Business Car Insurance Any Driver

Business Car Insurance Any Driver: What You Need to Know

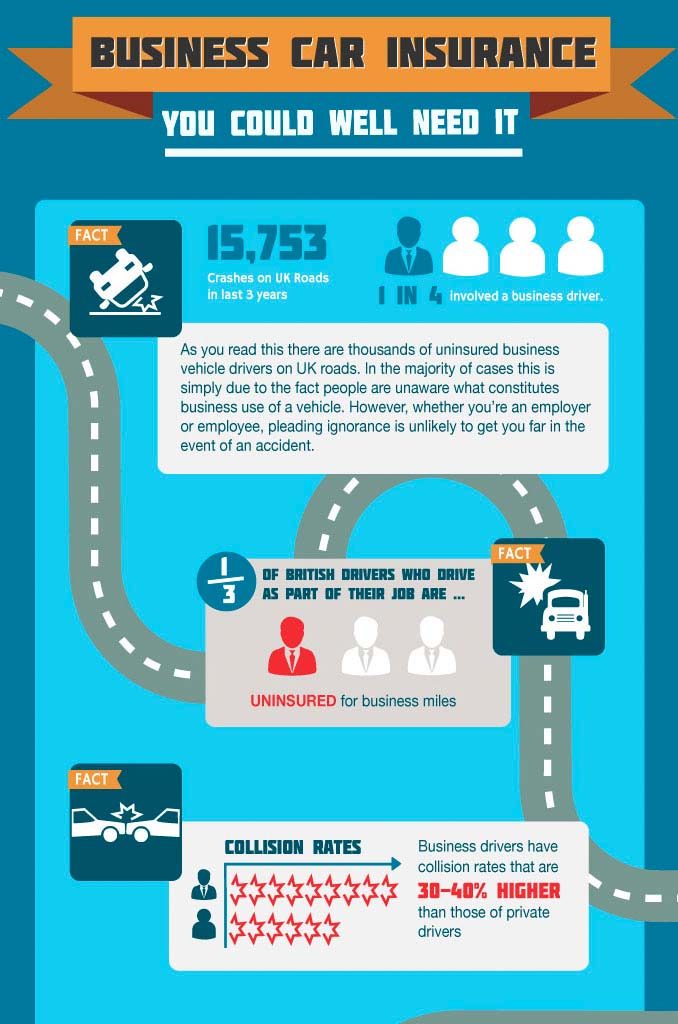

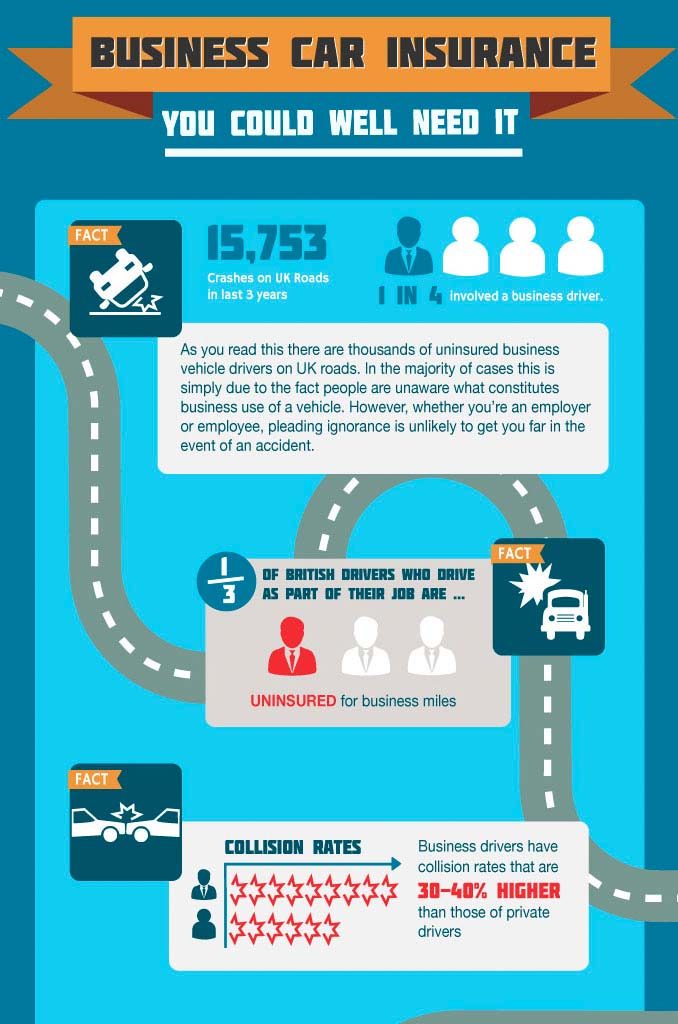

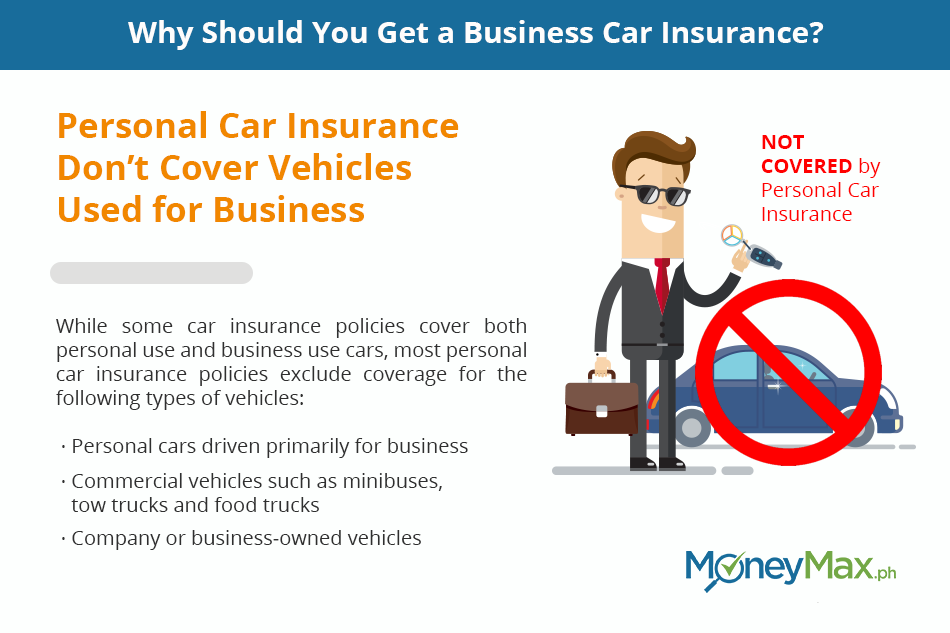

Are you running a business and need to insure your car or cars? You’ll need to consider business car insurance any driver, as it’s specifically designed to cover you as a business. But what exactly is it, and what should you know? We’ve created this guide to answer your questions and make sure you’re completely informed when you take out your policy.

What is Business Car Insurance Any Driver?

Business car insurance any driver is a type of policy that covers multiple cars and drivers under a single policy. If you’re running a business that uses multiple cars, this type of policy allows you to insure them all at once, rather than having to buy individual policies for each car. It covers any driver of the cars, meaning any of your employees who drive the cars are covered, too. This can be a great cost-saving option if you’re running a business with multiple cars.

What Do I Need to Get Business Car Insurance Any Driver?

When you apply for business car insurance any driver, you’ll need to provide the following details: your business type, the drivers’ details, the cars’ details, the cars’ use, and a no-claims bonus if applicable. You’ll also need to declare any modifications to the cars and any convictions or accidents the drivers have had in the past five years. It’s important to provide accurate information when you apply, as any errors or omissions could lead to problems with your policy.

What Does Business Car Insurance Any Driver Cover?

Business car insurance any driver typically covers the following: third party property damage, third party injury, fire and theft, and accidental damage. It also covers the cost of replacement keys, locks and windscreens. You can usually add additional cover, such as breakdown cover, legal expenses cover, and European cover, to your policy for an additional cost. It’s important to make sure you have the right level of cover for your business, as an insufficient policy could leave you with a large bill in the event of an accident or claim.

How Much Does Business Car Insurance Any Driver Cost?

The cost of business car insurance any driver varies depending on a number of factors, including the vehicles you’re insuring, the drivers’ age and experience, and the level of cover you choose. It’s important to compare quotes from different insurers to make sure you get the best deal for your business. You may also be able to save money by opting for a policy with a higher excess, or by increasing the security of your vehicles.

Where Can I Get Business Car Insurance Any Driver?

You can get business car insurance any driver from most major insurers. It’s best to shop around and compare quotes to make sure you get the best deal. You can get quotes online, or you can speak to an insurance broker who can help you find the right policy for your business. Make sure you read the policy documents carefully before you commit, to make sure you’re getting the right cover for your needs.

What is Business Car Insurance? | Business Insurance

All You Need To Know About Business Car Insurance

Business Car Insurance | Insurance Quote | Coversure

Why You Should Get Business Car Insurance | ABS-CBN News

Do Insurance Companies Cover Car Lockouts? - Red Rocks Locksmith