you are getting the right coverage for your needs. Different policies may offer different levels of cover, so it is important to make sure that you are getting the right amount of coverage for your needs.

Finally, it is important to read the terms and conditions of the policy carefully. This will ensure that you are aware of any exclusions or restrictions that may apply, and that you are fully aware of what is covered and what is not.

Conclusion

Third party insurance is an important part of owning a car, and it is important to make sure that you are adequately covered. By buying online, you can compare multiple policies and find the best deal for your needs. However, it is important to make sure that you are dealing with a reputable provider, and that you are aware of the terms and conditions of the policy.

Reasons why you should buy third party insurance online in 2020

What Is The Difference Between Comprehensive Car Insurance And Third

The loss your car incurs is not covered by your insurance provider but

Third Party Car Insurance Price In India - malayshasha

Third-party vehicle insurance Archives - Ibiliti