Cost Of Insuring A Tesla Model 3

Cost of Insuring a Tesla Model 3

Introduction

When it comes to choosing an electric car, the Tesla Model 3 is one of the most popular options on the market today. It offers a range of impressive features, from its semi-autonomous driving system to its high-tech interior, and its stylish exterior. But what about the cost of insuring a Tesla Model 3? In this article, we’ll look at the cost of insuring a Tesla Model 3, as well as some tips on how to save money on your car insurance.

Factors That Affect Insurance Costs

Like any other car, the cost of insuring a Tesla Model 3 will depend on a variety of factors, including the driver’s age, driving history, and location. In addition, the type of coverage you choose and the deductible you set will also affect the cost of your insurance. If you choose a higher deductible, you’ll likely pay less for your coverage, but you’ll have to pay more out of pocket if you get into an accident. Additionally, it’s important to note that the cost of insuring a Tesla Model 3 may be higher than other cars, due to the fact that it’s an electric vehicle and is therefore more expensive to repair.

What Does Your Insurance Cover?

When it comes to car insurance, it’s important to make sure you understand what your policy covers. Most policies will cover the cost of repairs if your car is damaged in an accident, as well as legal expenses if you’re found to be at fault. Additionally, your policy may cover medical expenses if you or your passengers are injured in an accident. It’s important to understand what your policy covers, so you’re not left paying for expensive repairs out of pocket.

What Are Some Ways To Save On Insurance?

There are a few ways to save money on your car insurance premiums. One way is to bundle your auto insurance with your home or life insurance, as this can often lead to discounts. Additionally, you can also look for discounts for things like installing an anti-theft system, or for having a clean driving record. Finally, if you’re a member of certain organizations or clubs, you may be eligible for a discount on your car insurance.

Tips For Getting The Best Rates

When it comes to getting the best rates on your car insurance, it pays to do your research. Make sure to shop around and compare rates from different insurers, as rates can vary greatly. Additionally, make sure to read the fine print on each policy, so you know exactly what’s covered and what’s not. Finally, it’s important to remember that the best way to save money on car insurance is to be a safe, responsible driver.

Conclusion

The cost of insuring a Tesla Model 3 will depend on a variety of factors, including the driver’s age, driving history, and location. Additionally, the type of coverage you choose and the deductible you set will also affect the cost of your insurance. However, there are a few ways to save money on your car insurance premiums, such as bundling your auto insurance with your home or life insurance, looking for discounts, and being a safe, responsible driver. Ultimately, the best way to get the best rates on car insurance is to do your research and compare rates from different insurers.

Here's How Tesla Model 3 Is Cheaper To Own Than Toyota Camry

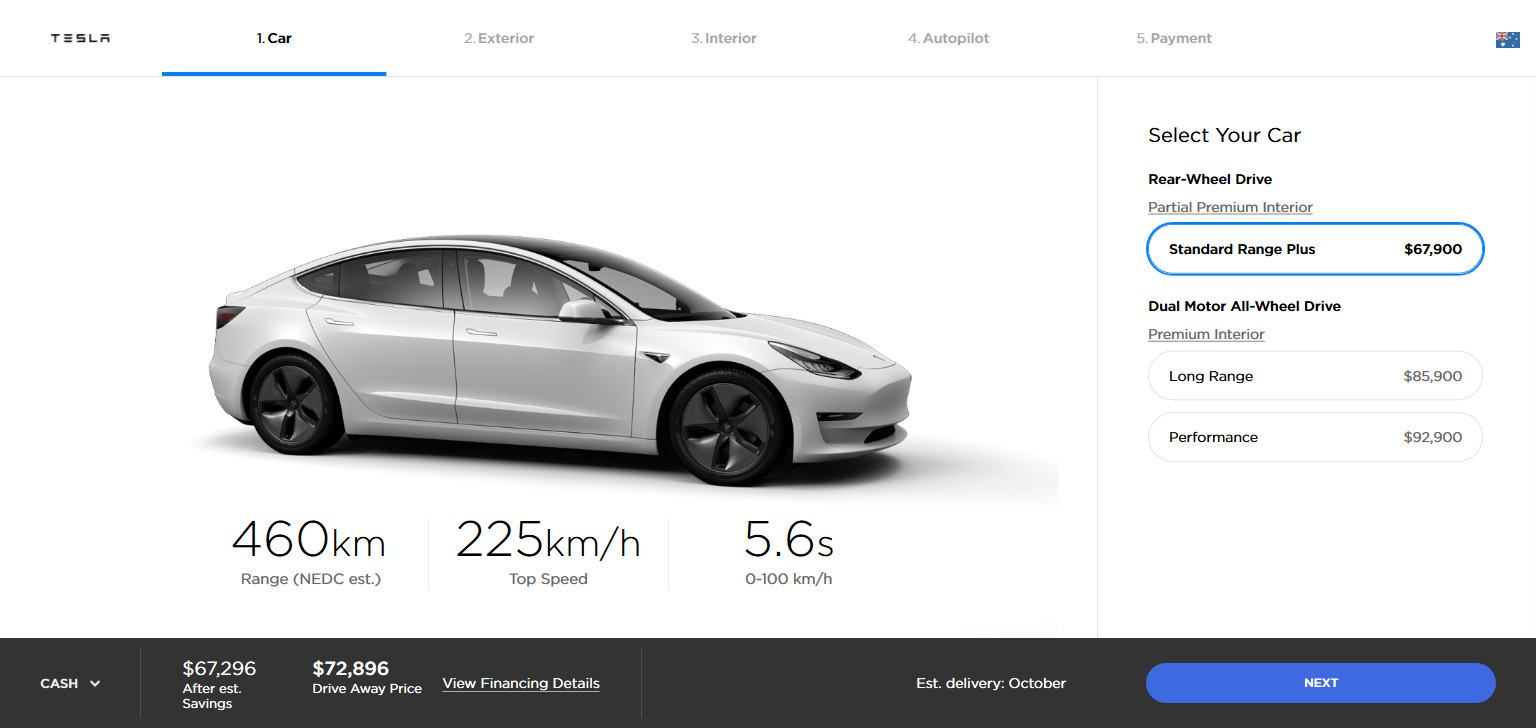

Tesla Model 3 prices jump in Australia as dollar falls against greenback

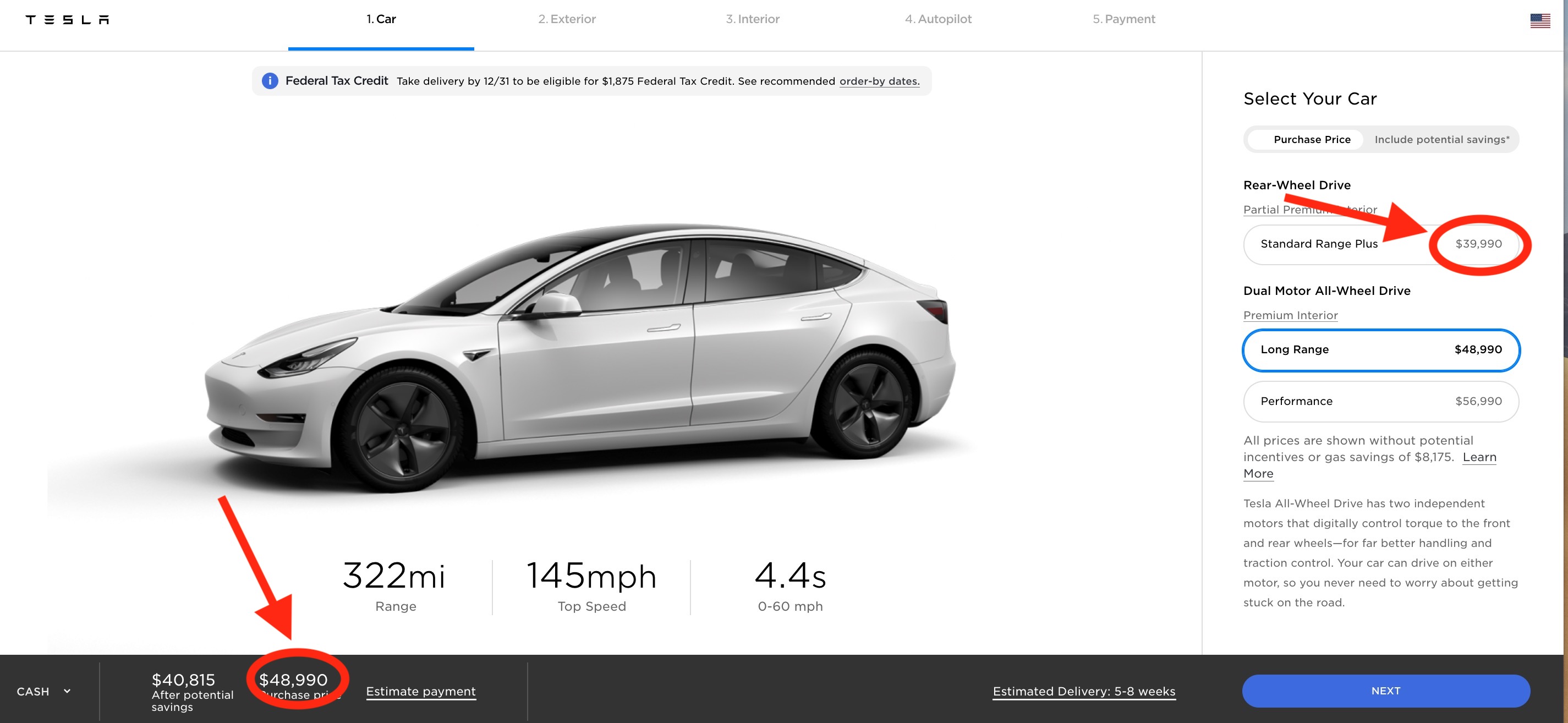

Tesla increases price of Model 3 as federal tax credit ends - Electrek

Tesla Model 3 Price Australia / Tesla Model 3 sees a price increase

Tesla Model 3 Teardown: The Nitty Gritty Details