Car Insurance Liability Coverage Definition

What is Car Insurance Liability Coverage?

Car insurance liability coverage is a type of insurance that protects drivers from financial losses due to accidents or property damage caused by their vehicle. In most cases, liability coverage is required by state law and is considered the minimum insurance requirement. It is also the most basic form of car insurance and is typically the cheapest option.

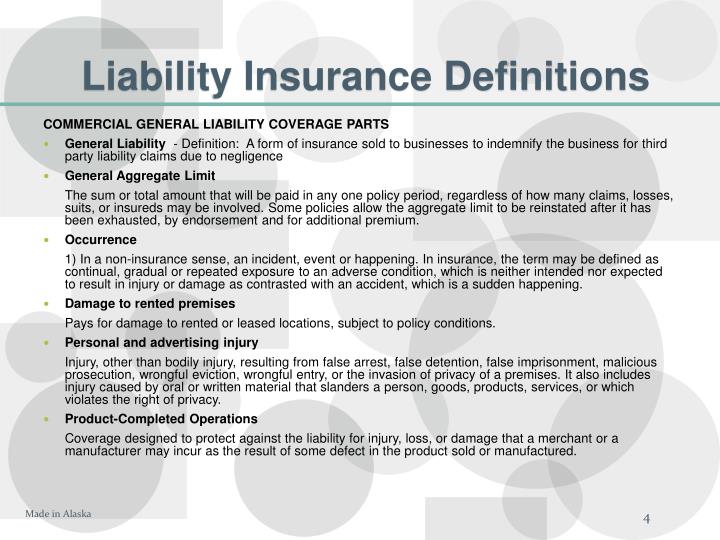

Liability coverage is made up of two components: bodily injury liability and property damage liability. Bodily injury liability covers the medical expenses and lost wages of the other driver and passengers when you are at fault for an accident. Property damage liability covers the cost of repairing or replacing any property damaged in an accident, such as another driver’s car.

Who Needs Car Insurance Liability Coverage?

Anyone who owns and operates a car should have car insurance liability coverage. This is especially true if you drive in areas with a high population density, as the chances of an accident are higher. Additionally, if you have a loan or lease on your car, your lender may require you to have a certain level of liability coverage.

What Are the Different Types of Liability Coverage?

The three types of liability coverage are bodily injury liability, property damage liability, and uninsured/underinsured motorist coverage. Bodily injury liability covers the medical expenses and lost wages of the other driver and passengers when you are at fault for an accident. Property damage liability covers the cost of repairing or replacing any property damaged in an accident, such as another driver’s car. Uninsured/underinsured motorist coverage is for when the other driver does not have insurance or does not have enough insurance to cover the costs of the accident.

What Does Liability Coverage Not Cover?

Liability coverage does not cover the cost of repairing or replacing your own car if it is damaged in an accident. It also does not cover medical expenses for you or any passengers in your car if you are at fault for an accident. Additionally, it does not cover any costs associated with personal injury or property damage caused by other drivers that are not covered by the other driver’s insurance.

How Much Liability Coverage Should I Have?

The amount of liability coverage you should have depends on the value of your car and the amount of money you can afford to pay out of pocket if you are at fault for an accident. Generally, it is recommended that you have at least the minimum liability coverage required by your state. If you have a newer or more expensive car, however, you may want to consider purchasing more coverage in order to protect yourself from financial losses.

Auto Liability Insurance - What It Is and How to Buy

Learn the Different Types of Car Insurance Policies

What Is Liability Insurance? | Allstate

canonprintermx410: 25 Beautiful Liability Car Insurance Definition

PPT - Automobile Insurance PowerPoint Presentation, free download - ID