Car Insurance Own Damage Premium

Tips to Reduce Car Insurance Own Damage Premium

Car insurance is one of the most important investments that you make as a car owner. It gives you the assurance that your vehicle is well-protected in the case of an accident, damage, or theft. One of the most important aspects of car insurance is the own damage (OD) premium. Your OD premium will depend on several factors, including the type of vehicle, the make and model of the car, and the year of manufacture. Fortunately, there are several ways to reduce the amount of money you pay for the own damage premium.

Choose a Higher Deductible

A deductible is the amount you would have to pay out-of-pocket in the event of a claim. The higher the deductible, the less you will have to pay for your own damage premium. If you choose a higher deductible, you will have to pay more out of pocket in the event of a claim, but you will save money on your own damage premium. It is important to remember that the amount of the deductible should be something you can afford to pay in the event of a claim.

Choose a Car with a Lower Premium

Another way to reduce your own damage premium is to choose a car that has a lower premium. Generally, cars that are smaller and less expensive will have a lower premium than a larger and more expensive car. The type of car you choose can also affect the premium. SUVs and luxury cars tend to have higher premiums than sedans or hatchbacks. It is important to remember that the type of car you choose may also affect the amount of coverage you get.

Compare Quotes from Different Insurance Companies

It is important to compare quotes from different insurance companies before you decide which one to choose. Different companies will offer different rates and coverage, so it is important to compare them before making a decision. You should also make sure that you are getting the most coverage for the lowest premium. Comparing quotes from different companies will help you make an informed decision and ensure that you are getting the best deal.

Opt for Longer Policy Terms

Choosing a longer policy term can help you reduce the amount you pay for your own damage premium. Generally, the longer the policy term, the lower the premium will be. This is because the insurance company is taking on a lower risk when the policy is in effect for a longer period of time. It is important to remember that the longer policy term may also result in a higher premium if you make a claim during that period.

Maintain a Good Driving Record

Maintaining a good driving record is one of the best ways to reduce your own damage premium. Insurance companies will typically offer a discount for drivers with a good driving record. This is because they view these drivers as being less likely to make a claim. It is important to remember that if you do have any traffic violations or accidents, they may affect your premium.

Conclusion

There are several ways to reduce your own damage premium when it comes to car insurance. Some of these include choosing a higher deductible, choosing a car with a lower premium, comparing quotes from different insurance companies, opting for a longer policy term, and maintaining a good driving record. By following these tips, you can ensure that you are getting the best deal on your car insurance own damage premium.

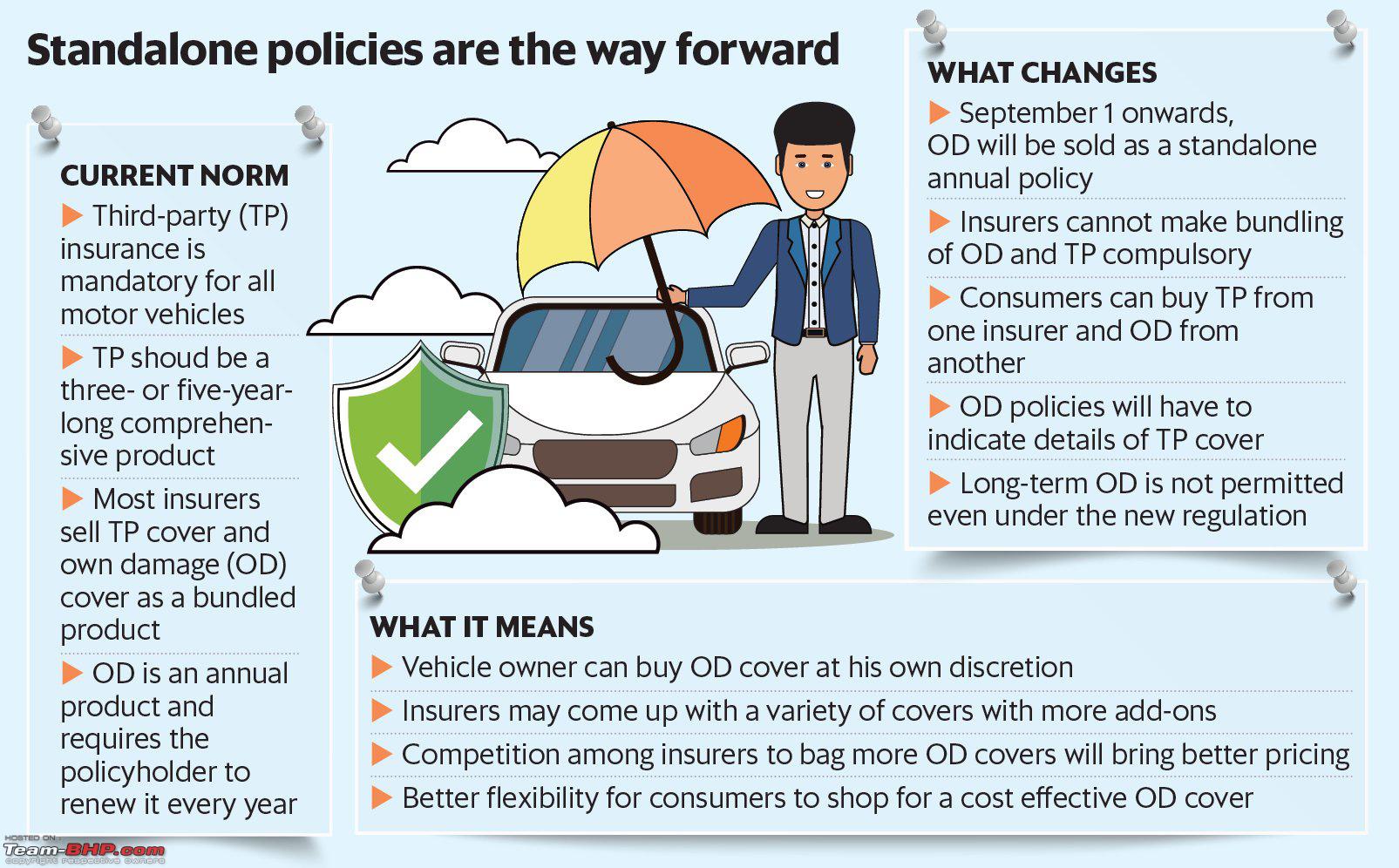

Car insurance set to become cheaper due to lower 'own damage' premiums

Own Damage Cover in Car Insurance Policy

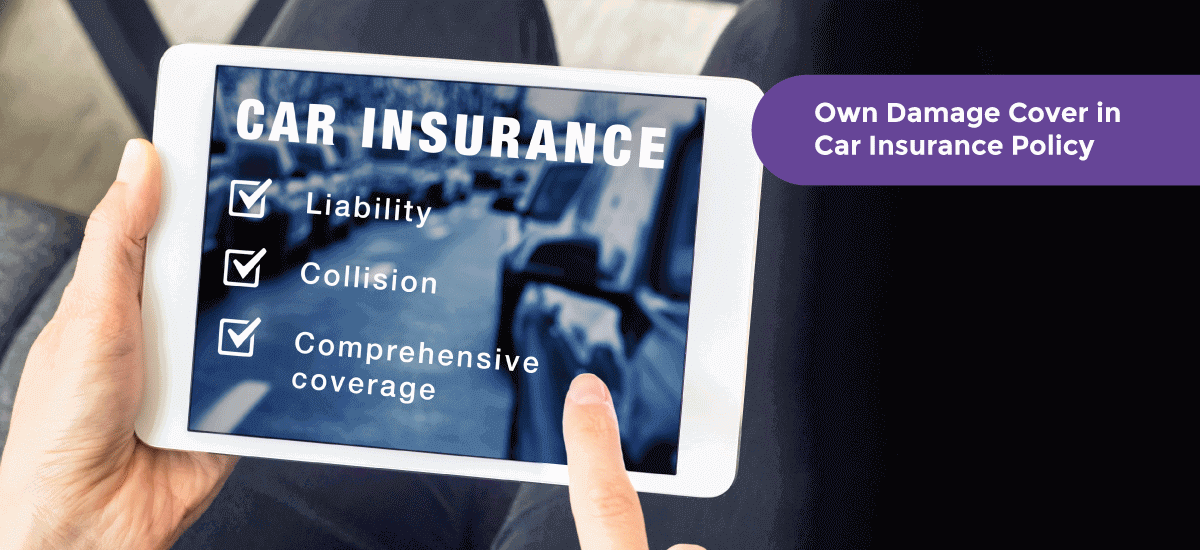

How To Calculate Car Insurance Premium Formula : How Car Insurance

Compact car crashed into insurance letters concept free image download

Page for individual images • Quoteinspector.com