When Should I Get Liability Only Car Insurance

When Should I Get Liability Only Car Insurance?

Having car insurance is essential for anyone who owns a car. Having car insurance not only provides financial protection in the event of an accident, but it also helps cover the cost of repairs and medical bills. When deciding what car insurance you need, you may consider getting liability only car insurance. In this article, we’ll explain what liability only car insurance is and when it’s the right coverage for you.

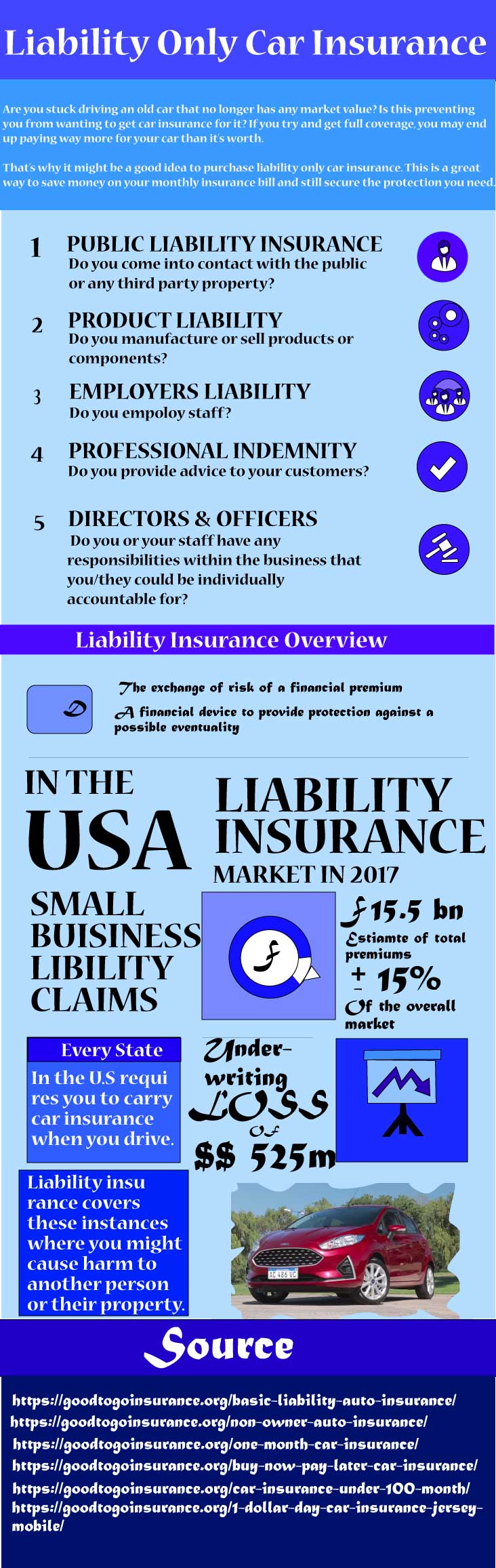

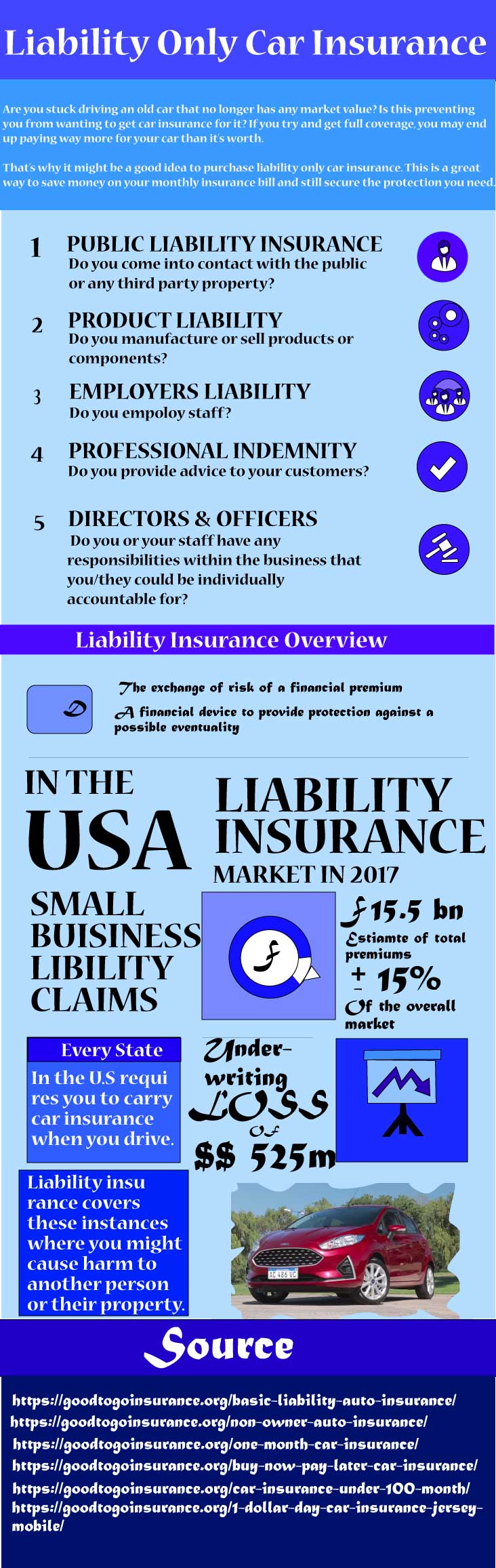

What is Liability Only Car Insurance?

Liability only car insurance is a type of insurance coverage that provides financial protection if you are at fault for an accident. It covers the cost of repairs and medical bills for the other driver(s) involved in the accident. It does not cover the cost of repairs or medical bills for the insured driver or any passengers in the insured driver’s vehicle.

Liability only car insurance is typically the minimum requirement for drivers in most states. It is important to note that having liability only car insurance does not provide any coverage for your own vehicle in the event of an accident.

Who Should Get Liability Only Car Insurance?

Liability only car insurance is usually the best choice for drivers who are on a tight budget. It is also a good option for drivers who have an older vehicle that is not worth much money. The cost of premiums for liability only car insurance is usually much lower than the cost of premiums for full coverage car insurance.

However, it is important to note that liability only car insurance does not provide coverage for your own vehicle. Therefore, if you have a newer vehicle or a vehicle that is worth a significant amount of money, you may want to consider getting full coverage car insurance. Full coverage car insurance will provide financial protection for your own vehicle in the event of an accident.

When Should I Get Liability Only Car Insurance?

If you are on a tight budget or have an older vehicle that is not worth much money, you may want to consider getting liability only car insurance. It is important to note that liability only car insurance does not provide coverage for your own vehicle in the event of an accident. Therefore, if you have a newer vehicle or a vehicle that is worth a significant amount of money, you may want to consider getting full coverage car insurance.

Bottom Line

Liability only car insurance is a type of insurance coverage that provides financial protection if you are at fault for an accident. It is usually the best choice for drivers who are on a tight budget or have an older vehicle that is not worth much money. However, it does not provide coverage for your own vehicle in the event of an accident. Therefore, if you have a newer vehicle or a vehicle that is worth a significant amount of money, you may want to consider getting full coverage car insurance.

Liability Only Car Insurance | Liability goodtogo car insurance

Car Insurance Coverage: Let's Dig In A Little Deep | Star Nsurance Tampa

What Is Liability Insurance? | Allstate

Resources & tools | Rockford Mutual Insurance Company

Ultimate Collection of 26 Amazing and Creatively Designed Infographics