How Much Does Allstate Charge For Gap Insurance

Sunday, March 23, 2025

Edit

Gap Insurance From Allstate

Gap insurance is an important financial protection to have on a vehicle, especially when you’re financing it. Gap insurance is designed to cover the difference between what your vehicle is worth and what you owe on it. It’s a valuable policy to have if you ever end up in a situation where your car is totaled or stolen, and you owe more money on it than the vehicle is worth. Allstate offers gap insurance for their customers, but how much does Allstate charge for gap insurance?

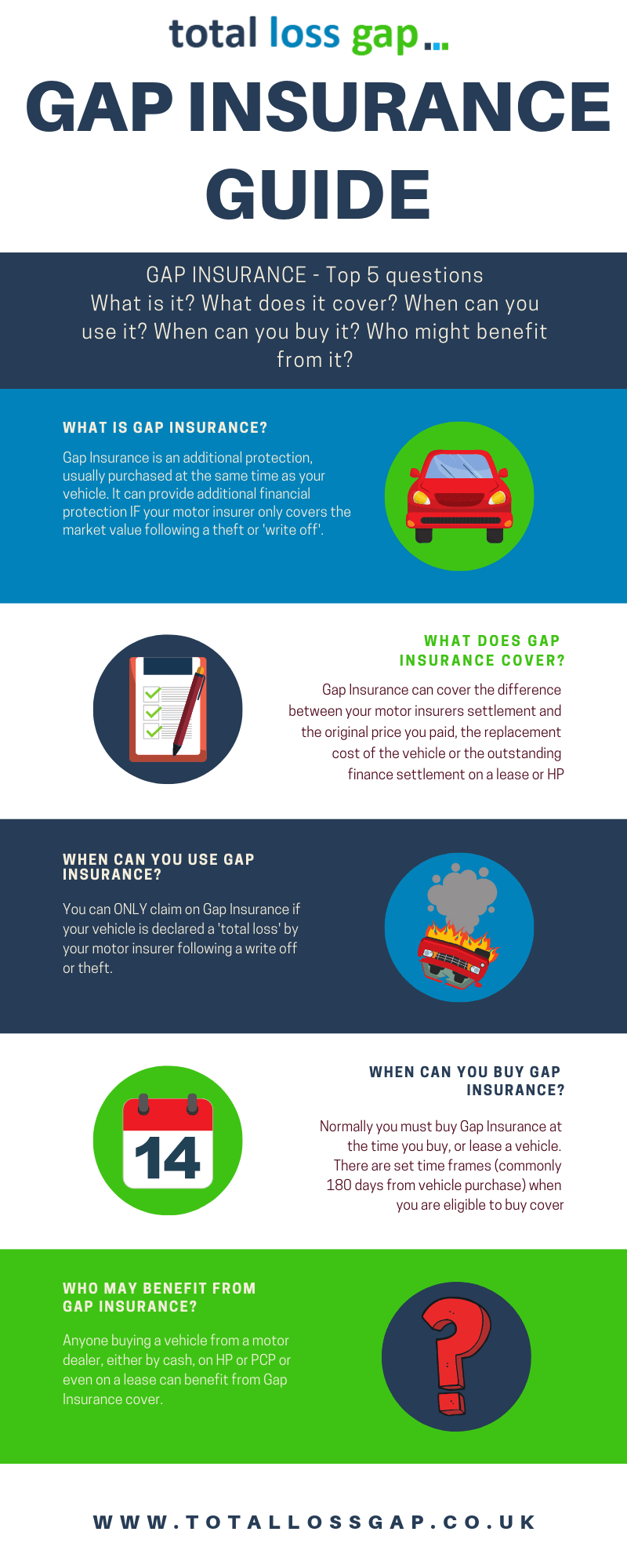

What is Gap Insurance?

Gap insurance (sometimes referred to as loan/lease gap coverage) is a form of insurance that covers the difference between the actual cash value of your car and the amount you owe on it. It’s important to have this type of coverage because if your car is stolen or totaled, many insurance companies will only reimburse you for the actual cash value of your car, which is typically less than the amount you owe. Gap insurance helps to cover the difference, so you don’t end up having to pay out of pocket for the difference.

How Much Does Allstate Charge for Gap Insurance?

The cost of gap insurance from Allstate largely depends on the type of coverage you choose and the amount of coverage you need. Most gap insurance policies are offered with a nominal fee, which can range from $20 to $50. This fee is typically added to your monthly car payment and will remain in effect until you pay off your vehicle. Additionally, Allstate also offers gap insurance in the form of a one-time payment. The cost of this one-time payment can range from $500 to $2,500.

What Factors Determine the Cost of Gap Insurance?

The cost of gap insurance from Allstate is determined by several factors, including the value of your car, the amount of coverage you choose, and the type of coverage you select. The age, make, and model of your vehicle will also be taken into consideration. Larger cars, SUVs, and luxury vehicles tend to cost more to insure, so you can expect to pay more for gap insurance if your car is one of those.

What Does Gap Insurance Cover?

Gap insurance from Allstate covers the difference between the actual cash value of your vehicle and the amount you owe on it. It also covers any additional costs associated with replacing your car. This includes any taxes, registration fees, or other costs associated with purchasing a new vehicle. Gap insurance also provides coverage for late fees, so if you’re late on a payment, the gap insurance policy will cover it.

When Should You Buy Gap Insurance?

It’s best to purchase gap insurance at the same time you purchase your car. This is because the cost of gap insurance is based on the value of your vehicle, so if you wait too long to purchase it, the cost of the policy may increase. Additionally, if you wait too long and then end up in an accident or have your car stolen, you won’t be able to get gap insurance coverage.

Gap insurance is a valuable policy to have on your vehicle, and Allstate offers a great option for those who are looking for coverage. The cost of gap insurance from Allstate depends on several factors, including the value of your vehicle, the amount of coverage you choose, and the type of coverage you select. It’s important to purchase gap insurance at the same time you purchase your car to ensure you get the best rate.

What Is Gap Insurance? - Lexington Law

How Much Car Insurance Do You Really Need? | DaveRamsey.com

What is Gap Insurance? Infographic

Is It Worth Getting Gap Insurance On A Pcp - TRAVELVOS

Allstate Insurance: Rates, Consumer Ratings & Discounts