Esure Motor Insurance Claim Line

Esure Motor Insurance Claim Line - A Comprehensive Guide

What is Esure Motor Insurance Claim Line?

Esure Motor Insurance Claim Line is a convenient way for individuals and businesses to get the cover they need for their cars. It offers a range of cover options that can be tailored to meet the needs of any individual or business. Esure provides a variety of cover for a variety of vehicles, from cars and vans to motorbikes and commercial vehicles. The claim line also covers any motor damage and theft, as well as legal protection in the event of a claim. Esure also provides a range of other benefits, such as breakdown assistance, legal protection and courtesy car cover.

What Cover Does Esure Motor Insurance Claim Line Offer?

Esure Motor Insurance Claim Line offers a range of cover options for drivers. This includes comprehensive insurance, third-party, fire and theft insurance and third-party only insurance. Comprehensive cover is the most comprehensive cover, offering the most protection and often the most expensive option. Third-party, fire and theft cover is less comprehensive and offers protection against damage caused by fire, theft or vandalism. Third-party only cover is the most basic cover and only covers damage caused to other vehicles and property in an accident.

What Additional Benefits Does Esure Motor Insurance Claim Line Provide?

Esure Motor Insurance Claim Line provides additional benefits, such as breakdown assistance and courtesy car cover. Breakdown assistance ensures that if a driver’s vehicle breaks down, they will be able to get it fixed and back on the road as quickly as possible. Courtesy car cover provides a courtesy car for up to 14 days if the insured vehicle is involved in an accident and cannot be driven. These additional benefits are designed to provide peace of mind for drivers and help to ensure that they can get back on the road quickly and safely.

How Do I Make a Claim With Esure Motor Insurance Claim Line?

Making a claim with Esure Motor Insurance Claim Line is simple and straightforward. If a driver has been involved in an accident, they should contact Esure as soon as possible. They will then be asked to provide details of the accident and any damage that has been caused. Esure will then investigate the claim and the driver will be informed of the outcome. Depending on the type of cover and the damage caused, Esure will then either pay for the repairs to the driver’s vehicle or provide a replacement.

Is Esure Motor Insurance Claim Line Affordable?

Esure Motor Insurance Claim Line is affordable and offers a range of cover options that can be tailored to meet the needs of any individual or business. Esure offers competitive rates and a range of discounts and offers to help keep costs down. Drivers can also take advantage of a range of payment options, such as monthly payments or an annual lump sum payment, to make the cover more affordable.

Conclusion

Esure Motor Insurance Claim Line is a convenient way for individuals and businesses to get the cover they need for their cars. It offers a range of cover options that can be tailored to meet the needs of any individual or business. Esure also provides a range of additional benefits, such as breakdown assistance and courtesy car cover, to help ensure that drivers can get back on the road quickly and safely. Making a claim with Esure is simple and straightforward, and Esure also offers competitive rates and a range of discounts and offers to help keep costs down.

The Blog | esure

How To Cancel Esure Insurance - Quotes quoteawards.com

How to Cancel Your Esure Car Insurance - Insurance Contact

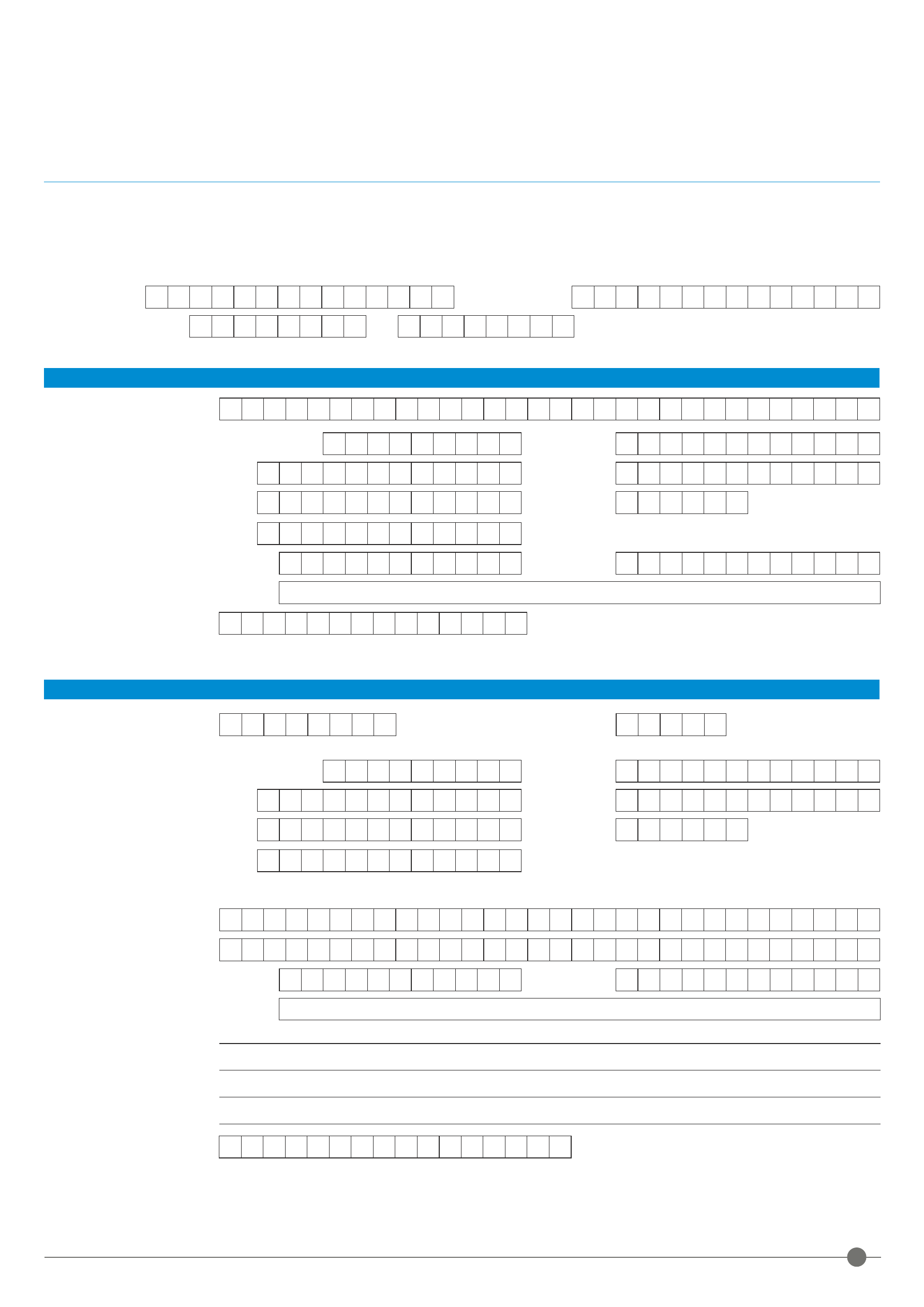

Motor Insurance Policy Claim Form - Edit, Fill, Sign Online | Handypdf

Make a Car Insurance Claim | esure