Car Insurance Prices New York

Wednesday, March 5, 2025

Edit

Car Insurance Prices in New York

Overview of Car Insurance Requirements in New York

Car insurance is a requirement for all drivers in New York. Drivers in the state must have a minimum level of liability coverage to cover any damages they cause to other people or property. Additionally, uninsured motorist coverage is required in New York. This coverage helps drivers who are involved in an accident with an uninsured motorist and can help with medical expenses and costs associated with repairing a damaged vehicle.

Factors that Affect Car Insurance Prices in New York

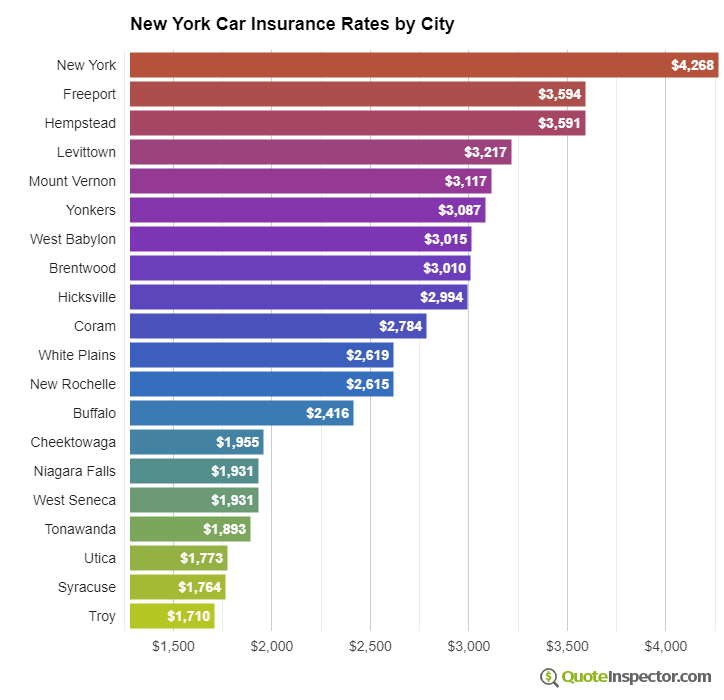

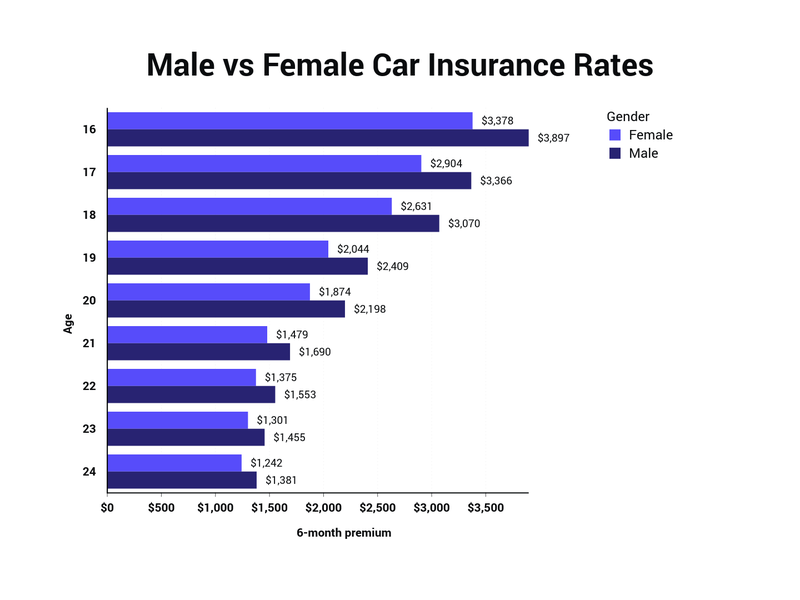

Car insurance prices vary greatly from one driver to the next. Certain factors can have a major impact on the cost of car insurance in New York. Some of the most important factors include the driver's age, driving record, location and the type of car. Age is an important factor because younger drivers tend to be more expensive to insure due to their lack of experience and greater risk of getting into an accident. Location is also important because insurance companies may charge higher rates in areas that are more prone to accidents or theft. Finally, the type of car can have a major impact on insurance prices. Luxury cars, for example, tend to be more expensive to insure due to their higher value and greater risk of theft.

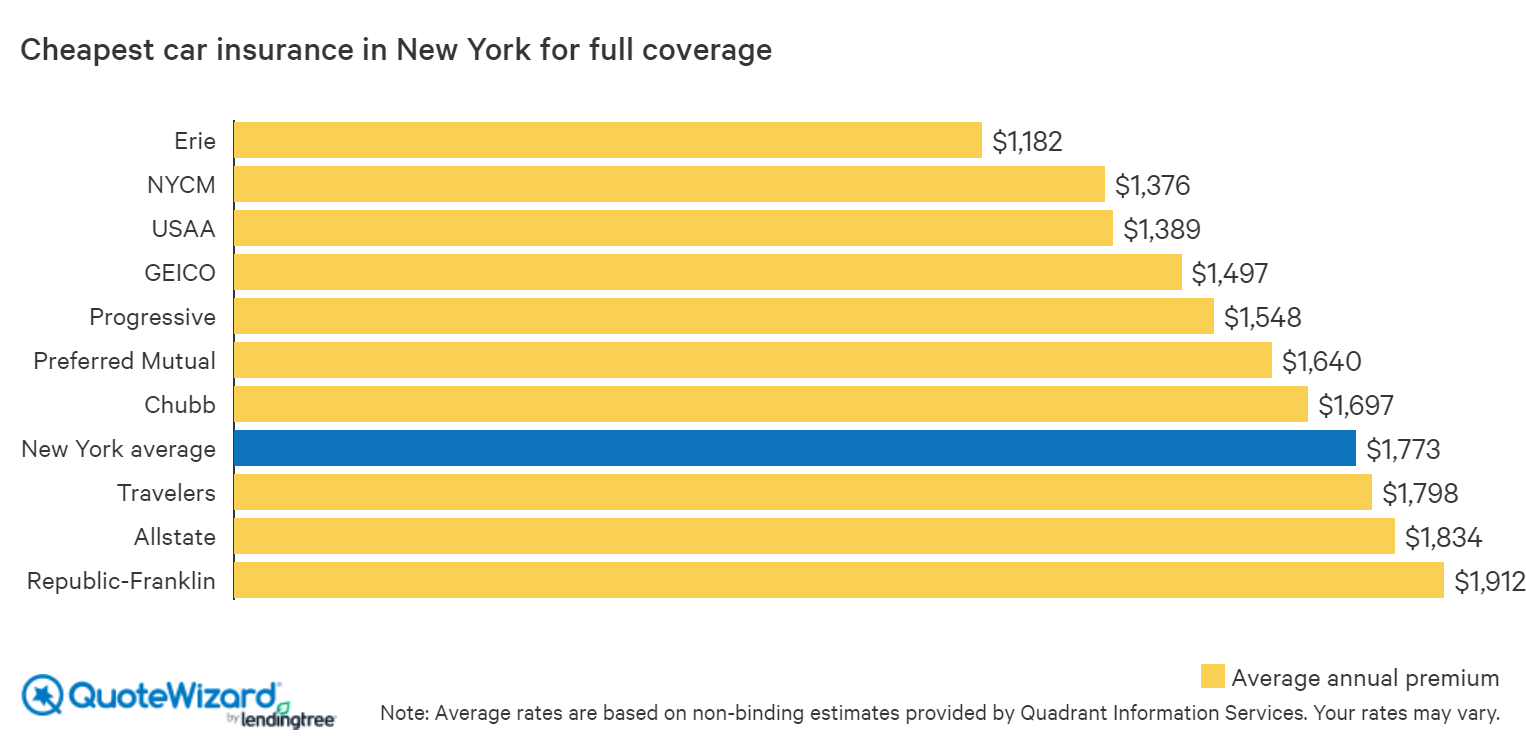

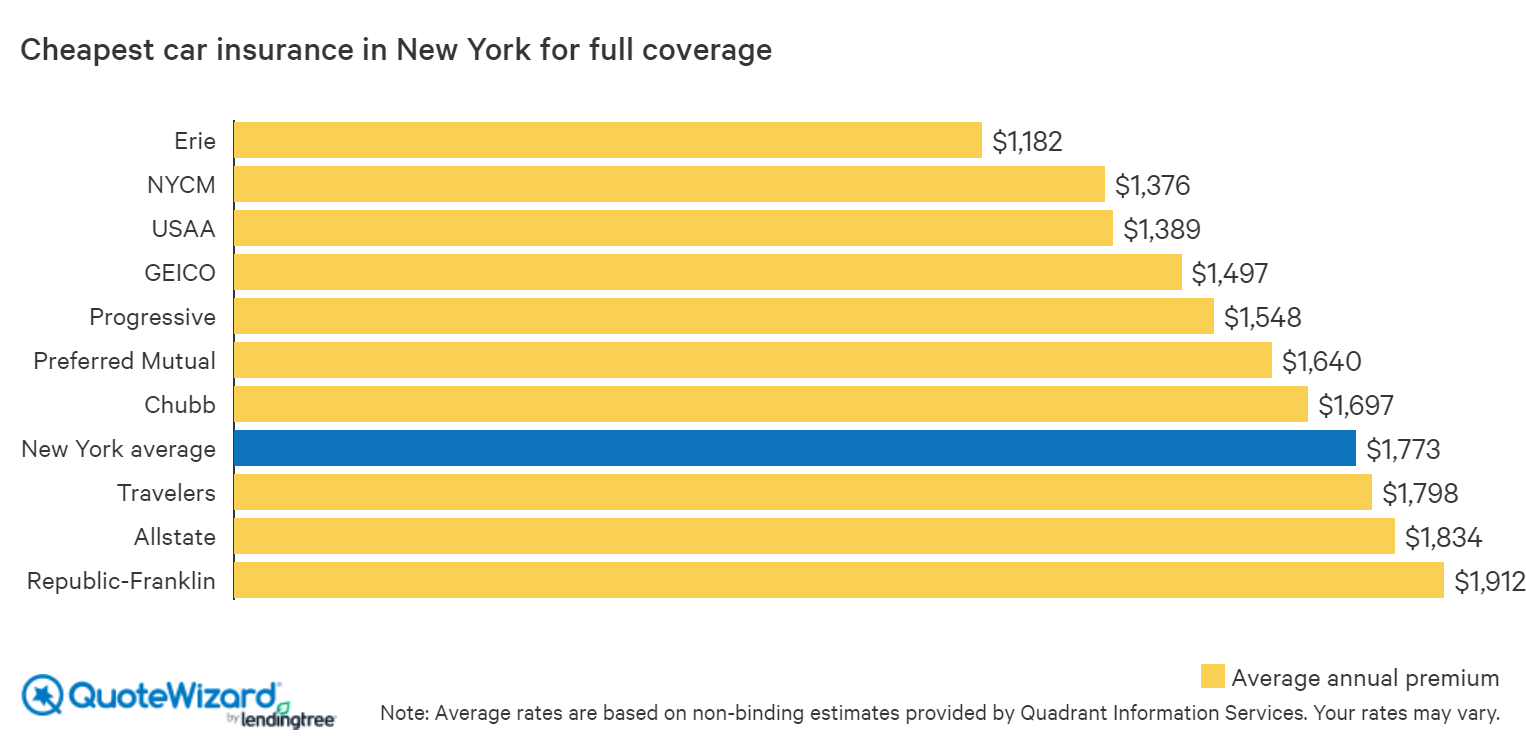

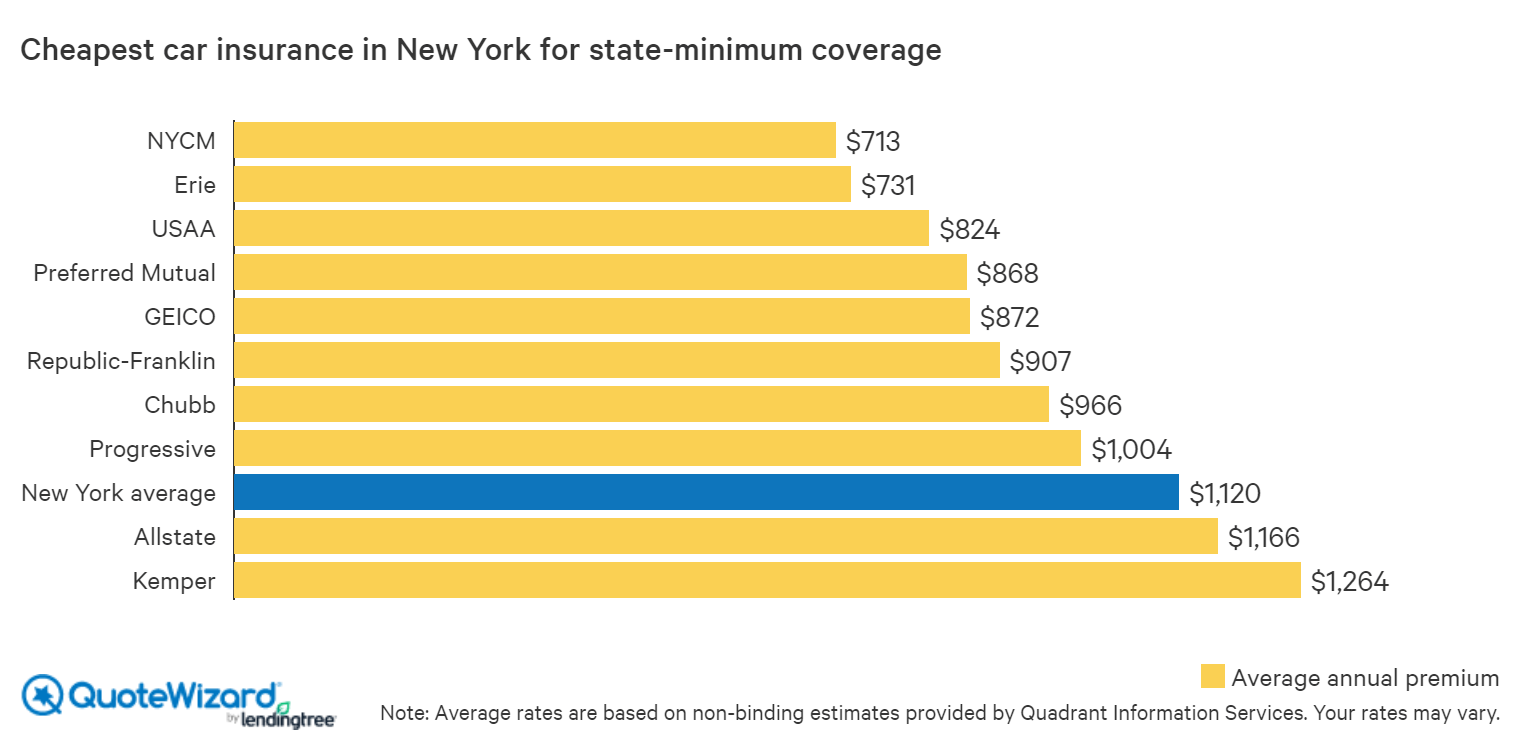

Average Car Insurance Prices in New York

The average cost of car insurance in New York is around $1,600 per year. This is slightly higher than the national average of around $1,500 per year. The cost of car insurance can vary greatly from one driver to the next, however. Drivers with a clean driving record and a safe car can often find rates that are much lower than the average. Additionally, drivers who have a poor driving record may find that their rates are much higher than the average.

Ways to Save on Car Insurance in New York

There are several ways to save money on car insurance in New York. One of the best ways is to shop around and compare rates from different insurance companies. Many insurance companies offer discounts based on factors such as age, driving record and type of car. Additionally, some insurance companies offer discounts for bundling multiple types of insurance together, such as home and auto insurance. Finally, taking a defensive driving course can also help to reduce car insurance costs.

Finding the Right Car Insurance in New York

Finding the right car insurance in New York can be a challenge. It is important to shop around and compare rates from multiple insurance companies. Additionally, it is important to make sure that the coverage is enough to meet the state’s minimum requirements. Finally, it is important to look for discounts and bundle multiple types of insurance together to get the best possible rate.

The Cheapest Car Insurance in New York | QuoteWizard

New York Car Insurance Information

The Cheapest Car Insurance in New York | QuoteWizard

Average Car Insurance Rates by Age and Gender Per Month

Car Insurance Cost by State [OC] : tableau

![Car Insurance Prices New York Car Insurance Cost by State [OC] : tableau](https://i.redd.it/4x4pugsvcyz41.png)