Should I Purchase Gap Insurance On A Used Car

Wednesday, March 19, 2025

Edit

Should I Purchase Gap Insurance On A Used Car

What Is Gap Insurance?

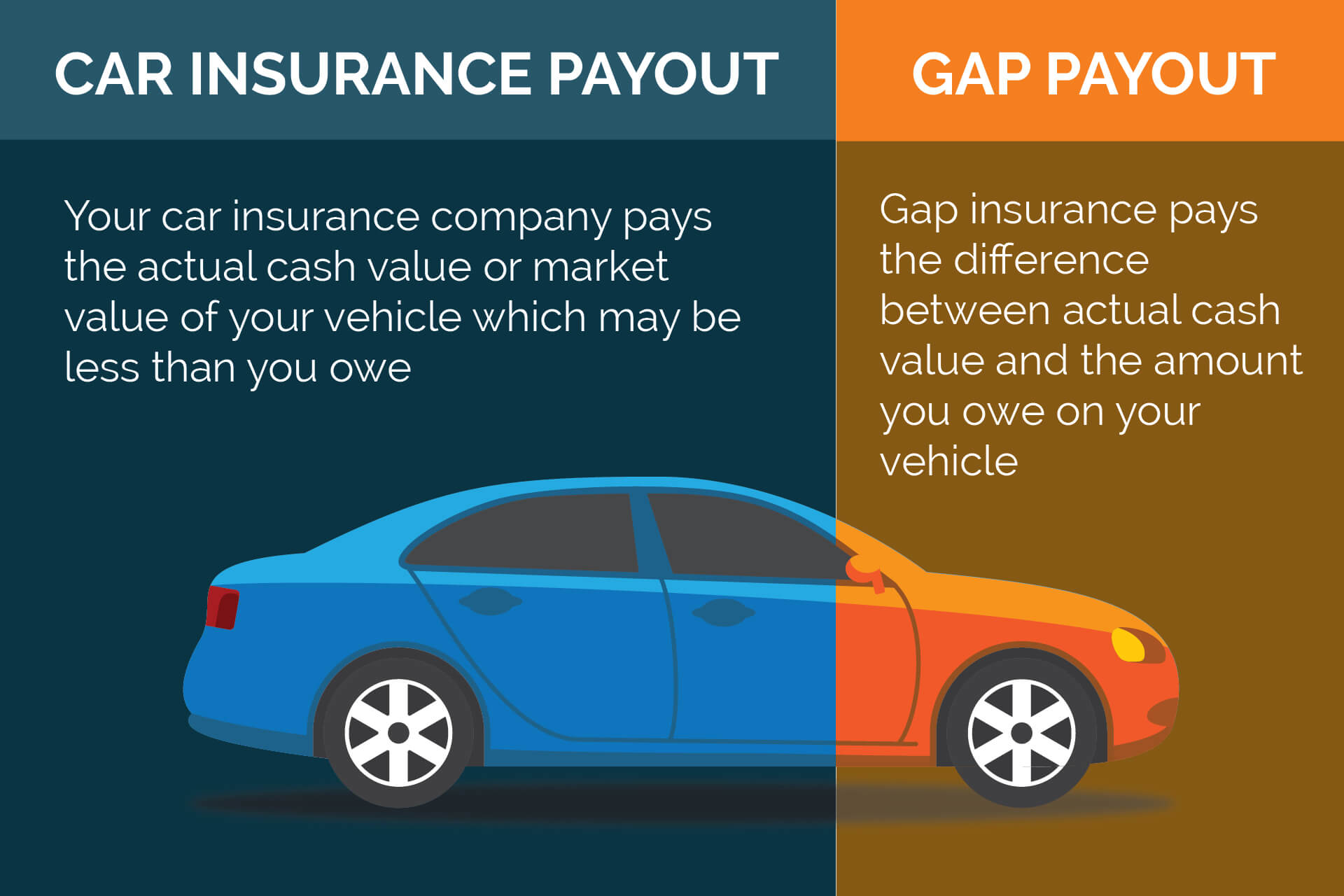

Gap insurance, also known as "guaranteed auto protection" or "loan/lease payoff coverage," is a type of insurance specifically designed to protect car owners who have taken out a loan to purchase their vehicles. It is intended to cover the difference, or "gap," between the amount you owe on your car loan and the actual cash value (ACV) of your car if it is stolen or totaled in an accident. The ACV is the amount of money your car would be worth if you sold it in its current condition, minus any depreciation.

Without gap insurance, car owners who are involved in an accident that totals their car may be stuck with a loan balance that exceeds the ACV of the car, leaving them with a financial gap that must be paid off. Gap insurance can help bridge this gap by covering the difference between the ACV and the loan balance, ensuring that the car owner does not end up in debt.

What Are The Benefits Of Gap Insurance?

Gap insurance can be beneficial for car owners in certain situations. For example, if you have a large loan balance that exceeds the ACV of your car, gap insurance can help you avoid being stuck with a large bill due to depreciation. Additionally, if you are in an accident that totals your car and you owe more on the loan than the car is worth, gap insurance will cover the difference so that you are not left with a large debt.

Another potential benefit of gap insurance is that it can also cover taxes and fees associated with the purchase of the car. This can help prevent you from having to pay taxes and fees out of pocket if your car is totaled in an accident.

What Should I Consider Before Buying Gap Insurance?

When considering whether to purchase gap insurance, there are a few things you should take into account. First, you should consider the difference between the ACV of your car and the loan balance you owe on it. If the difference is small, you may not need gap insurance, as the amount of coverage provided by the policy may not make up for the cost of the premium.

You should also consider the age and condition of your car, as older cars generally have a lower ACV than newer cars. If you are driving an older car, you may want to look into gap insurance, as the cost of the premium may be worth the peace of mind knowing that you are covered in the event of an accident.

Where Can I Buy Gap Insurance?

Gap insurance is typically available through your car insurance provider. Many insurance companies offer gap insurance as an add-on to your existing car insurance policy. You can also purchase gap insurance through a third-party provider, such as a bank or credit union.

It is important to shop around and compare rates from different insurers or providers before purchasing gap insurance. This will ensure that you get the best possible coverage at the lowest possible cost.

Should I Purchase Gap Insurance On A Used Car?

Whether or not you should purchase gap insurance on a used car depends on a few factors, such as the age and condition of the car, the difference between the ACV and the loan balance, and your personal preferences. If you have a large loan balance and a car that has depreciated significantly since it was purchased, gap insurance may be a worthwhile investment. On the other hand, if the difference between the ACV and the loan balance is small, the cost of the premium may outweigh the benefits of the coverage.

Ultimately, the decision to purchase gap insurance on a used car should be based on your individual circumstances and preferences. It is important to weigh the pros and cons of gap insurance before making a decision.

Gap Car Insurance Tips - Can I Buy Gaping Coverage Without Paying More

Should I Buy Gap Insurance : What Is GAP Insurance And When Should

Page for individual images • Quoteinspector.com

2017 Cheap Gap Insurance | Is Your Local Car Dealer the Best Place to