Best Insurance Rates For High Risk Drivers

Sunday, April 6, 2025

Edit

Best Insurance Rates For High Risk Drivers

What is High Risk Auto Insurance?

High risk auto insurance is a type of insurance policy that is specially designed for drivers who have a higher chance of getting into an accident than other drivers. These drivers can include those who have a history of traffic violations, a record of DUI/DWI convictions, or a history of being involved in accidents. High risk drivers may also include those who have less than perfect credit scores, are uninsured, or are young drivers. Because these drivers pose a higher risk for insurance companies, they will often pay more for their policies than drivers with clean records.

How to Get the Best Insurance Rates for High Risk Drivers

For drivers who are considered high risk, it can be difficult to get the best insurance rates. However, there are a few steps that high risk drivers can take to help them get the best rates. The first step is to shop around and compare rates from multiple insurance companies. It is important to compare the same coverage and deductibles when doing this so that an accurate comparison can be made. It is also important to make sure that the coverage being compared is adequate for the driver’s needs.

Next, it is important to make sure that the driver’s credit score is up to date and accurate. This is because many insurance companies use credit scores to determine the rates that they will offer to customers. The higher the credit score, the better the rates that the driver can expect to receive.

Finally, it is important to make sure that the driver is taking advantage of any discounts that are available. Many insurance companies offer discounts for drivers who have taken a defensive driving course, have multiple vehicles on the same policy, or who have no accidents or violations on their record.

Finding the Right Insurance Company for High Risk Drivers

Finding the right insurance company for high risk drivers can be a challenge. However, there are a few companies that specialize in providing coverage to high risk drivers. These companies understand the needs of high risk drivers and can provide them with the coverage they need while still offering competitive rates. Additionally, many of these companies offer additional benefits such as roadside assistance and rental car reimbursement that can be beneficial to high risk drivers.

The Benefits of Getting High Risk Insurance

Getting high risk insurance can have several benefits for drivers. Not only can it help them get the coverage they need, but it can also help them save money in the long run. By comparing rates from several different companies and taking advantage of discounts, high risk drivers can often get the coverage they need for less than they would pay for a standard policy. Additionally, many high risk policies come with additional benefits that are not available with standard policies.

Tips for Keeping High Risk Insurance Rates Low

There are a few tips that high risk drivers can follow to help keep their insurance rates low. The first is to make sure that the driver’s credit score is up to date and accurate. This can help to ensure that the driver is getting the best rates possible. Additionally, it is important to take advantage of any discounts that are available. Many insurance companies offer discounts for drivers who have taken a defensive driving course, have multiple vehicles on the same policy, or who have no accidents or violations on their record. Finally, it is important to shop around and compare rates from multiple companies in order to ensure that the best rate is being received.

Conclusion

High risk drivers can often find it difficult to get the best insurance rates. However, there are a few steps that these drivers can take to help them get the coverage they need at a price that is affordable. By shopping around and comparing rates from multiple companies, taking advantage of discounts, and making sure that their credit scores are accurate and up to date, high risk drivers can often find the coverage they need for less than they would pay for a standard policy.

Top 10 Car Insurance Rates 2019 | EINSURANCE

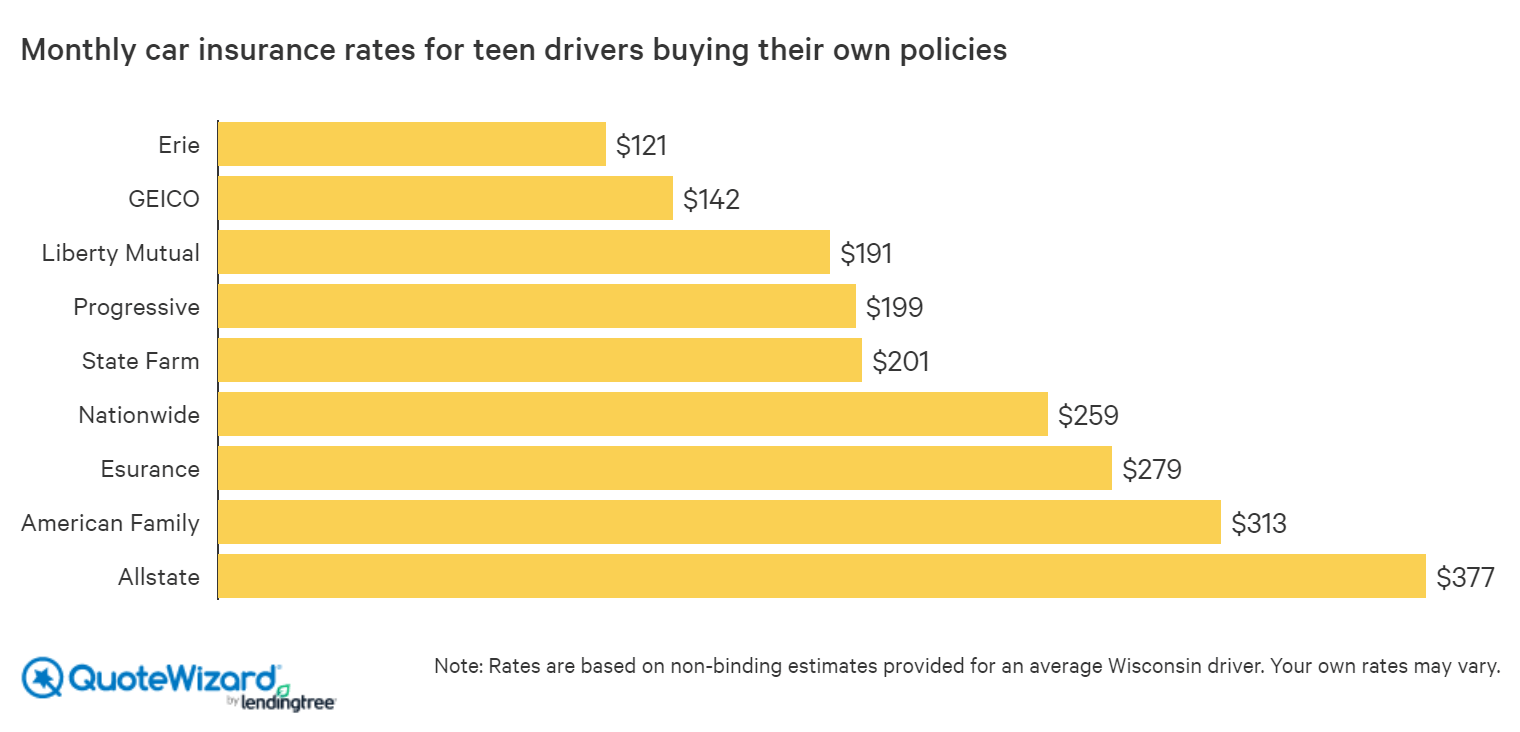

Best Car Insurance for Teens | QuoteWizard

Vehicle Insurance - Car Insurance Price Quote - Insurance Information

How To Find The Best Insurance Rates Around

Cheap auto insurance for high-risk drivers | All Star Auto Insurance