One Day Car Insurance Uk Phone Number

Tuesday, March 18, 2025

Edit

One Day Car Insurance UK Phone Number

What is One Day Car Insurance?

One Day Car Insurance is a type of insurance policy that provides temporary coverage for a single day. It can be useful for those who need to borrow a car, or if you want to rent a car for a day. It is also ideal for those who want to cover their car for a short period of time, such as when it is in the shop for repairs. One Day Car Insurance is a great way to get the coverage you need without committing to a long-term policy.

Benefits of One Day Car Insurance

There are several benefits associated with One Day Car Insurance. Most importantly, it offers a much more affordable rate than traditional policies. It is also much more flexible, allowing you to customize the coverage you need. For example, you can choose the type of coverage and deductible you want. You can also choose the amount of coverage you need, depending on the length of time you need the coverage. Finally, it is a great way to save money by avoiding the cost of an annual policy.

How to Get One Day Car Insurance

Getting One Day Car Insurance is easy. You can typically purchase it from an insurance broker or directly from the insurer. The process is typically fast and simple, and you can often purchase the coverage online. It is important to note that the coverage will only be valid for a single day, and you must purchase a separate policy for each day you need coverage.

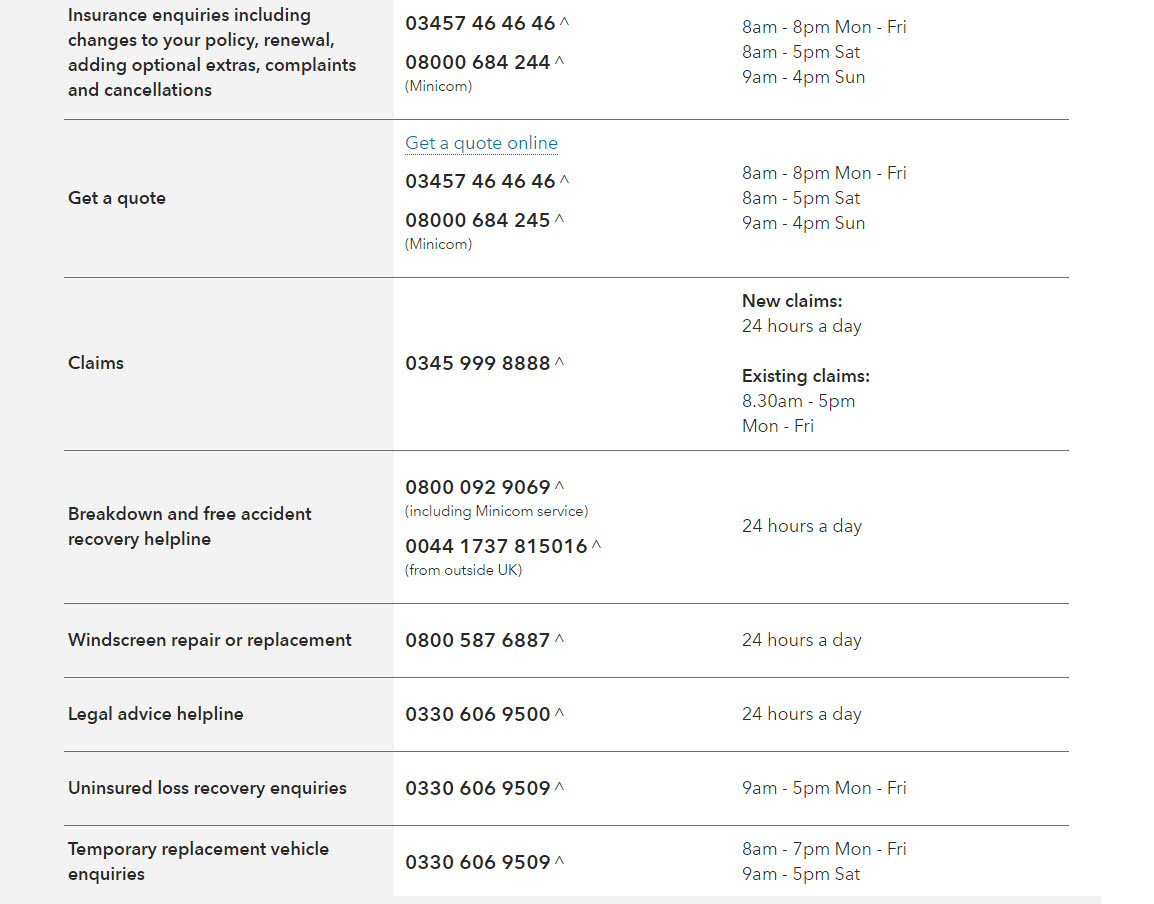

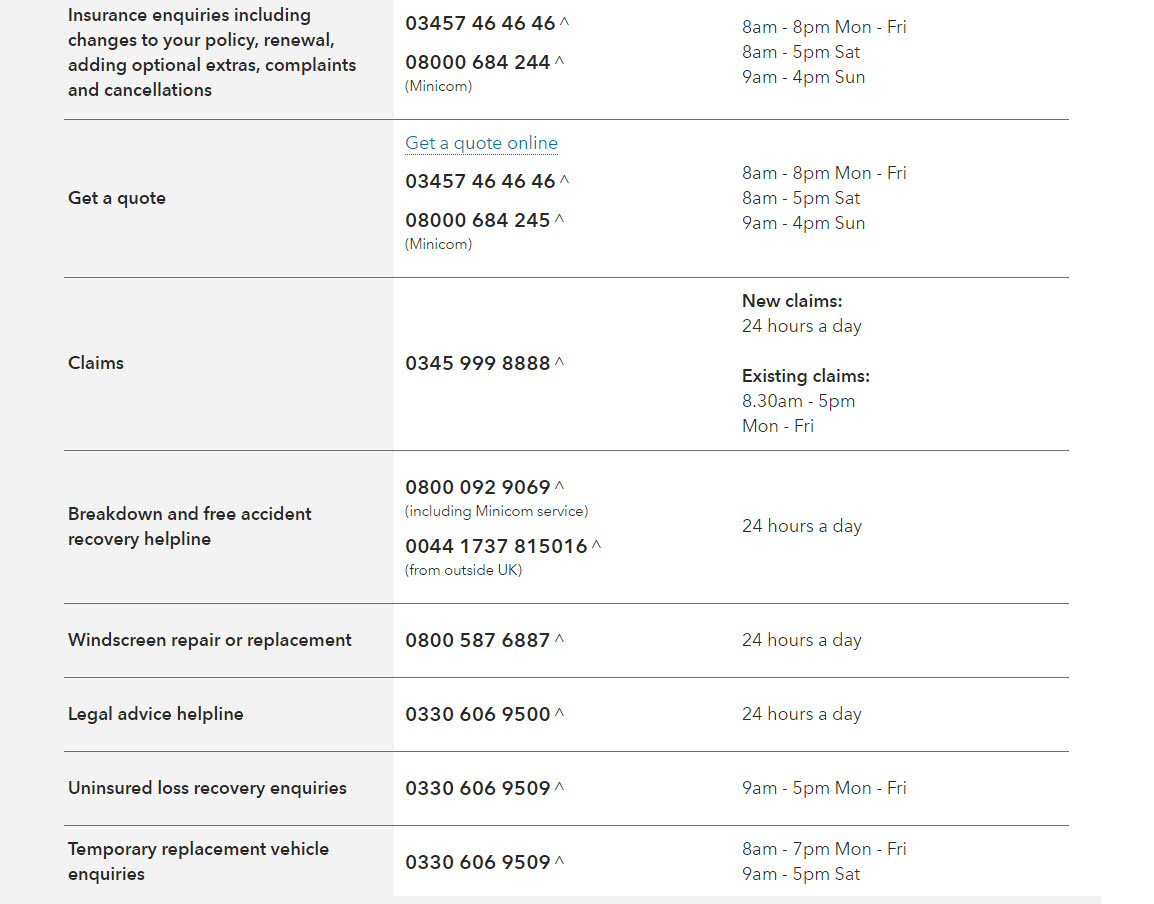

One Day Car Insurance UK Phone Number

If you need assistance with getting One Day Car Insurance, you can contact the UK phone number provided by your insurance provider. You can typically find this number on their website or in the policy documents. When calling, you can speak with a customer service representative who can help you with the process of purchasing the insurance. They can also answer any questions you may have about the coverage, as well as provide additional information about the policy.

Things to Consider When Buying One Day Car Insurance

When purchasing One Day Car Insurance, there are a few things to consider. First, make sure you understand the coverage you are getting. It is important to know the type of coverage, the deductible, and the amount of coverage you need. You should also make sure you understand any additional fees associated with the policy, such as administrative fees. Finally, make sure you understand the terms and conditions of the policy, such as how long the policy will be in effect for.

Conclusion

One Day Car Insurance is a great way to get the coverage you need without committing to a long-term policy. It is also much more affordable and flexible than traditional policies. To purchase this type of insurance, you can contact the UK phone number provided by your insurance provider. When doing so, make sure you understand the type of coverage, the deductible, and the terms and conditions of the policy. This will help ensure you get the right coverage for your needs.

Co-Op Insurance Customer Service Free Contact Number: 0800 068 4244

Insurance Archives - Page 4 of 6 - UK Customer Service Contact Numbers

One Day Car Insurance Quotes Uk - ABINSURA

How To Get Car Insurance For One Day - Go Compare Car Insurance For One

Car Insurance Day - Car Insurance Day February 1 2021 Happy Days 365