How Much Does Full Coverage Car Insurance Cost

How Much Does Full Coverage Car Insurance Cost?

Introduction

Car insurance is an essential part of life for anyone who owns a car. It provides protection for you and your vehicle in case of any accidents or damage. Full coverage car insurance is the most comprehensive type of insurance available, and it can be quite expensive. But how much does full coverage car insurance cost? This article will provide an overview of the costs associated with full coverage car insurance and give you an idea of what you can expect to pay.

Factors That Affect Cost

There are many different factors that will affect the cost of your full coverage car insurance. These factors include your age, driving record, the type of car you drive, the area where you live, and the amount of coverage you need. Your age is an important factor in determining the cost of your car insurance, as younger drivers tend to be charged higher rates due to their lack of experience. Your driving record is also an important factor, as those with a history of accidents or traffic violations will be charged higher rates. The type of car you drive is also a factor, as some cars are more expensive to insure than others. The area where you live is also important, as some areas have higher rates than others. Finally, the amount of coverage you need will also affect the cost, as more coverage will cost more.

Average Cost of Full Coverage Insurance

The average cost of full coverage car insurance will vary depending on the factors mentioned above. However, most drivers can expect to pay anywhere from $1000 to $2000 per year for full coverage. This cost will also depend on the type of coverage you choose, as some drivers opt for additional coverage such as collision or comprehensive. Drivers who choose to purchase additional coverage can expect to pay higher premiums. Additionally, some insurers offer discounts for drivers who have a good driving record or who have taken a defensive driving course.

How to Save on Insurance Costs

There are several ways to save on the cost of your full coverage car insurance. One of the best ways to save is to compare quotes from different insurers. This will allow you to find the best rate available. Additionally, you can look for discounts such as those for good drivers, safe drivers, and defensive driving courses. You can also raise your deductible, which will lower the cost of your premiums. Finally, you can look for bundling discounts, which will allow you to save by purchasing multiple types of insurance from the same insurer.

Conclusion

Full coverage car insurance can be quite expensive, but there are ways to save on the cost. By comparing quotes from different insurers, looking for discounts, and raising your deductible, you can save money on your full coverage car insurance. The average cost of full coverage car insurance will vary depending on your age, driving record, the type of car you drive, the area where you live, and the amount of coverage you need. However, most drivers can expect to pay anywhere from $1000 to $2000 per year for full coverage.

What's the average cost of car insurance in the US? - Business Insider

Cheap Car Insurance in North Carolina | QuoteWizard

What is No-Fault Insurance and How Does it Work? | QuoteWizard

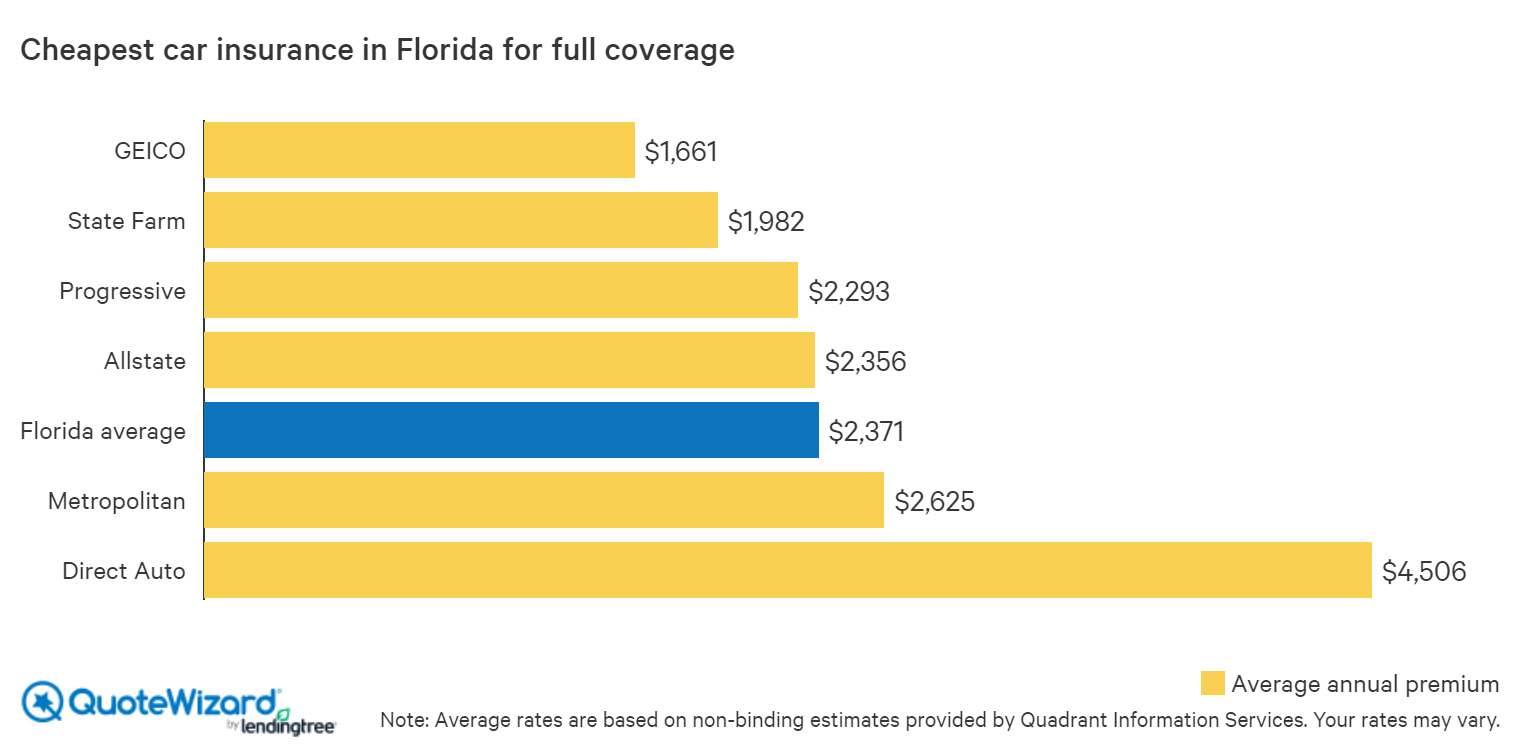

Cheap Car Insurance in Florida (2020) | QuoteWizard

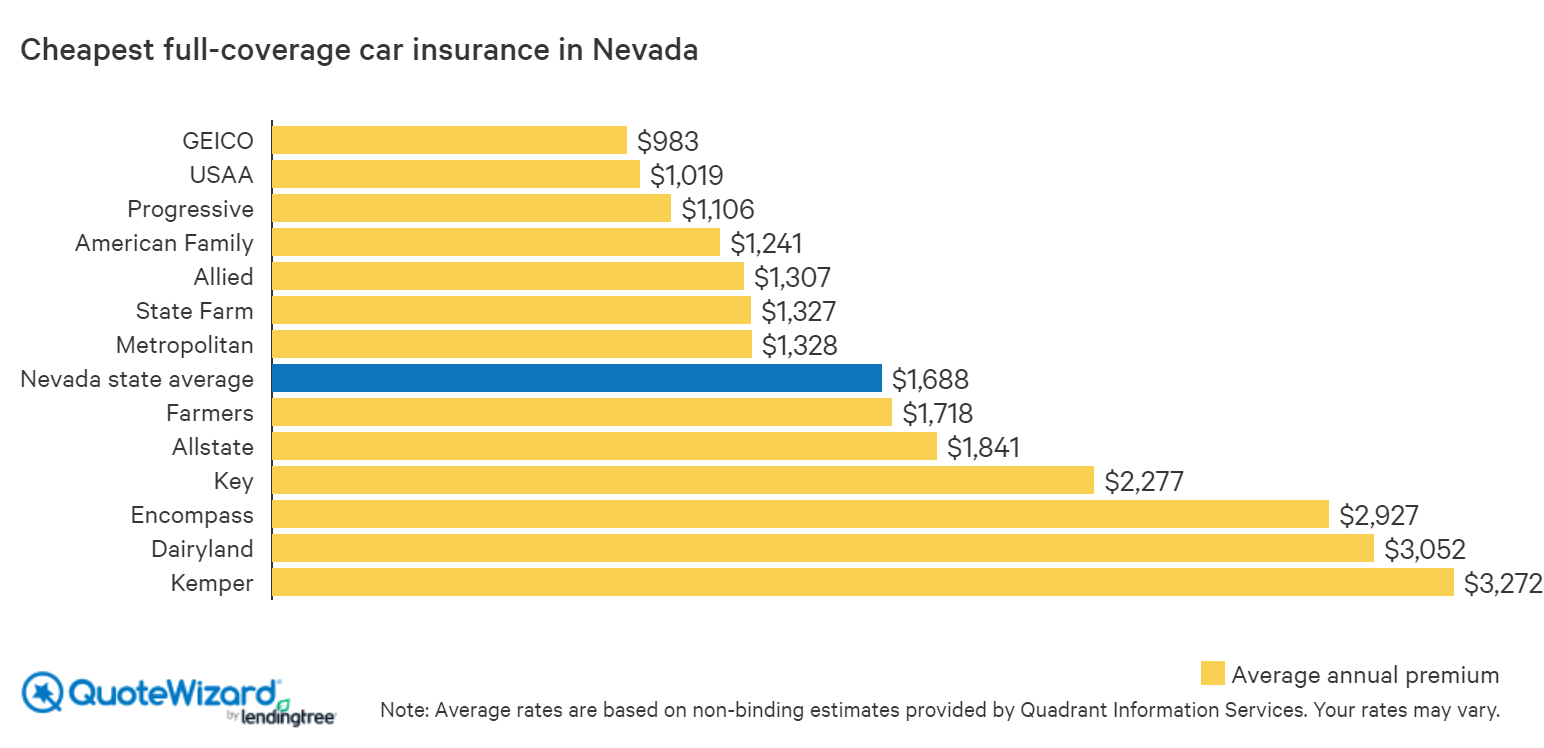

Where to Buy Cheap Nevada Car Insurance | QuoteWizard