Insurance Costs For Electric Cars

Thursday, March 20, 2025

Edit

Exploring Insurance Costs For Electric Cars

The Benefits of Owning An Electric Vehicle

Electric cars are becoming increasingly popular as more people become aware of the environmental and financial benefits they can offer. Electric vehicles are cheaper to run, have lower maintenance costs, and can be charged up quickly and easily. They also don't produce any tailpipe emissions, meaning they are much better for the environment. As a result, electric cars can be a great investment for those who are keen to reduce their carbon footprint and save money on their running costs.

Insurance Costs For Electric Cars

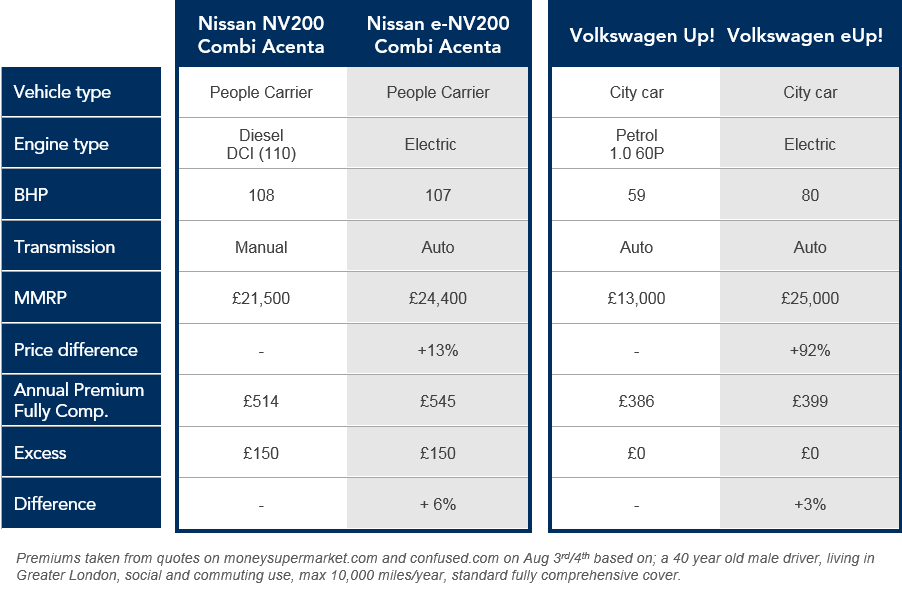

One of the major concerns for those considering buying an electric car is the cost of insurance. Electric cars tend to cost more to insure than their petrol and diesel counterparts due to their higher purchase price and the fact that they are more expensive to repair. However, there are some ways in which you can reduce the cost of your insurance.

Firstly, you should shop around for a good deal. As with any car insurance, it pays to compare quotes from a range of providers as prices can vary significantly. You should also make sure that you are getting the right level of cover for your needs. If you are a safe and experienced driver, you may be able to get a lower premium.

How To Reduce Insurance Costs

In addition to shopping around for the best deal, there are a number of other ways in which you can reduce the cost of your insurance. Firstly, you should consider installing security devices such as an alarm or immobiliser. This will reduce the risk of your car being stolen, which in turn will reduce the cost of your insurance.

You should also think about signing up for a black box policy. These policies use a telematics device to record your driving style and habits. If you are a safe and responsible driver, you could benefit from a lower insurance premium.

What About Multi-Car Policies?

If you have more than one car in your household, you may want to consider taking out a multi-car policy. This will allow you to insure all of your vehicles on one policy, which can often work out cheaper than taking out separate policies for each car.

It is also worth looking into pay-as-you-go insurance. This type of policy allows you to pay for your insurance on a monthly basis, rather than upfront in one lump sum. This can be a good option if you are on a tight budget and want to spread the cost of your insurance.

Conclusion

Electric cars offer a number of benefits, from lower running costs to reduced emissions. However, it is important to consider the cost of insurance before making a purchase. By shopping around for a good deal, installing security devices, and considering a multi-car policy or pay-as-you-go option, you can reduce the cost of your electric car insurance.

Average Cost of Electric Car Insurance UK 2020 | NimbleFins

Is it easy to insure an electric car? We consider the cost

Insurance Comparison Uk - How Car Specs

Cheapest Electric Cars (Total Cost of Ownership) In UK | CleanTechnica

Buying an Electric Car? For Savings, Time Could Be of the Essence