General Liability Insurance Policy Example

General Liability Insurance Policy: An Example

General Liability Insurance is a type of insurance coverage that provides protection to businesses and individuals from a variety of potential risks. This insurance is often referred to as “slip and fall” coverage, and can help to protect you from the financial responsibility of incidents that occur on your property. It is important to understand what a General Liability Insurance Policy covers and what it does not cover in order to make a sound decision when purchasing a policy.

What a General Liability Insurance Policy Covers

A General Liability Insurance Policy typically covers the costs associated with legal fees, medical bills, and property damage that result from an incident on your property. The policy will also cover third-party claims of negligence, such as libel or slander. This means that if someone is injured on your property and decides to file a claim against you, the policy will cover the legal costs associated with defending yourself in court. Additionally, it can also provide coverage for accidents that occur during the course of business operations. This includes things like customer slips and falls, or damage to a customer’s property.

What a General Liability Insurance Policy Does Not Cover

A General Liability Insurance Policy does not cover the costs associated with intentional acts, such as assault or battery. Additionally, it does not cover the cost of any damages that are caused intentionally by the insured. It is important to note that some policies may have exclusions for certain types of incidents, such as those that occur in the workplace. Additionally, the policy will not cover the costs associated with the negligence of the insured, such as failing to properly maintain their property.

Why You Should Have a General Liability Insurance Policy

Having a General Liability Insurance Policy is an important way to protect your business and yourself from the financial responsibility of an incident. If an accident occurs on your property and you are found to be liable, the costs associated with defending yourself in court can be extremely expensive. Additionally, the costs associated with medical bills and property damage can add up quickly. Having a General Liability Insurance Policy can help to ensure that you are not responsible for these costs.

What to Consider When Shopping for a General Liability Insurance Policy

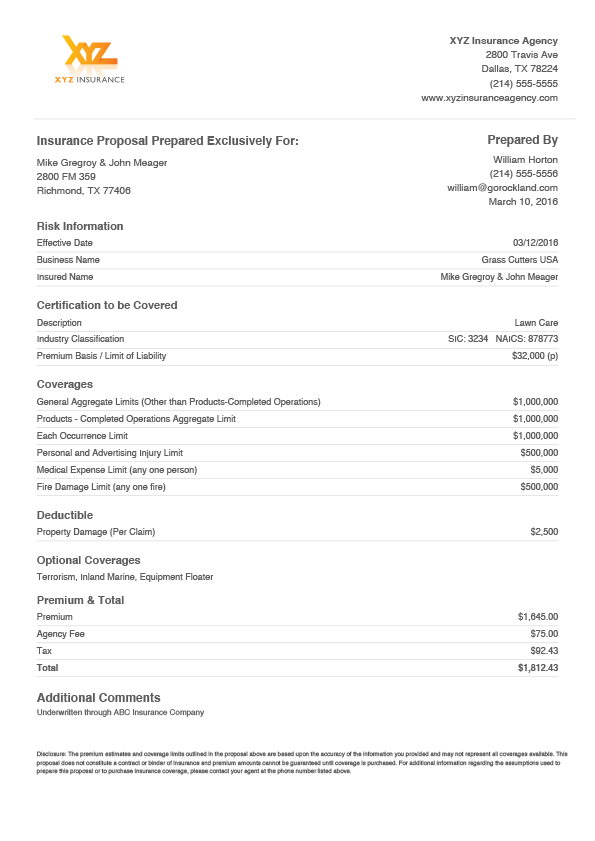

When shopping for a General Liability Insurance Policy, it is important to consider the type of coverage you need and the amount of coverage you want. Additionally, you should consider the deductibles and other costs associated with the policy. It is also important to research the company you are purchasing the policy from to ensure that they are reliable and have a good reputation. Finally, you should read the policy carefully to ensure that it meets your needs.

Conclusion

A General Liability Insurance Policy is a great way to protect your business and yourself from the financial responsibility of an incident. It is important to understand what a policy covers and what it does not cover in order to make a sound decision when purchasing a policy. Additionally, it is important to consider the type of coverage you need, the amount of coverage you want, and the deductibles and other costs associated with the policy. Doing your research and reading the policy carefully can help to ensure that you have the coverage you need.

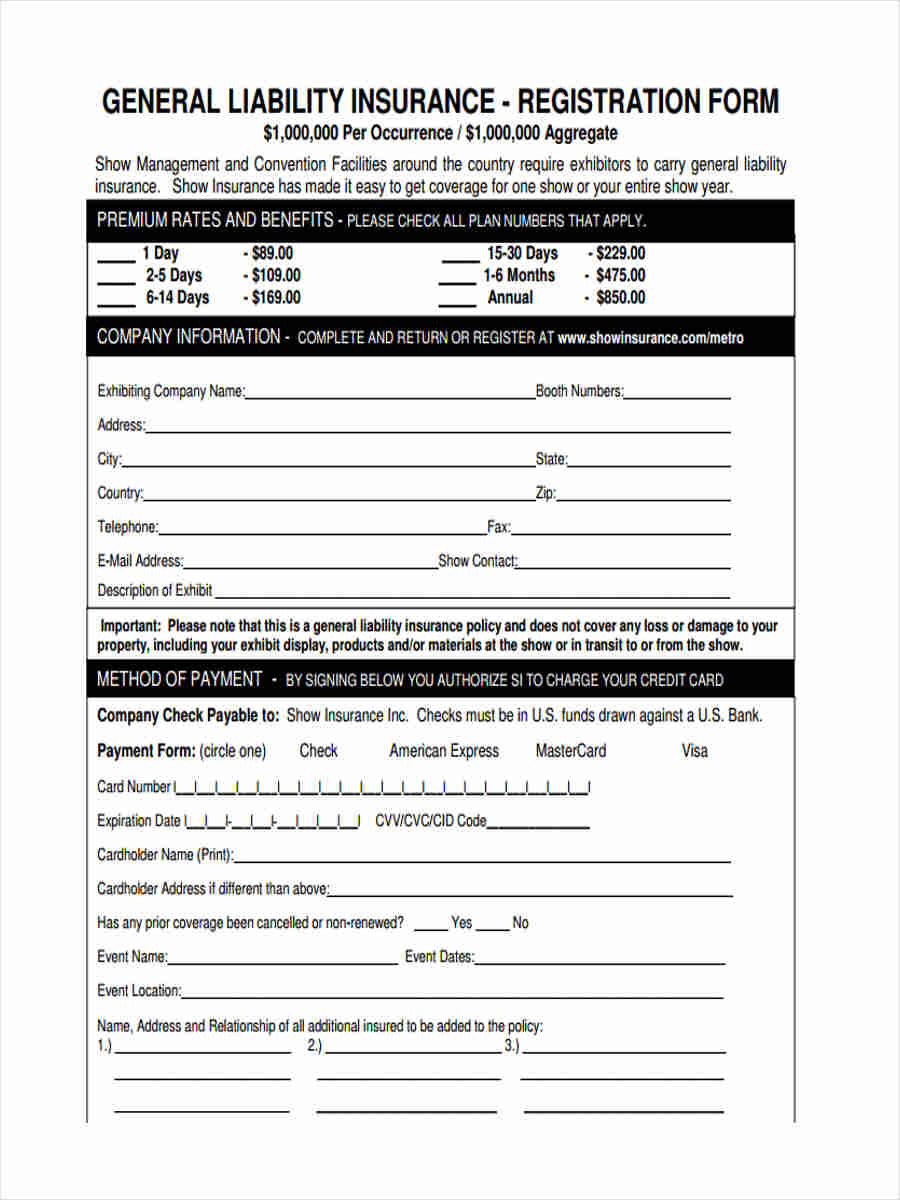

FREE 7+ Liability Insurance Forms in MS Word | PDF

general liability insurance for small business ontario

What is General Liability Insurance? - YouTube

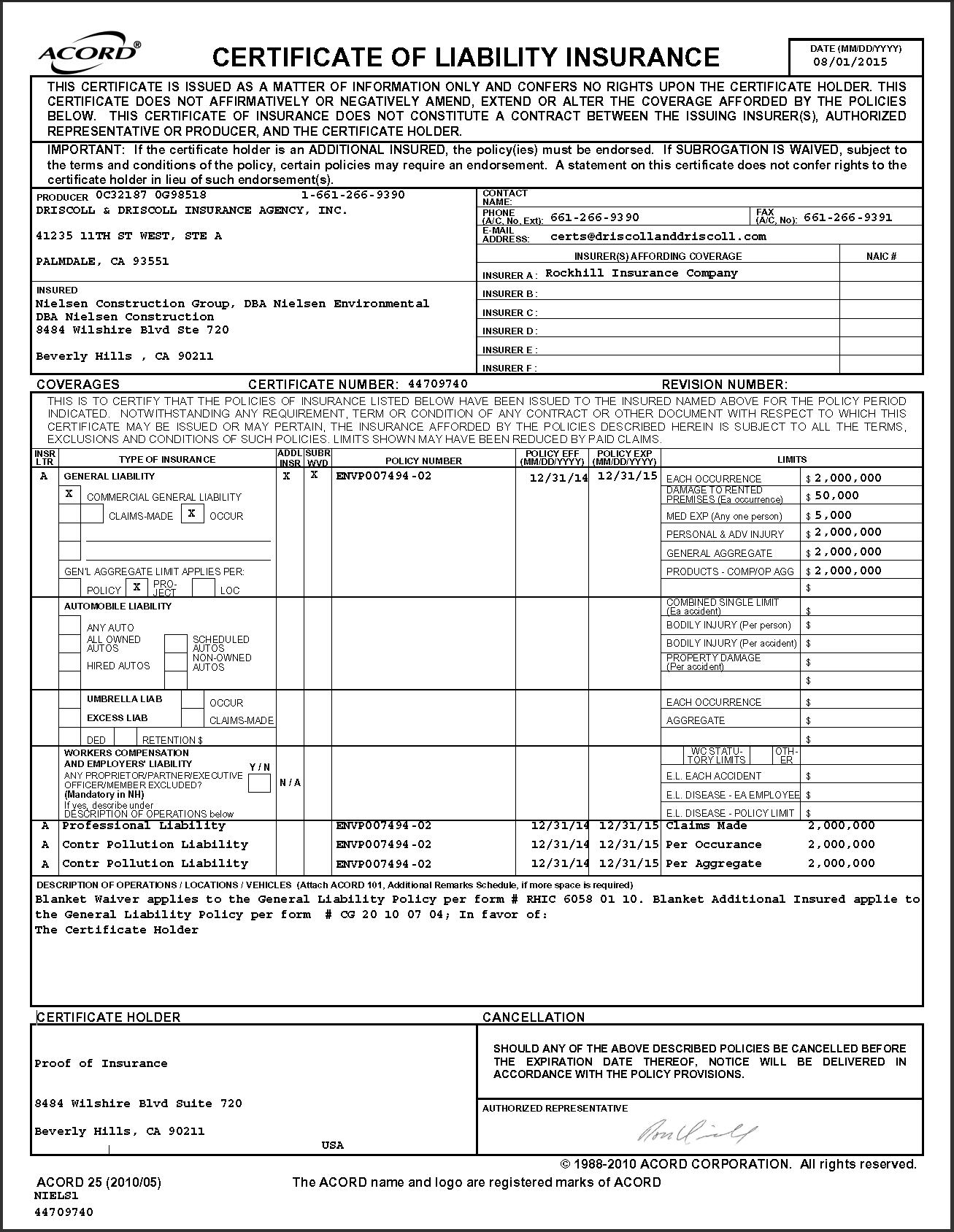

Contractor Insurance | Nielsen Environmental

Example Insurance Quote Templates - Custom Quote Form