Average Car Insurance Per Month For One Person

Average Car Insurance Per Month For One Person

The Basics of Car Insurance

Car insurance is a type of insurance policy designed to protect drivers and their vehicles from any financial losses that may occur due to accidents, theft, damage, or other unexpected events. The cost of car insurance can vary significantly between providers and states, but it is important to understand the basics of car insurance before making a decision about which policy is best for your needs.

Average Cost of Car Insurance

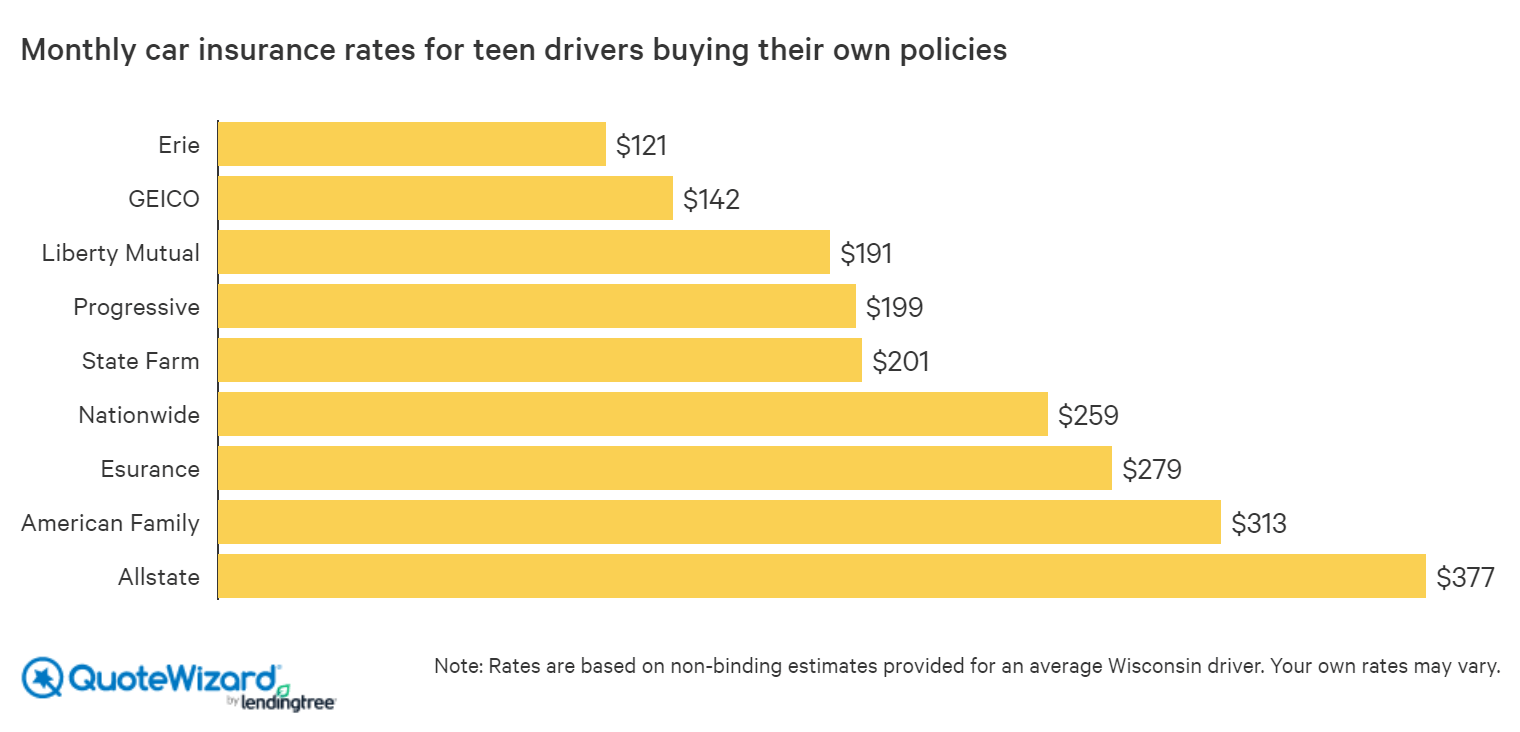

The average cost of car insurance is difficult to determine as it varies widely depending on several factors such as the type of car, the age and experience of the driver, and the driving record. Generally speaking, the cost of car insurance is higher for drivers who are considered to be a higher risk. This includes young drivers, drivers with poor driving records, drivers who have recently had a claim, and drivers who are considered to have a higher risk of accidents.

In addition, the cost of car insurance can also be affected by the type of coverage that you choose. Different types of coverage, such as collision and comprehensive, can affect the overall cost of your policy. It is important to understand the different types of coverage before making a decision.

Average Cost of Car Insurance Per Month For One Person

The average cost of car insurance per month for one person can vary greatly depending on the factors mentioned above. Generally speaking, the average cost of car insurance per month for one person can range anywhere from $50 to $200, with the average cost being around $100. However, this is just a general estimate and the actual cost can vary depending on the provider, the type of car, the coverage, and other factors.

Factors That Affect The Cost Of Car Insurance

The cost of car insurance is affected by a variety of factors, including the age and experience of the driver, the type of car, the type of coverage, and the driving record. Young drivers and drivers with poor driving records tend to pay more for their car insurance than more experienced drivers. Additionally, drivers who choose higher levels of coverage, such as comprehensive coverage, tend to pay more for their car insurance than drivers who choose only the minimum required coverage. Finally, drivers who have had a recent claim or have multiple violations on their driving record tend to pay more for their car insurance than drivers who have a clean driving record.

Conclusion

The average cost of car insurance per month for one person can vary significantly depending on several factors. It is important to understand the different types of coverage and the factors that affect the cost of car insurance before making a decision. By researching different providers, comparing quotes, and understanding the different types of coverage, drivers can find the right car insurance policy that meets their needs and budget.

Average Price Of Car Insurance Per Month - designby4d

What's the Average Auto Insurance Cost Per Month? | The Lazy Site

The Best Average Cost Of Car Insurance 2022 - Dakwah Islami

The Basic Principles Of How Much Is Car Insurance Per Month? Average

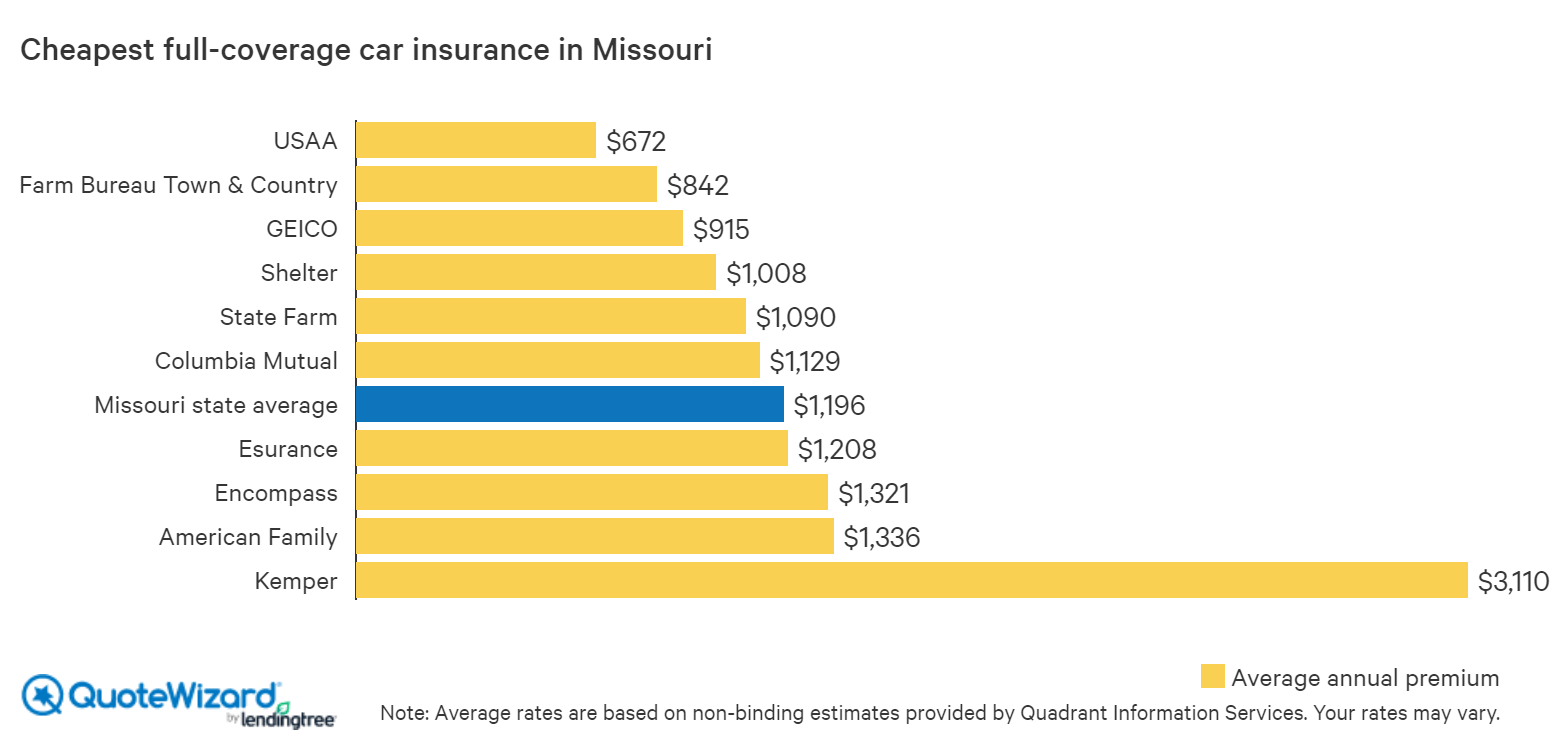

Average Car Insurance Cost In Missouri Per Month