Which Gap Insurance Is Best

Which Gap Insurance Is Best For You?

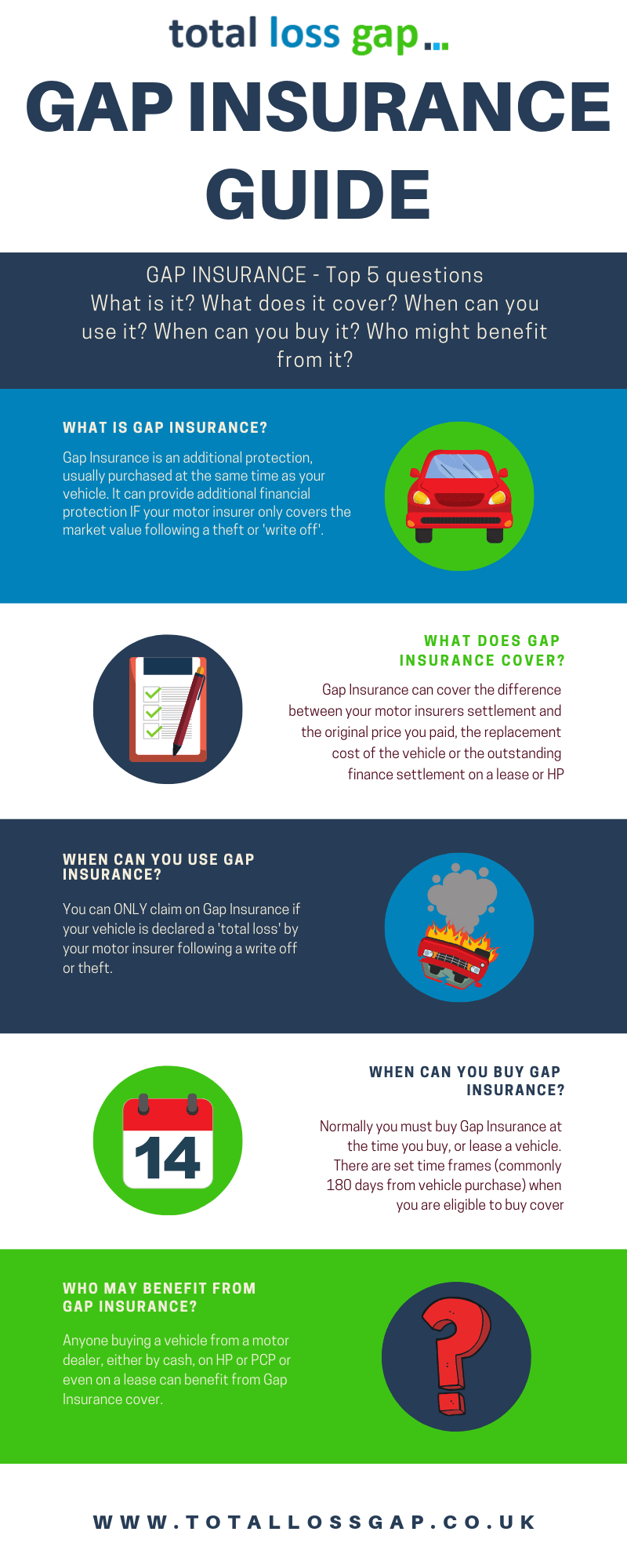

What Is Gap Insurance?

Gap insurance is an insurance policy that covers the difference between what you owe on your car loan and the actual cash value of the car the moment it is totaled or stolen. It is also known as “loan/lease gap coverage” or “guaranteed asset protection” (GAP). Gap insurance is usually offered by car dealerships when you buy a new car and may be offered by your insurer when you buy a new policy. This type of insurance is not mandatory, but it can save you a lot of money if your car is totaled or stolen.

What Does Gap Insurance Cover?

Gap insurance covers the difference between the actual cash value of your car and the amount you still owe on your car loan. This is important because if your car is totaled or stolen, the insurance company will only pay you the actual cash value of your car, which may be less than the amount you owe on the loan. For example, if you owe $20,000 on your loan and the actual cash value of the car is only $15,000, gap insurance would cover the remaining $5,000.

When Should You Buy Gap Insurance?

Gap insurance is a good idea if you are financing a car, especially a new car. When you buy a new car, it depreciates quickly and can be worth less than the amount you owe on the loan. This is especially true if you put a down payment on the car or if you have a long loan term. Additionally, if you get into an accident, you could be left with a loan balance that is higher than the actual cash value of the car.

Where Can You Buy Gap Insurance?

Gap insurance can usually be purchased from your car dealership when you buy a new car. It can also be purchased from your insurance company if you already have an existing policy. If you are purchasing a policy from your insurance company, make sure to get quotes from multiple companies to make sure you are getting the best deal. Additionally, some credit unions and banks may offer gap insurance as part of their loan package.

How Much Does Gap Insurance Cost?

The cost of gap insurance varies depending on the type of policy you purchase and the amount of coverage you select. Generally, gap insurance costs around $20-30 per year and can cover up to $50,000 of the difference between the actual cash value of your car and the loan balance. Additionally, some policies may also cover sales tax, registration fees, and other costs associated with the car loan.

What Are the Benefits of Gap Insurance?

The primary benefit of gap insurance is that it can save you from having to make a large out-of-pocket payment if your car is totaled or stolen. Additionally, gap insurance can provide you with peace of mind knowing that you are covered if something unexpected happens to your car. Finally, gap insurance can also help you if you have to purchase a new car, as it can help to cover the difference between the loan balance and the actual cash value of the car.

What is Gap Insurance? - YouTube

GAP Insurance - Explained in a Complete Guide | TotalLossGap

The Top 10 questions on GAP Insurance you will want to know

What is GAP insurance and should you buy it? - YouTube

Gap Insurance – LowestQuotes.com